If you’ve been reading more than a month or two, you know the question of when to retire has been on our minds big time for many months, ever since we realized that we’re significantly ahead of schedule on our saving plan. We’re talking about a relatively small time difference — sticking it out until year end, or leaving maybe in the summer or fall if we hit our numbers sooner — but opinions have been strong on both sides. There are those who’ve counseled us that we’ll never regret quitting as soon as humanly possible, and those who’ve urged us to collect those year-end bonuses and maybe save a little extra on the way there.

When we last talked about it here, we shared our then-current thinking: that we’d work until one of two things happen, either we hit year end or we reach our stretch taxable savings/investments goal. (Or option three: one or both of us get laid off. Not especially likely. More on this in a future post.)

But since then, some things have changed, and it’s led us to make peace with working until the end of the year. Today we’ll share why we made this mindset shift.

Before we dive into all of this, a few basic facts to ground all of this:

- We’ve revised our target “magic number” for our taxable funds to a stretch goal that is already about 20 percent higher than our original target number.

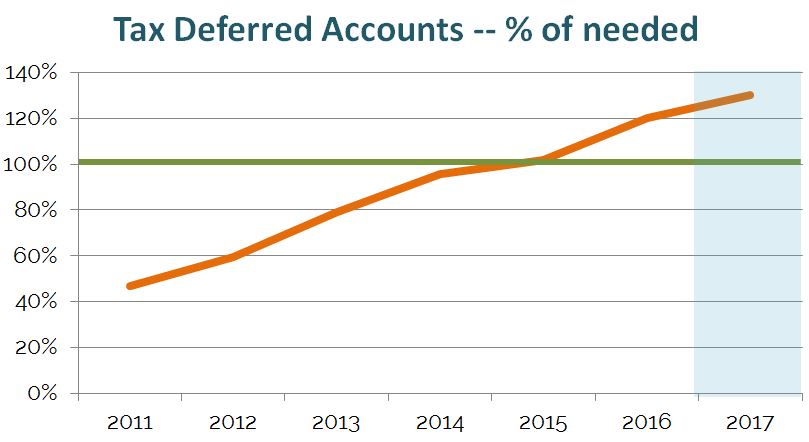

- Our 401(k)/tax-deferred funds, which we don’t plan to tap until age 60, are already significantly above what we project we’ll need to roughly double our monthly spending when Mr. ONL turns 60, assuming modest rates of return below historical averages. (Baller later years, here we come! Or, you know, maybe we’ll just be able to cover our health expenses.)

- We recently paid off the mortgage on our home, so we can save like gangbusters this year.

I say all of that to answer questions in advance about whether we’re being hasty in quitting at X time, or whether we’d be able to build up a nice cushion by working until the end of the year. Of course we can save more, but we don’t really need it.

Health Care Uncertainty

The single biggest reason I want to keep working through year’s end is the gaping health care abyss that we’re staring into. We care tons about having good health care coverage in early retirement, when we’ll no longer have access to employer-sponsored insurance, because we absolutely don’t want to end up like the quarter of Americans who struggle to pay their medical bills — even with insurance! — or the share of them who end up bankrupt.

While we still don’t know much about what the current presidential administration will mean for retirees — though there are still outstanding pledges to roll back Medicare benefits, among other things that affect traditional retirees — the biggest concern for anyone contemplating early retirement in America should be the lack of consensus around a replacement for Obamacare.

Our hope has been that Congress won’t repeal the Affordable Care Act until they have a reasonable option in place to replace it, and so far they seem to be sticking to that plan, given that they’ve had weeks now to repeal the ACA officially and they haven’t done so. And public pressure on them to keep affordable coverage intact is only increasing. That’s the good news.

The bad news is that the lack of action means none of us know what to plan or budget for, and worse, the delay may soon throw the current health insurance exchanges into chaos, and insurance companies may be forced to leave the exchanges simply because they lack clarity about what the new law might look like. This will mean that millions could lose coverage even with Obamacare and its subsidies in place. Enrollment was already down this year because of the country’s confusion around the ACA.

One good reason why we want continuous health coverage: that fall would be expensive.

We’ll keep monitoring the health care situation because we are intensely focused on this, and we’ll share more here as we know it, but in the meantime, we are seriously considering budgeting for a full rack rate health insurance plan not on the exchange, just to be on the safe side. And that’s a far cry (and many, many dollars — at least $10,000 per year) away from what we had been planning for.

