This is a post I’ve been excited to write for months, well before we knew where we’d actually land for the year… and now here we are! :::All the shoulder shimmies::: (Bonus points if you want to add in your own jazz hands.)

We’ve been wrestling with a lot of stuff lately, like what the next president means for our health care, whether to use our year-end bonuses to pay off the mortgage or beef up our investments, and what getting ahead of schedule in our savings this year means for our early retirement timing. And today we’ll look at all of that, along with the full fourth quarter chart rundown.

Are you excited? We are!

So much to cover today! It’s a whole year’s worth of build-up. Let’s dive right in!

Our Allocation Decision

I’m super excited to share back on this one! We created our year-end goals in part to guide our decisions of what to do with our bonuses, but we passed our year-end taxable target back in October, well before we got our bonuses, and we only had a manageable bit of the mortgage to pay down to hit our year-end goal.

Now that we know our bonus amounts (which we’re totally happy with though not blown away by, including the little extra that I fought for), we had an even tougher choice to make because of the psychological angle. After bringing the mortgage down to the year-end target we’d set, we still had enough leftover to do one but only one of two very pleasing things:

- Almost entirely pay off the rest of the mortgage, or

- Get the taxable savings and investments up to a very happy and meaningful round number

Originally I was leaning toward mortgage payoff and Mr. ONL was leaning toward investing. (No one was leaning toward the third option: upping our cash reserves.) And somewhere along the way we traded places (noticing a trend?). I just got really excited about the chance to see that particular number on the spreadsheet, which is an unjustifiably dumb reason to make a financial decision, but given two equally good choices, it’s as good a reason as any. But then Mr. ONL said he was game to pay off the house, and I jumped ship like the fair-weather fan I apparently am. (And then I mixed a whole bunch of other metaphors.)

So… we’re (almost) paying off the mortgage!

*Penny would insist that I acknowledge here that that will not make us entirely debt-free, as we still have a mortgage on our rental property that we’re paying off on schedule, not ahead of schedule. But we still think it will feel amazing when we own our home free and clear in a matter of weeks. :::Pretending to be chill about it, but really we’re over here pinching ourselves:::

Where We’re Landing: 2016 Q4 Update

We’re downright stoked with our progress in 2016, despite 2016 being an a-hole of a year in so many other ways. And with blowing past our savings goals and getting the mortgage down to almost zero, it makes the charts extra fun.

If you want to see lots more charts, check out our financial updates from October 2015, the first quarter of 2016, the second quarter of 2016 and the third quarter of 2016. Curious why we don’t share real numbers? Here’s why.

Let’s start with my favorite one first. Is there anything prettier when it comes to mortgage balance than the tiniest possible slice of pie? I’m so proud of us for (almost) paying off our house in less than five and a half years.

And here’s some more context that feels a little mind-blowing, even to us, who’ve been diligently tracking this stuff. A mere 14 months ago, we still owed half of our original mortgage balance, and now we’re down to relative pennies.

Taking a step back, we’ve seen growth in our overall net worth in 2016 that we’re completely happy with, and this is without adjusting upward our supposed property values, which would surely inflate the number even more.

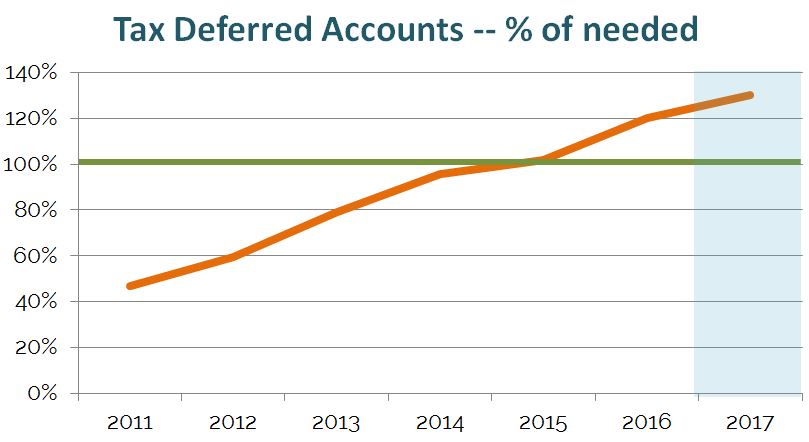

We also see great trends on the year across all of our net worth components… I even had to adjust the scale to make more space for our tax-deferred/401(k) funds.

Speaking of 401(k)s, we’re now well beyond what we ever expect to need in those funds, but we still believe in keeping that big nest egg for our later years. We’ll plan to max out again in 2017 for tax reasons and because we can afford to, even though we don’t need to.