It’s entirely possible that we won’t have answers by year’s end, but that’s still almost 11 months away, which we’re hoping is enough time to get a better idea of what’s coming next than we have now.

The Philanthropic Fund

As we urged everyone who could possibly afford it to do, we gave a lot to causes we care about at the end of last year. (Our nudging on it also earned us a brief Buzzfeed mention.) I don’t say that to brag, but to share that it was a galvanizing moment for us. We gave significantly more than we have in the past, because it’s such an important time to do so, and because we could. And we realized: we will be extremely sad if we can’t keep giving in retirement. We don’t expect to be able to give at the same levels, and of course we’ll make an impact by volunteering our time in abundance, but we always want to be able to give actual money, which is what most charitable causes need.

So we decided: everything we earn above our stretch magic number is money we can put into a donor advised fund, which will let us take the tax write-off in our last high tax bracket (and probably last itemizing) year, and will provide funds for future giving even when we can’t technically afford to give much. Knowing that any months after we hit the big number are going to fund our future giving will make them feel a lot more worthwhile than if we were just hoarding more for ourselves than we need.

The “Year of No” Is Working

We recently declared 2017 our “Year of No,” mostly referring to our new focus on setting boundaries at work. And here’s the crazy thing: It’s working.

In my case, I talked to my management about working smarter, not harder and getting more support to do so, and they came through for me. And I’ve talked with them about delegating more so that I’m creating opportunities for others while reducing my own workload, and they were supportive of that too. (Can I just say one more time how grateful I am to work for a wonderful company? My desire to leave is not about that at all.)

So far this year, I’ve been working weekly hours in the 40s, not the 60s, and have been able to empower others in the way I’ve always wanted to in order to leave behind a strong legacy of great people. If it continues this way, I will have no trouble making it through the end of the year.

More Money Is on the Table

In Mr. ONL’s case, some circumstances have changed that make it even more advantageous than in the past to stick it out til the end of year. And whether that extra money ultimately goes into our investments or our donor advised fund, it’s just one more argument in favor of sticking to our original (but already shortened) timeline.

Those Crazy Markets

We are staunchly opposed to meandering into talk of when the crash will come, and we no longer pay any attention to daily or weekly market fluctuations. But we’re overdue for a recession as is, and now the country is moving in an isolationist direction, which most economists believe is generally bad for countries’ economies. While we are absolutely not rooting for a crash, having it happen while we’re still working would sure be a lot easier to cope with than if it happens after we pull the plug. Plus, saving just a smidge more in anticipation of a big or extended correction wouldn’t be the worst contingency plan ever.

– – – – –

Is This “One More Year” Syndrome?

In a word, or actually two: Hell no. We’re sticking to our guns on this one, and quitting at the end of this year, no matter what, even if health care is unclear, and even if markets go all bajiggity. That’s been our plan all along, and is in fact still a lot sooner than our original goal of quitting in 2020. All we’re doing now is walking back the idea that we could even shave a few more months off of our timeline.

What Would You Do?

If you were in our shoes, would you stick it out til the end of the year, or pull the plug as soon as you possibly could? Are any of the factors that we’re thinking about on your mind as well? How are you planning (or not planning) for the health care uncertainty? Anybody else eyeing beefing up a donor advised fund? Let’s chat about it all in the comments!

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: the process

You are both young , stick it out for now and keep your options open. Seeing the end in sight will help.

Good advice! Thanks. :-)

Probably more important than when you go is what the transition looks like. Will one of you keep working while the other sets up the next passive income stream?

Nope! We’re committed to quitting at the same time, but we have some other plans up our sleeves for post-retirement income. ;-)

I’d be tempted to quit now! But I would also probably stay through the end of the year.

Also I love the implications of your first bar graph. If you kept piling up money at the rate you did for the first two years, looks like you’d end the current year with about 2.5 units of money (lol and I wonder what the units are!). BUT instead you really ramped up your savings and you’ll have 7 units of money by the end of the year!!! That’s such a gaping discrepancy and it’s amazing that you changed your trajectory like that!

Haha — yep, you’ve captured our thoughts vs. feelings. :-) Rational thoughts = stay. Feelings = leave now. Hahahaha. And as for where we end up on savings, stay tuned! Obviously the markets will have a lot to say about that, though it’s nice that we can save so much faster now with the mortgage gone!

I can 100% relate to, well, all of this. Haha – even posted my own article about how we’re postponing retirement due to increase in charitable giving.

The biggest differences are timeline and work flexibility. We’re more like two, two and a half years out – which in some ways is good, as what will happen to health insurance markets will be more of a known. We’re definitely not currently accounting for $10k a year for premiums. :(

For flexibility, I could almost assuredly go to part time work at my current position. I may even be able to swing a digital nomad type of position. Being able to have even 20% of my current salary flowing in would make everything much safer, especially in the early years.

That’s awesome you’re so focused on giving! I love that!!! And I hope for you guys that there will be more health care certainty on your timeline… and that you won’t have to plan to spend $10-15K a year on health care! And if you can go digi nomad, do it! What a great option to have. If we could do that (we can’t), we could quit now because we could absolutely live on that and wouldn’t need our investments at all.

We would stick it out through the end of the year – especially if we were working manageable hours.

Donor advised fund is a great plan for your final taxable year! Definitely something we will want to do as we get closer.

That’s great you guys will also do a DAF! I love hearing how charitable our community can be. :-) And thanks for the affirmation — of course if work gets bad again, then this could all change. ;-)

Without knowing about details like money, your goals and generally living in your shoes, I can’t really say what I’d do if I were in your position. All I can say is I am of the belief that flexible people will make early retirement work almost regardless of when they choose to retire.

Regarding healthcare, my wife and I are strongly considering one of the Health Sharing ministries now to help save on costs. While many of those organizations require a certain belief system, others don’t – and the ones that don’t are definitely those that we are targeting. It makes healthcare much easier to understand and manage, and we know plenty of people, especially within the RV community, who use Health Sharing and love it. Thus, that will probably be what we end up doing.

Regarding a “recession” – eh, whatever. Markets ebb and flow. They go up and down. We don’t much care when the tide turns. In the end, the markets will do what the markets have always done. We aren’t all that concerned about them.

At the moment, money isn’t a big influencer for us any longer. We have what we think we’ll need and anything else is just gravy. It’s funny…my wife just received a huge recognition at her job a couple months ago, and she’s still leaving in April, throwing it all away.

It feels good!

I’m glad that you guys are happy with your plan and feel comfortable with all of it. You already know I would not do well with quite so much of the “winging it” approach, but I always appreciate that we all have the ability to shape our plans to our own comfort levels. ;-)

That’s great you’ve found a potential answer through the health sharing ministries, though they are based on the ACA and might also go away or at least change significantly. Very much a moving target for all of us right now!

I do not think this is one more year syndrome. I think you’re being cautious, based on the information you have and uncertainty in front of you. Healthcare is one of our major concerns regarding early retirement. Granted, we’re a few years away, but for now, we’re also planning on full rate coverage of about $1k/mo for our family of 3 – just to be safe. Hopefully, we won’t need to pay that amount, but you just never know.

Mr. MMM’s father was on the phone yesterday talking about their healthcare and ACA coverage. It’s unbelievable what is coming out of their pockets each month.

It’s always better to be prepared. This year will fly by!

Mrs. Mad Money Monster

Ugh… doesn’t it kill you to think about having to pay that much? I know it does for us. Yay for “more affordable” and “better” health care as promised! ;-)

Scaredy cat Penny would stay. When I see what my medical bills are versus what they would be if I had typical insurance, let alone terrible insurance (or none!), I want to chain myself to my desk. Granted, I do pay more than a lot of people for my insurance, but with all these doctor visits, screenings, and visits to specialists, it’s been worth every penny and many more.

I think as long as you can stay without driving yourself crazy and you can keep boundaries between work and the other aspects of your life, it makes sense to stay for the peace of mind. But there also has to be a tipping point where you know you’d walk, right? You seem to have a really good sense of not letting yourselves get too lost in it (especially after that loyalty post!).

It’s also a great idea to have health care if you have a big life event coming up like, oh I dunno…. having a baby :)

Um, yeah! :-)

Oh, I get it! And if we had kids or a baby on the way, I bet we wouldn’t be comfortable leaving right now, given all the health care turmoil. But at least for us we know we can leave the country and get care elsewhere if we really have to, and knowing we have that backup-backup-backup plan is what helps me think about moving forward. And yes, there is a tipping point. If things get as bad this year as they were in the second half of 2016, then we’ll have very different kinds of conversations!