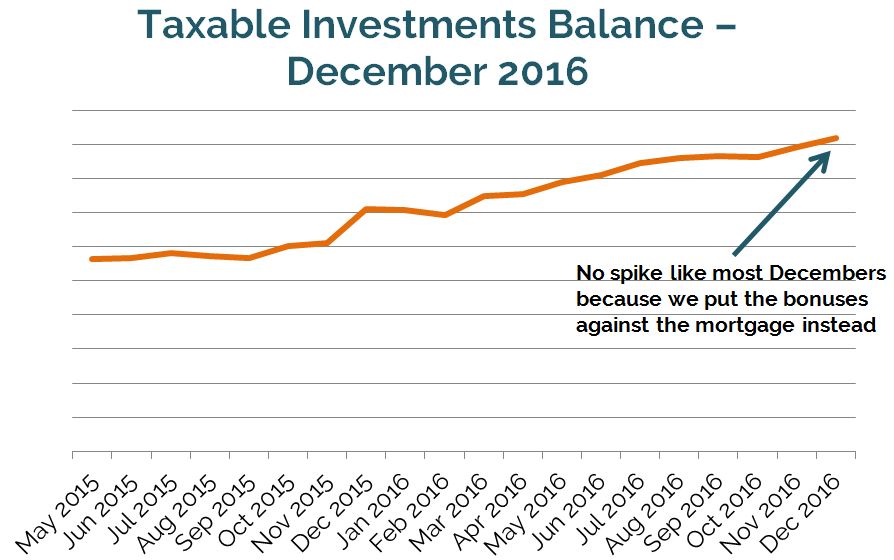

Of course, taxable savings are what really matter to us now, because those funds will support us in the ~18-19 years between when we retire and when we can begin accessing our tax-deferred funds without penalty. And even though we didn’t dump a bunch of money into them at the end of the year this time around, we’re still thrilled with where we’re ending up on the year.

We trended ahead of schedule all year on our taxable savings compared to where we wanted to end up by year’s end, and so didn’t need to dump our bonuses into our taxable accounts to get us where we wanted to be.

Our fast progress this year means that we can officially aim not just for the early retirement number we originally hoped to have, but for our stretch goal, hereafter known as our “magic number.” So from now on our charts will be based on that higher bar:

And finally, where we’re landing on our pie chart showing the percentage of our total goal that we’ve saved in taxable investments each year. We include this chart mainly so that anyone who’s curious can see how fast it’s possible to save up for early retirement. We’re slightly shocked that we still hit this big a chunk of what we need to save this year, given that we almost paid off our house, too. This is based on our lower original ER number, not our magic number, so we’ll have to represent this differently in our quarterly updates in 2017.

There you have it on the charts. That’s where we are at this point in time, and now we look ahead to what it all means for when we can pull the ripcord!

—> Follow along with our adventures between blog posts — all the non-financial stuff! — on Twitter, Instagram and Facebook. <—

The Timing Question

The last few weeks have been a good and important reminder to us that you can never over-communicate when it comes to money. We thought we’ve been having the same conversation, but turns out we were actually having two different ones. When I was talking about quitting earlier than end of next year, it was under the assumption that we’d hit our stretch goal early — and when Mr. ONL was talking about working til end of 2017, it was under the assumption that we wouldn’t hit our number until year end. So he heard me saying I wanted to quit before we’d hit our number, and I heard him saying that we had to finish out the year no matter what… and neither was what we were actually saying. SO… turns out our difference of opinion was actually a sameness of opinion, just expressed differently.

But the great news is that we have been on the same page all along, and just didn’t realize it. (More evidence that burnout is bad for marriages — it limits time to discuss this stuff in detail!) And that makes our decision on early retirement timing easy. Here’s our plan:

Work until one of the following two things happens:

- We reach the end of 2017, or

- We hit our stretch goal in our taxable savings and investments (our “magic number”)

Technically we’d also call it quits if one or both of us gets laid off, but we’re not pursuing that. So whichever ball gets to the end of the funnel first gives us our exit!

That will trigger our giving notice and seeing if those prorated bonuses are more than a rumor (though we won’t count on getting one more penny after we give notice — anything extra at that point will be gravy). Given that we’ll be saving faster in 2017 than we could in 2016 (see below!), we should be to our magic number no later than October, but it could come faster with market help… or come slower with market headwinds. But our plan is the same either way, and we’re as committed as ever to leaving at the end of 2017 even if we’re not at our number.

Financial Plan for 2017

In addition to the goals we’ve already shared for the new year, here are our financial to do’s, based on where we’re landing and our revised timing plan:

Pay off the last bit of mortgage on our home — We’re coming close to pay-off this year end, but will have a small lingering balance that we’ll knock out in February or maybe even January. We’ll share the big “Ding dong the mortgage is dead!” announcement when it’s time!

Amp up our monthly investing like crazy — As soon as the mortgage is gone, we’ll be able to redirect that money into investments/savings each month, which will accelerate our pace. With the small raises we got added to the money we no longer need for the mortgage, we should be able to increase our monthly investing by 50 percent.

Hit that magic number as soon as we can — Though we’re huge believers in pacing yourself and making sure that you still enjoy your life en route to early retirement, being so close, it will be awfully tempting to just hurry up and get to our magic number. Because impatience.

Take care of health care ASAP — We said in our pre-retirement to do list post that we’re going to go health care nuts in our final year of work, but now we’re moving up that timeline, just in cases (#loveactually). We see our primary docs right at the start of January, and then we’ll be in for a whole bunch of specialist visits, just to make sure we check out everything worth checking out. Then we can go into early retirement with a thoroughly clean bill of health, which should provide some peace of mind in case the future of health insurance is unclear at that point.

Aim higher on charitable giving — We felt happy to devote a bigger share of our income to charitable giving this year than we have in the past, and we want to continue that in 2017. We’re going to look into setting up a donor advised fund before we pull the plug so we can do some sustained giving even in our lower income years.

It’s a lot to do, but we’re motivated like crazy to make it all happen, and fast. Thanks for coming along for the ride!

Our Best Holiday Wishes to You!

It’s been pretty amazing to hear from so many of you guys with well wishes for our bonuses and our early retirement timeline. It feels downright spectacular to feel you rooting for us virtually. And we hope you all know the feeling is mutual. We’re rooting for all of you whose plans we know, and for those who’ve never dropped a line, it’s not too late… we’d love to send some good FIRE vibes your way. But regardless of whether you want to share your journey, we’re sending out lots of holiday love to all of you. Your support means so much to us, and makes this path to early retirement a thousand times more fun.

*** HAPPY HOLIDAYS! ***

I’ve been writing a lot lately about feeling burned out at work, and so I’m going to take the full holiday period off to relax and enjoy deadline-free time with family and friends. Back at ya January 2nd! xoxoxo

Let’s Discuss!

How was your 2016 in total? Any new or big goals for 2017? Anything you’ve recently realized or decided? For aspiring early retirees, how’s your timeline looking? Anything we can give you a virtual high five for? Let’s chat!

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: goals

It is all looking good and I can feel your excitement, it is all coming together. Paying off the mortgage is a great feeling. Have a lovely festive holiday.

Thanks for sharing our excitement! Sending lots of warm holiday wishes across the pond! :-)

You can never overcommunicate (about money or anything honestly). We once almost adopted two cats because my wife loves cats, I’m indifferent, but when she heard me say “sure” she thought I was as eager as she was. In the end she wanted to help her friend more (who was moving and couldn’t keep them) than actually get the cats but thought I wanted cats.

Fortunately, I’m allergic to cats! Which we learned when we visited them… so cats were out of the question (I never knew because I never had cats or dogs growing up). On the ride out, we sorted it out and never got them. :)

2016 was good for us, financially no big changes in our situation (which is good), and I hope you hit your stretch so you can join the club. :)

Happy holidays!

#Truth! We almost DIDN’T buy our house because we each thought the other didn’t like it as much as we did individually. But then we did talk about it, realized we both loved it, and now here we are about to pay it off! Hahaha. Congrats on a good financial year! Can’t wait to join you guys on the fun side! Hope you and your family have a great holiday. :-)

Thanks for highlighting the communication piece, we have had a few of those as well lately talking about baby stuff and ultimately end up realizing we were saying the same thing but in different words.

Congrats on the great year and enjoy relaxing over the holidays – you deserve it!

Marriage is funny, huh? ;-) Even for people who are good at communicating for the most part can still have hiccups. Oh well… glad we got past that one! Thanks for the congrats and well wishes — hope you guys have a wonderful holiday! :-)

Wow, you guys are absolutely killing it! That’s gotta be an amazing feeling! Enjoy your holidays, and I look forward to hearing from you two in 2017!

It DOES feel amazing… but to be perfectly honest, it also doesn’t feel real, like at all! Hmm… maybe a topic for a post in January? ;-) Hope you and your family have a wonderful Christmas!

We ended up blowing out every goal we had this year thanks to income surprises by my wife working longer then expected without the costs of day care. It sounds like you also had a very successful year and maybe now that things are slowing down you can really get things in order for that upcoming next phase. Congrats on reaching your goals and a happy holiday.

Wohoo!!! Way to go on your goals! So happy for you guys. Now we’re just hoping things stay quiet for a little while… not that that’s likely! ;-) Happy holidays to you!

2016 wasn’t exactly a banner year for us, with a death in the immediate family, the tragic loss of a cherished pet, a very expensive leaking roof that could wait no longer for massive repairs, and that’s not to mention the election results and the dramatic drop in bond values just to end the year on an even more somber note. What have I learned from it all? Don’t take for granted those “slow” years where nothing much happens! Slow and steady growth, reliable income streams, no land mines to step on, and expenses that remain stable throughout the year create the relaxing, comfortable familiarity necessary to avoid a stressful retirement. The quiet, predictable rhythm of day to day life is underrated! Weathering financial storms is never easy, but when you have a fixed income that relies upon your assets, they can be downright terrifying. As we rebalance and recalculate and budget for 2017, I’m reminded of how much we took for granted in the past. We will navigate this change, and diversify more intently so as to avoid a recurrence (fortunately we had done so last year, although thanks to my cautious nature we were still too heavily in bonds to avoid some losses, though hardly catastrophic). I’d like to see a calm 2017, but given the current political climate I’ll settle for no disasters🔗.

Sorry you had so much personal stress and sadness on top of what was the worst year in memory for nearly all of us. :-( But I love the lesson you took from it, to appreciate those “average” years and to enjoy the lack of drama. We’re with you — we’ll settle for no disasters next year. Happy holidays to you both! Wishing you good health and peace in the new year! :-)

So awesome what you guys have accomplished over the last few years. It’s very inspiring to see it all laid out. Congrats! We don’t get final numbers until almost the last day of the month, but we already know its going to be good–should be at least 16% above goal! We are also off on vacation, so we will just not think about it and enjoy the time with family. Will be a nice treat in January to plug in all the numbers and make our final allocation decisions then.

Oh my gosh, it still doesn’t feel real. Like I look at those numbers and think, “That’s all just Monopoly money, right? And at some point, someone is going to say, ‘Just kidding!'” Haha. Major high five to you guys for likely coming in so high over your goals! Wohoo! Enjoy your time off with family — don’t think about money at all. ;-) Happy holidays!

I’m excited for you! It’s great to see people reaching their goals, and especially to see people you’ve been following approaching FIRE. It makes it feel so much more real and achievable for the rest of us.

So, thanks! And have a great and relaxing holiday season!

Thanks for sharing in our excitement, Matt! :-) I know what you mean how real seeing someone else reach their goals makes it feel… but what’s hilarious is that it doesn’t feel real to us yet! Haha. Something to look forward to in 2017, I guess! Thanks for the warm wishes — hope you have a wonderful holiday!