I like your path – logically that makes a lot of sense. Healthcare is such a big part of the decision to quit your jobs, but, unfortunately, it’s also such a big unknown. So I definitely agree with staying for the year for that alone.

As a side note, I chuckled out loud when I saw the chart with “Zero Fs Given” on the scale… classic!

— Jim

Ha — that zero Fs given end of the spectrum is clearly not where we are, and not what we advocate for! But that’s what it is. ;-) And you’re right — this is 100% the logical decision, and now with the health care uncertainty, it’s also the emotional decision!

I love the idea of the Donor Advised Fund, especially for retirement income. We’ve always based on our giving on our income, but in retirement our income will be based on our expenses. I think we will use a Donor Advised Fund for retirement giving, too.

I also completely understand wanting to play it safe with health care costs so up in the air. But mostly I’m so glad to hear that you’re succeeding at setting boundaries and are working more reasonable hours. I think that’s great that you got the green light to delegate more and empower others!

I love that you guys are also thinking about a DAF — but I’m not surprised at all. ;-) It is weird thinking about how much to give when you kind of have no income, or at least no new money coming in, so it’s nice to think about having this chunk set aside for the purpose. And yeah, the work side is feeling better — fingers crossed it keeps going this way!

I am uninsurable without the preexisting conditions exclusion (PCOS and infertility). Good thing I like my job.

Oh, amen sister. The pre-existing condition piece is HUGE for us. Soooo hoping they give us some clarity on that soon!

Yup, the preexisting conditions piece is huge. Between my asthma and therapy visits over the years, I doubt I have much chance of private coverage if they allow that back. Thankfully my husband likes his job so I have access to insurance through him until I find my own again!

Same here! I don’t actually want them to cut anything that’s currently covered (what men do not think it’s in everyone’s best interests to cover women’s health care needs?! aren’t we also in your households?!), but pre-existing condition coverage is HUGE for so many people. Fingers crossed it survives!

Like previous years, 2017 will go by in an instant. Work doesn’t sound torturous, it sounds advantageous to completely finish off the calendar year and perhaps most of all…you’re almost there. You will both finish up on a high note and will have the rest of your lives to do what you want, when you want. I understand the decision and believe that this will give Mrs. ONL the proper amount of time to complete the mental transition by leaving colleagues set up for future success.

We fear the opposite — 2017 seems to be the slowest year ever so far. ;-) But I bet you’re right that we’ll look back on it and feel like it was over quickly. And the legacy piece is super important to me especially, so I like that argument for sticking it out. :-)

In your position I’d be looking to see if my bosses would let me go part time after the number is hit. Worst case it’s a no and you can use that to ease yourself in. Alternately retire but offer your services for a bit of contract work for a while post retirement. Both ease you into it, give you a way back in if needed, but start you on the way out.

I was also going to suggest going part-time, if possible. It’s a nice way to ease into ER while still having insurance against market downturns or healthcare legislation. At least that’s what I tell myself–because going part-time is my plan for this year!

Going part-time is a completely great suggestion, we’re just not sure it would work in our cases for a variety of reasons. But don’t think we haven’t discussed this at length! A frequent musing around our house: “I wonder if they would give us health insurance if we work four hours a week but take no actual pay…” ;-)

We are definitely thinking about this, though it’s not our first choice to keep doing the work we’re doing now. But lots of thoughts are swirling around. :-)

You mention looking at rack rate for an insurance plan, but you did not mention COBRA coverage at all. Since that would last up to 18 months, with relatively certain costs (adding the employer cost to your current spending) wouldn’t that serve as a likely contingency target, at least for its duration? And would having that as an option give you any better feeling for being able to ride out the uncertainty of whatever follows Obamacare?

The reason for that is COBRA is 18 months, and we’ll have 25-28 years (at least) of health insurance needs before we become eligible for Medicare, if that’s even a thing. So COBRA is definitely on our radar, but it’s such a tiny amount of our total time (plus it’s crazy expensive, anyway) that we can’t plan around that in a big way. But it’s an important thought to capture because there’s an increasingly likely chance that we’ll resort to COBRA if Congress can’t get their act together on this.