The child in me feels like Maggie won. If you need me, I’ll be pouting in the corner 😉

Congrats! This is incredible progress. Having a paid for house will really ramp up your ability to invest!

Does time off mean no Twitter? But, but, but!

Dude, be reasonable. I’m not going off Twitter. Do you want me to suffocate??? :-D Hahahaha

What’s funny is you totally helped convince me to go taxable, and I was completely there. But then when Mr. ONL said he was good with the mortgage, that pull was too strong, because I hate debt SO VERY MUCH. And we also hate our mortgage servicer SO VERY MUCH. Soon we’ll be free of both of them (not counting the rental — but that mortgage gets paid by the rent, so it feels different).

Hope you guys have awesome holidays… and I hope the polar vortex lets up soon!

Oh good I was really worried you would be off Twitter too!!

Hahahaha. Not happening. ;-)

Congratulations on almost being primary mortgage free! It’ll be so great for you to see the ginormous amounts of cash you get to shovel into your taxable investment accounts in 2017.

My bet is you’re out by end of August 👏🏻

My 2016 went awesome! I hit every goal and more I set for myself…. And met some pretty great people!

Thanks, G! And omg, yes, I love the very idea of “shoveling.” :-) And I hope you’re right about August! I would sooooo love to be “out” by next FinCon!

Huge congrats on the big year for you, too! Can’t wait to see how many goals you’ll crush now that you’re in a new and better job! And amen to meeting awesome people! xoxoxox

I love all of your charts, and happy to see so many up arrows! I love the idea of getting a lot of health stuff taken care of. Good to have some peace of mind going into early retirement. So excited for you guys (and a little jealous-lol! )

Aren’t up arrows the best? Haha. ;-) Yeah, 2017 is all about health. I expect to feel like a pincushion by the end of it!

Super exciting–congrats on your mortgage progress! And you’ll definitely make huge strides toward the magic number once that debt is totally out of the way.

I’m glad to hear you’re taking a little break for the holidays, and cleared up your miscommunication with Mr. ONL. My best friend and I often argue the same point to each other. It’s kind of hilarious when we realize what we’re doing. Maybe not so much when it’s about major decisions with your spouse though.

Thank you, Kalie! Can’t wait to knock the mortgage out once and for all… so soon. And thanks for letting me know that the miscommunication wasn’t just us. It’s easy to assume that we’re making the same underlying assumptions, but in this case, nope! :-) Now in hindsight it IS hilarious, but it wasn’t when we were in the midst. Hope you, Neil and the kids have a wonderful Christmas! :-)

Congrats on wrapping up a great year! I am also finding that we need to chat about things twice as much as seems necessary. We actually need more time to figure things out now that we are FI, because there are so many more choices and options. It takes time to narrow down what exactly is right for us individually, as a couple and as a family. Finding the right direction for 7 people isn’t a 20 minute convo!

Thanks, Ms. Montana! So interesting, isn’t it, that people who are totally on the same page about money can still have these little miscommunications about important details? Thanks for letting me know it’s not just us! :-)

Mote charts than I can shake a stick at! Impressive! I especially like seeing the net worth gain over all those years. I have no idea how to make a chart but I only hope that mine could look as good as yours in the end. :)

You guys kicked 2016 in the ass. I can’t wait to see what 2017 brings (perhaps an identity reveal??) and your official retirement. I know you have so so so may awesome things planned for FI!!

I love me some charts. :-) Andy ou betcha we’re going to reveal ourselves! I’m currently plotting the contest that will go along with the big reveal, and I’m all ears if you have ideas! ;-)

Awesome job, especially with that mortgage! That’s amazing to see how much of that mortgage you crushed in just a year.

Can’t believe 2016 went by so fast. 2016 was a crazy year for me. Got engaged. Paid off all my student loans. Switched jobs. Finally took the jump from talking about starting a blog to actually doing it. Oh yeah, also took a 50k paycut to switch jobs! And yet, I’m still saving as much money as I was saving when I was making the big bucks.

Thanks, FP! And high five on a huge year for you! Wow, you did so much! That’s quite a testament to your focus that you’re saving just as much despite the pay cut — how inspiring! And we’re so glad you joined the blog community. Pretty much the best group of folks around. :-)

Hey guys – congrats on all your success! You guys are kicking ass over there and I love watching your progress. It definitely sounds like you’ll hit retirement with more than you expected, which is always a great feeling to have! And paying off that mortgage? Totally cool.

For us, it is tough to describe 2016 as anything other than downright awesome. We hit our financial goals early. We sold both homes and moved into our Airstream. I’m done with full-time work in a week and have a BUNCH of passion projects that I am currently working on. I’m more busy now than I ever was when I *only* focused on my full-time job.

It’s a nice feeling. :)

Thanks, Steve! It all feels pretty amazing. In the end, we’re going 15-20% over our original taxable number, which gives us a lot more peace of mind to accommodate market crashes (you know I need that peace of mind!), and will be good for our well-being. So stoked for you guys as you get closer to your retirement (days for you! only a few months for Courtney!). Can’t even imagine how excited you must be this week!!

Beautiful 2016 financial wrapp Mrs. ONL. You set the bar high with all those nice charts and graphs! My only wish is that there were numbers next to them!

It looks like you’ve got things right on track for dumping your careers in 2017.

We’ll be waiting for you! Enjoy the ride!

Thank you! Believe it or not, the charts are just simple PowerPoint graphics. ;-) And you can imagine whatever scale you wish for the numbers — hahaha. Can’t wait to join you in FIRE next year! Thanks for cheering us on! :-)

Congratulations on the mortgage!

the charts are wonderful…both as charts and as reflections of a wonderful financial reality. You guys totally belie the saying that”nice guys finish last”.

Have an enjoyable and restful holiday. See you in 2017!

Thanks, Madeline! That’s so sweet of you to say. :-) Sending lots of warm holiday wishes your way!

Awesome charts! Yes, you should take a few days off and relax a bit. I know how being burned out can messed up your productivity. I was just going through the motion and couldn’t think clearly. It’s tough.

2017 is going to be a great year for you guys. Good luck!

Happy holidays. :)

Thanks, Joe! Writing the burnout posts made it hit home that I really need to rest up and take some time away from the computer… including, gasp, the blog. ;-) Thanks for the well wishes! Hope you and your family have a wonderful holiday!

Amazing year and so happy to see your awesome progress. I’ve been surprised with your post schedule so definitely take much needed break over the holidays.

Thanks, bud! And I’ll definitely take those orders and rest up over the holidays. ;-) Hope you and your family have a wonderful break as well!

I went ahead and did those jazz hands for you. Woot! You’re killin’ the game. I’m looking forward to tweeting a solid series of GIFs when you pay off that mortgage! :)

You’re the best! Thanks for the jazz hands. :::spirit fingers::: Hahaha. CAN’T WAIT to slay the mortgage… soon! Happy holidays to you and Garrett!

Best news ever… You are both telling the same and clarified the exit scenario. Excellent Christmas gift I would say.

Enjoy the holiday…

Thanks, my friend! Sending holiday wishes to you and the ladies! ;-)

Thx… I might drop you a mountain pic… We all look forward to a family ski holiday.

Ooh yes! Please do! I’d love to see where you go skiing.

It’s been exciting and fun to watch your progress! I’m wondering what your thoughts are about if the market decreases in 2017. If you have hit your magic number at one point, but then your taxable account takes a 10% or 20% or more dive and stays down the rest of the year (or years) does that change anything? I too have a magic number but I don’t know how to take in account a significant change in the market if and when that comes. Do you work longer? Or just dial back your withdrawals until the market rebounds and still plan to retire?

Thanks so much for following along with our journey! :-) We have a LOT of thoughts about what happens if the market backslides (or, really, WHEN it does that), and our magic number has 20% overage built in, plus our budget is well padded and we could cut it by a third pretty easily. Plus we have a thousand other contingencies (I’m only exaggerating slightly!). ;-) I’m going to cover this exact Q in a post in January — stay tuned! Bottom line: We’ll still retire, but we wouldn’t necessarily recommend the same for everyone… totally depends on your situation and how much cushion you have built in!

Wow – your mortgage is almost gone – so awesome! I’m incredibly happy for both of you and love how exciting it is to follow your journey. Thanks for the continued inspiration that big gains can be achieved in a relatively short amount of time. Keep at it my friend, almost there!

And have a wonderful holiday – enjoy “shredding it” or whatever you do out there on the slopes!!

I’m pretty sure, they “schralp the gnar!” I still haven’t had a meeting where I can work that phrase in yet… but it’s coming!

Hahaha. My wager is going to expire… better hurry up!

Thanks, Harmony! I’m pretty sure it hasn’t sunk in yet that we’re really killing the mortgage… I wonder how it will feel when it’s officially at zero?! Hope you and your family have a great holiday! Mr. ONL may shred a bit, but I mostly just go out to have fun. ;-)

Great job. 2016 was great for us, because I think we finally found our calling and purpose. We accidentally stumbled into the personal finance community, which was also a massive blessing for us. We started Wealth Well Done in September, and are starting to hit our stride. We’re a long ways from retirement (low six figure net worth), but I don’t think our dream is 100% retirement. I am a trailblazer, and entrepreneur at heart, so my dream is to run a business/ministry that I absolutely love working at every day. Wealth Well Done is a project I can give my life to, which provides me life purpose, which is my greatest feeling of being wealthy. I am already self-employed as an independent sales pro that brings in a solid income stream, but my dream is to slowly transition from the sales lifestyle, into what I really want to do in the next 3 years, which is writing, inspiring, helping, leading, creating, caring, and teaching. That is my absolute dream that I am setting out to accomplish next. Glad to be part of this community.

Finding your calling and purpose is better than achieving any money goal — so huge congrats!! It’s awesome you’ve joined the PF blog community — it’s a pretty amazing and supportive bunch, wouldn’t you say? ;-) Sending you lots of luck to achieve your three-year plan of focusing entirely on your vision instead of working for someone else!

Congrats on hitting your goals and then sailing past them! Can’t go wrong paying down the mortgage either – almost, but that sounds like a certainty by first quarter anyway. Good job!

Our 2016 was good, just based on my memory of our monthly updates. No major surprises like last year, yet…

It was a great year to take our first step towards a major lifestyle change with Mrs. SSC leaving megacorp and teaching. Oddly enough, we are still on target for a 2018 FFLC date, just no more 2017 option. However, if she gets a job that starts in 2018, we’re fine pulling the ripcord early and making a major move. That’s SO totally out of our control though.

We probably missed our original goals since the dramatic loss of income happened mid-year, but like most people, we’re ahead of where we thought we’d be, so even with not saving as much, we still seem to be on track.

Enjoy the break and Happy Holidays to you guys!

Thanks, buddy! I’m sure you can tell, but we’re more than a little excited at how good to us this year has been. I’m super thrilled for you guys that you’re still on track despite Prof SSC taking her paycut for her dream job. Happy holidays to the four of you! :-)

Great job! I have also noticed a rise in seniors using the reverse mortgage as a way to supplement their retirement.