Cash is king when there are a lot of uncertainties. You guys are doing great so just keep at it. One more year isn’t such a huge deal in the grand scheme of thing. Yeah, I’m worried about healthcare too. Good job at work.

Thanks, Joe! Always appreciate you cheering us on! And let’s hope we all get some certainty around health care soon!

Good for you for doing what works best. :) It sounds like it makes a lot more financial sense to stick it out through the end of the year.

If it were me, I would quit my job so fast my head would spin. I think it comes down to whether you love what you do or if you could do better things with your time. I’d personally like to do better things with my time.

Well you know we WANT to do what you’re talking about doing. ;-) Because we would absolutely love to be doing better things with our time! But we see the tremendous upside to seeing our plan through to the end, and so we’re feeling good about this. :-)

Love your attitude about work. I set my date at 6/30/2017 about 18 months ago, I’m well ahead of my number and my schedule but I want to stick around and do it on my terms. I have been open about my plans with my company and I’m doing my best to set several of my colleagues up so they can take over all these relationships I’ve developed over the years (I’m in sales). It feels good to try and help these folks whom I respect and trust and allows me to really walk away with my integrity intact (which was quite important to me). The current state of politics still freaks me out and since my spouse will be working – I will be able to get health care through his employer. That little back stop makes the decision to stick with the original date easier. One thing to think about on the healthcare front (which may make you feel better). You two are both young and healthy and I would venture to say that work is probably the thing most contributing to whatever potential health care crises you may encounter. Remove work from the equation and live a lower stress, lower gold star seeking life, and I think you may be healthier over the long run and reduce the odds of such a crisis significantly.

I LOVE that you are able to leave on your terms, and OPENLY, and keep your integrity. That’s so huge — and RARE! I really do think the secrecy itself is taking a toll on us, and just being able to be open about our plans with everyone will be a huge weight off. And I do think you’re right that subtracting work will make us healthier — just not enough healthier to ever make me feel okay being uninsured. Especially if pre-existing condition coverage goes away. Fingers crossed they keep that!

Just for the sake of playing devil’s advocate, is it possible if you did tell them that nothing would change? It felt a little weird being totally honest with them and in some ways I’m missing out on a couple of opportunities for “growth” which really are just meetings. Would they simply fire you right away if you shared your plans with them? If your intentions are pure – you aren’t leaving to go bring your talents elsewhere – then perhaps they would be on board with it? I understand why you wouldn’t want to say anything … and coupled with the large annual bonus at the end of the year. I’m mostly commission based with some added on incentives and me telling them I was leaving in June gave me an opportunity to renegotiate my base salary and throw in some of those add on incentives I’ve gotten every year into that salary. Clearly you are a really valuable employee and I assume so is Mr. ONL and I find it hard to believe that valuable employees just get tossed by the wayside like a crumpled piece of paper. And yes, crossing fingers on insurance. :)

I always appreciate a devil’s advocate. :-) Short answer is: almost 100% no for me, maybe for Mr. ONL. And now that we’ve decided we’re working the full year, we will start talking more about the timing of giving notice. In client work like we both do, the client relationship is so key that our companies will want to move other people into our roles ASAP once they know our plans to ensure seamless succession, and that will quickly marginalize us. Mr. ONL’s job involves more short-term projects, so he could still possibly do interesting work over a long-ish transition period, but it won’t work that way for me. I don’t think it would be quite as unceremonious as getting tossed out like a piece of paper (I do expect a party!) ;-) but I don’t think giving a lot of notice would serve us well. But obviously this is something we’re still thinking a lot about!

Interesting. It’s a bummer you can’t be honest but I understand your hesitation. I do client work as well but the dynamics are different in that they are mostly transactional. I’m sure at some point, the timing will “feel” right to make the announcement. Perhaps in the meantime, the year of saying no and being slightly more detached will ease the anxiety? And not that I know how you are thinking – but maybe you are a little fearful they might be angry with you (and no gold star loving person deals well with folks not being angry)? Just in case you might be worried about that – that’s on them – it has nothing to do with you. If you kicked ass until the end (which I know you will), then you more than held up your end of the arrangement. I have a feeling you might be surprised and some of the folks you work for and with might be supportive, super intrigued and even inspired by your life choice. Others might think you are crazy. ;)

I am definitely feeling less anxiety at work so far this year (though more anxiety in the world generally, so it balances out). ;-) I do think about the anger/betrayal piece given that this won’t be a decision made at that point in time, but rather one we’ve been planning for a loooong time. I only worry about that from a few key people who’ve invested a lot in me over the years, not from the company as a whole. I really do think everyone will be supportive (at least eventually!), but you know I don’t want to let down the people I care about most. :-) As for timing, I have several projects currently slated to wrap up late summer, so that is starting to feel like a good time to talk transition.