Thanks, Chris!

That’s a lot of charts and graphs. They all seem to be going in the right direction, which is the important thing.

I used to not be excited about paying off the mortgage because it is such a low interest rate. However, now I see it as an important milestone as it means our biggest expense is gone (well until kids’ college happens). Unfortunately, that’s still about a decade away.

I love the story about the communication issue. (Jim’s was good as well.)

Yeah, I know that paying off the mortgage is not great on paper, but it’s huge psychologically, and it’s a barrier that can go away to enable faster saving and investing. I bet you’ll pay yours off faster than you think you will. ;-)

It’s really got me thinking about it more than I thought I would. With a 2.75% interest rate, it’s hard to justify… and I’ve always been math-dominated rather than psychology-dominated.

You can make a super solid argument either way, so go with what feels right to you! There’s no right or wrong answer here.

Congrats on everything friends! This sounds like the perfect plan. 2017 will definitely be one for the books! And then I’ll see you at FinCon in October and then you’re planning a trip to Alaska in 2018… amright? It’s on my calendar. :)

Thanks, M! :-D And yes, SO EXCITED for FinCon, though I’m trying not to get my hopes up about being “out” by then. ;-) And a trip to Alaska is definitely in the cards as soon as we can possibly swing it!

:)

*Especially* now that I know that Alaska is warmer than much of the lower 48 in the winter!

And it’s snowing all perfectly today! Sledding will be happening this evening (in the dark) :)

I think the sledding in the dark part would throw me off. But the rest sounds good!

I love the sayonara career funnel–what a great way to express where you are! Congratulations on all of your progress this year! 2016 has been a great year for me too. My invested assets grew over 10% in spite of quitting my job, buying a car (which I don’t include in my NW) and 7 months with no earned income. Quitting was really scary and I’m very thankful that the stock market cooperated this year. Whew! Enjoy the holidays!

Thanks, Liz! How awesome that you’ve had such a great year financially even after retiring (I’m sure your non-financial life was awesome *because* you retired — ha!). How great that you got a soft landing in retirement from the markets! Now let’s hope it continues for you next year so you get some insulation from sequence of returns risk. Happy holidays!

Big round of applause on what appears to be a stellar 2016!

This “talking about stuff” thingy is darned trickier than making spreadsheets isn’t it..?!? Glad you could find time to get plans aligned.

I hope you find some time to hit the white powdery stuff over the holiday period as well as get some quality sleep and rest. I always find endless runs makes for very good sleep!

Cheers to both of you and very best wishes for the coming year, which will bring another level of excitement! :>)

Thanks, Mr. PIE! And yeah, it’s funny how we each assumed the other knew our own assumptions, but nope! Turns out you have to *keep* having those money talks, it’s not one and done. ;-) Hahaha. We’ll do our best to get in lots of turns this holiday season, snow-dependent — hope you guys can do the same! Warm holiday wishes back at ya! :-)

So exciting to hear how close you are to paying off the mortgage! I sat down with my husband on Friday for a budgeting 2017 conversation – it was a great way to reflect on our spending this year, determine short-term savings goals and figure out what we needed to change to hit our FI goals. Thanks for your inspiration and insight!

Thanks, Emily! Thanks for sharing in our excitement! :-) High five to you guys for sitting down and mapping out your vision for 2017 — you’re so far ahead of the game just for doing that!

Whoa, I wasn’t expecting you guys to throw the bonuses at the mortgage after that last post! Congrats on almost being primary home mortgage free though – that is super exciting! :)

I love your description of how you guys were much closer than you realized and were just describing things differently. Communication is so key! I really love all the conversations we had for the postnuptial agreement. They were so important to have and so much more detail than most people do before getting married. The whole communicating about finances in marriage definitely seems like it’ll be a growing and a learning experience for how to approach the conversations, especially since our styles are so different even though our values are aligned.

2016 was actually not nearly as bad financially for me as it looked like it was. My net worth went up by my more than my net income and our combined net worth went up by our combined net income for the year, which is pretty good with how expensive September-November were.

Happy holidays and here is to more great progress in 2017!

I wasn’t expecting to go for mortgage payoff either! :-) But I’m pretty freaking excited about it. And yeah, even for people who are generally pretty good at being married and in the habit of communicating openly and often, it’s funny how stuff can still get lost in what goes unsaid. So don’t leave things unsaid! Be clear! That’s our lesson of the month. :-) Congrats on the great year financially, even with your grad school expenses and unexpected dip in income! Happy holidays!

I’ll let you know how 2016 went when I check at the end of the month. I guess it’s all in Mr. Market’s hands at this point. :)

Oh, and of course, I actually started a blog. Ha.

I’m super happy you bit the bullet and started the blog — and it seems like it’s doing well, so that’s awesome! When’s your departure date for your big adventure??

That will be Late Feb or Early March.

So soon! How exciting! And do you know how long you’re going to go? Feel free to point me to a post if this is all on your blog already. ;-)

I actually haven’t written a post about that, I guess because it’s sort of all open ended at this point. I don’t know if I’ll get sick of living out of a car with all the random lodging or if I’ll love it. If I love it, no reason not to keep it going within reason. I’m hoping that booking the longer stays will help make it feel like I’m not constantly on the go. I would say I expect it to last at least through the end of summer.

I get not wanting to put things in writing, because then they feel set in stone. But that’s all so exciting! Can’t wait to hear all about it.

I’m glad it turned out that you and Mr. ONL were both saying the same thing (though I have to say that was much more anticlimactic than “we stood on one leg in the snow and Mr. ONL caved first!” or “We did shots and Mr. ONL passed out first, so now I get to retire in October”).

Congratulations on a most stellar 2016, an even better 2017 and an (almost, nearly) paid off mortgage.

Oh, I would never be the one to last longest in a drinking contest! I barely drink so am the worst lightweight. Hahahaha. I know it’s a bit anticlimactic to say we’re going to wait and see, but that approach makes the most sense for a bunch of reasons. Thanks for the congrats! Can’t wait to get that mortgage fully paid off now!

What an amazing year! I was really interested in your comments about the communication issue. That can be such a challenge. Glad you were actually on the same page (and such an awesome page to be on!) 2017 is going to be incredible for you. So excited to follow your progress! We have many big decisions to make in 2017. Keep working? Downsize? And for my kids – which grad school and which undergrad! So many changes ahead :)

Thanks, Vicki! :-) I’m rooting for you in all of your big decisions in 2017! I’m personally hoping you can at least work LESS if not stop altogether. Hope you all have wonderful holidays!

I love the funnel graphic!

We are envious on your upcoming mortgage payoff. That is one of our top priorities, but it’s likely going to take us about 4 more years. We really need to ‘amp up’ the taxable accounts as you’ve mentioned.

We just posted our 2016 reflection on our site and it was a really good year, both financially and personally. One area we want to do better on is our charitable giving, so we plan on learning more about the donor advised funds.

Always enjoy reading your articles and hope you and Mr. ONL have a relaxing holiday.

Thanks! Appreciate the nice compliment! :-D Paying off your mortgage on that timeline is super awesome, especially since you’re also focusing on taxable account investments concurrently. Here’s hoping we all have a great financial 2017 as well! Happy holidays. :-)

Woot woot! Congratulations on the mortgage decision, and enjoy the time off!

This year we didn’t hit any huge goals-our goals right now are around paying off the mortgage, saving for college, and saving for retirement. Those are big, longer-term goals, but I did reach the shorter-term goals for funding them. The mortgage is on track for my 5 year payoff goal, college is on its way, and I’m maxing out retirement. So financially it’s been a good year!

Thank you!! :-) Don’t sell yourself short… we can’t all meet long-term goals every year, but reaching those short-term goals is AWESOME! Congrats to you!!

So many congrats to you guys!!!

You should be very, very proud of yourselves. Enjoy your well-deserved break and Happy Holidays!

Thank you! We *are* proud. :-D Hope your holidays are relaxing and fun!

1. Great job hitting the stretch goal.

2. Loved the hat tip to Penny! ;)

3. I just wrote about how quickly momentum builds – you’re charts are another proof point!

4. Best of luck in 2017 – I hope it’s the “met goal” ball that drops!

Thanks! And yeah, that momentum is for real. In any given moment, it may not seem like things are happening quickly… but the charts don’t lie. ;-) And here’s to all of us meeting lots of goals in 2017!

I’m digging the decision funnel! Very smart of you guys.

One thing, can I encourage you guys to engineer your layoff with a nice severance package? Mine is still paying out even though I left in 2012. It is totally worth it and will be a total catalyst for you to break free with financial happiness! I can send you my book as well to read and review. Just shoot me an e-mail.

Happy Holidays!

Sam

I will email you! Not sure that engineered layoffs are possible in our situation, but it’s absolutely worth considering, and I know you’re a pro on the subject. :-) Happy holidays back atcha!

Wow, congratulations on a stellar 2016! Very inspiring!

The biggest win for us in 2016 was discovering the FIRE movement. Truly a life changing discovery. As newcomers to FIRE, we’ve got a ways to go but thanks to blogs like yours, we’re super-charging our savings/investments and never looking back!

Thank you! And congrats for discovering FIRE! I know exactly what you mean about it being life-changing, and so glad you’ve joined the club. ;-) Here’s to a great 2017!

It is wonderful that you figured out that you meant the same thing even while using different words. Both my and my girlfriend’s careers are potentially disrupted by the change in Administration, so I will be looking to work even harder on developing the skill that doubles my pay. We both want to have cash reserves to help others. Happy Holidays!

Happy holidays to you, too! And I hope your plan works out — having extra cash reserves to help others is high on our list, too. <3

Great job with the mortgage…and the charts. :)

:-)

Congratulations on a successful year. I think you made the right choice on paying down the mortgage, especially with ACA. From the tone of thelast couple of articles, it seems like you guys are very much ready to launch into your next life!

Thank you! Yeah, we’re expecting parts of the ACA to stick around for at least a few years, so I think we’ll feel good about the choice to pay off the house. And you’re so right that we’re ready to be done! Happy new year. :-)

Congrats at almost having that mortgage wiped out! It has to feel amazing. And thanks for sharing your amazing graphs! :)

I agree on the communication. I know we over-communicate about everything, especially finances, but it’s so important to make sure we both are on the same page. After 23 years together, I think we do a decent job of this.

Our FIRE date is anywhere from 6 to 9 years away. It all depends on college expenses for the kids and how we are doing with real estate investing. We are still looking for our first house, but fingers crossed we’ll find something within a year.

Thank you! And glad you like the graphs. :-) And gosh, if there’s anything we learn, it’s that there’s no such thing as over-communicating about finances! So keep that up! Good luck on your house search, and on figuring out your FIRE timing! :-)

congrats on enjoying the fruits of your hard work and focus. I think you should add another stretch goal for 2017. The goal should be to be laid off towards the end of the year so that you can then both collect unemployment for a while. Boom!