I still say you should be “out” by the time FinCon rolls around so we can take pictures and post them sans emojis.

Also I really love that you used the word “Bajiggity”.

I think the more notable thing is that it took me so long to use bajiggity on the blog. ;-) And all of this is independent of when we give notice — that’s all still TBD, but I still hope big time that we can be out by FinCon. That’s only two months notice, so I think chances are good!

Sometimes it’s nice to have a date set in advance so you can keep a countdown and make preparations for your giant party. Planning this for the end of the year makes sense so you can look forward to it and enjoy the anticipation. If you kept it flexible month-to-month, you’d miss some of the planning, the goodbyes, the thrill of the countdown… Not that the early retirement wouldn’t be worth the trade, but I’d like the certainty of the end of year timeline and not having to keep deciding over and over each month.

I love how I’m worried about health care and you’re thinking about the party. :-) hahahaa But it’s such a great point about the countdown and celebration. They say the real joy from vacation comes from looking forward to it, not from the thing itself, so maybe it’s the same. (Nah, it’s probably not.) ;-)

I think if we were in your situation with the thoughts that you have, sticking it out until the end of the year shouldn’t be too bad especially with your “Year of No.” The health care question is a big one – one where a bit of extra cash couldn’t hurt. The market could still go up for a short bit, but it does seem like we’re a bit overdue for a major correction.

In any case though, at least you have the option of sticking it out until the end of the year! At worst case, you have extra money to cushion uncertainty, and best case you have extra money for charitable giving! :-D (also, you’re only giving yourself till the end of the year and not multiple years) Good luck though!

Thanks for the good luck wishes! Yeah, there is a lot of uncertainty, maybe even more than the usual amount. ;-) As you said, a little extra cash couldn’t hurt across the board. (Also, WOHOO! You didn’t go to spam!!)

I know! It’s about time! Woot!! :-D

Woot! :-)

We are very concerned about the future of healthcare and understand your desire to hold onto the health insurance you currently have through your employer.

We must first mention that both Mr. FE and I are apolitical and are neither Democrat or Republican, but we have our reservations when it comes to the survival of the Affordable Care Act.

We’ve already seen three out of the five major health insurers exit the marketplace with others expressing interest in following suit. Our best guess is that if any more insurers make an exit, the ACA will eventually collapse leaving many without insurance or an affordable option. Needless to say, we are skeptical that the ACA will be remain viable as we look toward the future.

Let’s hope the current administration (whether for or against) is able to find a more effective and affordable health care replacement for ALL of us!

100% with you — I don’t care about politics in this case. I just want people to have access to good health coverage. Though it’s hard not to be skeptical when you promise that you have something better for years and then the time actually comes to do it and you show that you have nothing. Not encouraging!

As someone who has been retired for 10 years, I say you can never save enough money before you pull the plug. At 70, health has become the big issue. I have macular degeneration in both eyes (one wet, one dry). I no longer drive and future concerns are where to live in order to have access to groceries, bank, pharmacy, doctors, etc. At some point I’ll have to leave my paid for house. Uncertainty is unsettling! Please wait until the end of the year.

Gosh, it is stories like yours that make me so glad we are saving the bulk of our investments for our 60+ years. When I hear of the younger folks converting all of their 401(k) funds into backdoor Roths to spend sooner, it just makes me cringe for them!

I’m not sure that the intention for most is to spend sooner on the 401K/Roth conversion. I think it’s more to take advantage of the tax laws and have more flexibility with that money. I wasn’t really on board with the idea at all at first but when you can do it without tax implications, it really makes a lot of sense and I think should the tax laws stay the same, it’s not a bad plan. I have that strategy in the back of my head for a few years out after I’m not earning income. I think that once you are retired (and me), our financial strategies will change a little bit and this is another piece we can add or not add depending on our own financial and tax situations.