I have Pie chart envy for your home loan pay off. I’m getting closer by the year myself, got some big goals for the next few years to finally pay it off. On track to pay off a 30 year in 8 years.

We aren’t sure that the layoff strategy would work in our circumstances, but we’re exploring it! And yeah, not gonna lie — that pie chart DOES feel awesome. :-) We’re now so close to mortgage free, and it feels amazing. And in your case, paying off your mortgage in 8 years is so awesome, too! Congrats!

Great year! You must feel so awesome to have the mortgage just about paid off. I am not there yet but I imagine is almost like a high. Thanks for sharing. I read posts like this from around the blog world and it really helps keep me motivated. Congrats to you and now it is time to sprint to the finish line.

-Brian

It does feel awesome to be so close to mortgage-free! :-) Glad to share some motivation — and thanks for the congrats! :-)

I just found your blog this week and have been reading voraciously. I haven’t done all the charts you have done, but I have done a lot of spreadsheets. I started about 10 years ago with the agreement with my wife that we wanted to retire young enough to enjoy it. From there, it was analysis of our spending habits, our saving habits, and our investment profiles.

It turns out that we are walking out of the office for the last time one week from today! We are debt free, have a nice nest egg, with different accounts that will activate at different ages so that our income is ever-increasing (which should counter the increase in the cost of living).

I plan to start my own blog, but have not yet started. I will probably start in my first week of retirement. Hopefully, I can share a few things that will ease your transition.

Hi Jeff — thanks for reading! And wow, you must have already walked out of the office by now! How exciting — and congrats! I love that you plan to have your income increase over time — same here. We don’t buy the myth that income needs reduce over time, so love when we hear from folks who are planning for more money in the future. And let me know when you launch your blog! Happy new year. :-)

Congrats on meeting your goals!

Enjoy the powder.

Thank you! Hope you got some great powder over the break! :-)

I realized I was holding my breath halfway through this post and finally let it out in a big gust of Happy Sigh when it turned out you were talking about the same thing in terms of when to give notice. Perfect!

This year sucked crabapples (per my last post about unplanned expenses) but I keep trying to NOT thinking about the amount of money I could have been socking away and focus instead on what I’m going to do next to make it right. I’m hoping that you’ll have time to have a bit of an in depth chat one of these days so I can fill in some of those blanks on the game plan map. Or strategy book. Whatever you want to call it.

Again, big happy whooop! for you two!

Aw, thanks for being so invested in us! :-D Yeah, glad we were on the same page all along. Now as to whether we can actually quit when we have the money… different story. ;-)

And I hope you aren’t beating yourself up about past financial stuff — all we can do is look forward.

Thanks for the well wishes! Happy new year!

Wow! Truly impressive work on paying down the mortgage! That chart says it all! That net worth chart is starting to look like a nice clean exponential curve too! That’s the hope right!

I’ll be doing my own look back on 2016 to see where I land in the next week or two. Just need to get those end of year paychecks and dividend checks in the door to know for sure, but the teaser trailer looks good…

Happy holidays to you both and best wishes for 2017!

Thank you! Your chart is starting to look exponential… too bad we won’t work a few more years to get the full exponential growth to take effect! Haha, just kidding. ;-) I hope your end of year checks turned out well! Happy new year!

There has been nothing more satisfying to me than paying off our mortgage. It’s been three years now and I cannot express to you how psychologically freeing it is!!!

Do it!! :0)

So great to hear! We have made the big chunk payment and are now just waiting until we can pay off the last little bit with our payoff quote. So soon! :-)

Congrats on a great year!

My year cruised right along as well and I will finish 2016 at about 86% of my target FIRE number. Should be able to hit the number by the end of 2017. I plan to sell my house this spring and quit my day job by the end of the year.

Have you ever run the numbers to see what your net worth would be if you had invested your money in the stock market instead of paying off the mortgage early? My biggest financial mistake was building my house and paying cash for it. It feels great being rent/mortgage-free, but the opportunity costs have been tremendous. I built back in 2005 and in 2015 I ran the numbers to see what my net worth would have been if I had just stayed in my apartment. It was a depressing day when I realized I had made a mistake that cost me a few hundred thousand dollars and instead of being FIRE’d for a couple years already, I had about three years left of work to pay for my mistake. Considering how the stock market has performed since early 2015, and I *still* haven’t sold the house, it’s probably close to a half-million dollar mistake by now. Oops.

Congrats, Travis! That’s so awesome that you had a great 2016 and are on-track to hit your big goal this year! And as to your Q, we tend to avoid running retroactive analyses, because what’s done is done, and we can’t make decisions in hindsight. Second-guessing like that only leads to beating ourselves up, which we find isn’t good for us. Though our timeline is to retire in a year, so the difference of a year isn’t huge in terms of lost gains, it’s the kind of thing that you can’t know looking forward, so we don’t try to guess.

As for your mistake, I’m sure that’s painful to know that you would have been better off renting, but I hope you don’t spend time beating yourself up about it, because it could just as easily have ended up the other way. If stocks hadn’t rallied and housing had, you’d be feeling pretty great about yourself, even though both outcomes are sheer luck. All you can do is move forward.

Here’s to a great 2017! :-)

What an accomplishment. It is seriously incredible to see your progress. Best of luck on the new chapter!

-Brian

Thanks, Brian! It feels pretty incredible. :-) Happy new year!