If the intent is flexibility, then I can get behind that. And to your point about strategies changing post retirement, whatever the health care situation ends up being will impact this, too. We had thought, if we had room under the ACA subsidy limit in a given year, we could backdoor convert some 401k funds to Roth without hurting our ACA costs or paying tax, but now those calculations get tossed out the window. But depending how the new system turns out, that could affect this thinking as well.

I’ve run a lot of projections on using 401(k) or pretax IRA dollars to convert to Roth and be able to spend them earlier and the key seems to not do that too early. How to strike that perfect balance isn’t clear but my current projections suggest having at least ten years expenses in taxable at early retirement time and being in my late forties before considering manipulating retirement account money at all. On the other hand, I’m not willing to leave all of the funds in retirement accounts until 60 because that will create a huge unbalance in funds. It’ll be a curious balance to strike when the time comes!

I like that idea to have at least 10 years in expenses in taxable accounts at early retirement time. I haven’t considered it that way. I’m not sure it’s the right thing in my situation but I think that’s probably one of the important ways to approach it. Since I have taxable income this year, I wasn’t going to even to start messing around with any more complicated strategies than what I’ve got going on right now, but I think it’s important to consider these things once you are in the place where you aren’t earning income.

It’s definitely an interesting idea! We’ll have more like 14-15 years of expenses in our taxable accounts when we retire, not accounting for inflation, and also not factoring in the rental income that will get bigger about 11 years in. But that’s just our comfort level!

That’s interesting! Of course you know I’m curious what your calculations are based on, and how you arrived at 10 years, but conceptually that seems to make sense. I have no issue leaving the true retirement money alone, but I find it super comforting to know we’ll be well covered when we’re older (or if we die sooner, then we’ll leave behind a fantastic bequest to some worthy causes).

I’ll let you know when I do the calculations again! I never really consider writing a post on them since they’re really so hypothetical at this point. I do back of the envelope ones every once in a while. It’s so hard to project the exact need! Other bloggers say you “only” need five years in taxable if you plan to use Roth conversions. I think that five years is too little because it will result in needing to dip into pre-tax accounts for conversion before you really should. Part of where I came at 10 years is that I will have likely have several years of expenses as principal in Roth accounts that can be withdrawn. My vague plan at the moment is to rely on taxable + any other income streams I come up with until my mid/late forties and then do some Roth conversions / possibly set up a SEPP while withdrawing Roth principal. 14-15 years seems pretty reasonable with you guys not having any Roth accounts! My estimate is to have about 10 years in taxable + 3 years in Roth principal.

Yeah, five years of taxable seems like waaaaaaay too little for my comfort! And knowing that your 10 years of taxable is supplemented by 3ish years of Roth makes it all make more sense for me. :-)

Good reasons to work till year end. The health care is an important point to take into consideration. A few months can make the difference here.

I hope you get certainty soon. That being said, between now and 65 years from now, a lot can change.

Enjoy the snow!

We absolutely know that so much can still change, so flexibility will always be part of our approach. If we wait for total certainty, we will be waiting forever. ;-) But it seems a few months of waiting could be very smart here.

between waiting forever and a few months extra till year end, there is one that is the smart thing to do. Good you do that.

Great that work is rather 40 than 60 for you right now… The fact that you delegate more now, might make it easier the day you want to quit.

Thanks — yeah, we think this is the smart choice even if it’s not our preference. ;-) And YES, work is much better at this point, so I’m going to focus on keeping it that way!

Our plan is pretty much to roll with what comes. As Mrs. SSC and I were discussing this weekend, if we roll all of our 401k’s into roth backdoor funds we can use that to just live off of now and figure the rest out as we’re older… We can always reclaim the kids 529’s as well, so that has our security blanket fund covered as well.

Hahaha, just kidding, but we really were talking about the fact that next year, we probably could pull the plug and move with jobs or not.

I know I said in my post today, we could end up sticking around here longer than we want, but I think even with the healthcare uncertainty, when we hit our number and find a place we want to go to, we’re probably outta here.

Steve said it best in that “flexible people will make early retirement work almost regardless of when they choose to retire.” We feel the same and especially being so close it wouldn’t take much for us to be like, “Oh here’s a town, and a decent job to cover living expenses and here’s a nice house. Later Houston, we’re out!”

I think the “decent job to cover living expenses” piece that you guys are planning for makes a WORLD of difference. That willingness to keep working, albeit in a much less stressful role, will keep you in a good position to be flexible. It’s when you cut off that flow of money and availability of health insurance that things get scary fast! So that’s all part of our calculus now… does one of us need to keep some part-time connection to work, even though we don’t want that, just for the insurance?

I think it’s a great idea to “stick with it” until the end of the year. You never know what our new president is going to do… and having decent healthcare is a very good idea.

Frankly, from a historical perspective, we’re in bubble territory right now. At the top of the wave that could be about ready to come crashing down as all of this new legislation gets put into place.

I think you’re smart to be cautious.

Thanks — this just feels like the right call, even if we’d love to be done now! What do you do for health care? Is this all throwing a wrench in your plans, too? And yeah, the numbers definitely say bubble. We never try to predict this stuff, so won’t guess what’s coming, but being a little extra cautious probably isn’t the worst idea.

“Our 401(k)/tax-deferred funds, which we don’t plan to tap until age 60, are already significantly above what we project we’ll need to roughly double our monthly spending when Mr. ONL turns 60, assuming modest rates of return below historical averages.”

So let me throw some examples so I understand the math. Assume expenses are 401K a year, until Mr. ONLY turns 60 the expenses are being covered by other taxable/rent income expenses. Then when age 60 hits, your tax deferred funds assuming a 4% rule would cover double or 80K in expenses, that sound right?

Yes, that ratio is correct. Just substitute in our real numbers. ;-)

Ooops meant 40K, but if your budget is 401K per year, talk to my main man Johnny Depp;)

Haha, it’s definitely not!

I’m glad you’re at peace with it. Now you’re where I’m at on budgeting health… WHO THE HECK KNOWS?! – and I love the donor-advised fund idea for the rest of the year. This year has really made me WISH SO BAD we only had one year left! :)

Ugh, I know! I really do think this will feel like a slow year for all of us. :-( I know you have been in the camp of wanting us to quit ASAP, which I support! But given the health care climate, I just can’t do it without more info!

I think sticking it out until the end of the year is great for your situation. And you’re already ONE MONTH down! I am working on a similar post – but we have you by many years, so sticking out another year is a much bigger deal. Some of the incentive to work another year involves a nice increase in my pension. But that requires waiting a long time too…

True! Slightly more than a month, even! :-) And I so hope for your sake that you aren’t looking at working much longer, even if it means a bigger pension. I know that could be hard to turn down, but you deserve your exit 100%.

I’m bummed that this isn’t necessarily the decision you were hoping to make (particularly in light of the crazy political uncertainty right now that’s helping drive your choice) — but also really glad that you’ve picked a firm date. I hope that will save you some stress this year about whether or not to pull the plug early. It’s official now, and it will be here before you know it! I still think you’re more than likely going to end up with an abundance of cash in early retirement and 60+ retirement, but you’ll be exceptional philanthropists when that happens :)

I think you’re right that the firm date will help us (me) mentally prepare better for it all. And geez, there’s so little uncertainty these days on so many things that being able to create some modicum of certainty about something feels good! And I absolutely hope you’re right about the excess — mathematically we have a good chance of that, and nothing would make us happier than being able to make it rain with our favorite causes. :-)

Still happy you poked my on the giving comment on your last post. #1 that BuzzFeed mention was awesome and #2…. is it ok that everything else glazed over when I was stoked that you posted a photo of you guys tag teaming sending that route :)

Do I still get to call it sending it if I’m top-roping? ;-)

Let’s just pretend you were on lead , it will be our secret

Ok, thanks. Appreciate that. ;-) (I’m totally a wuss climber, though. Leading freaks me out. Much bigger fan of exposed and unroped class 3, which makes my heart go pitter patter.) ;-)

If you hated your job, I’d say quit. But as you’ve got this incredible opportunity to empower others, shape leaders and leave a legacy, staying makes sense. In fact, perhaps early retirees should have goals to shape and develop people… Keep businesses in people that will deliver the results that translate to investment growth!

I completely agree with this! We all SHOULD focus on leaving a positive legacy behind in the form of great people who will be set up for success (and, as you say, the results that will drive share prices!).

Personally, I would quit now, but having an extra year of padding on your investments would be nice as well, so now it’s purely up to you and how flexible you guys are.

If you hate your job, quit. If not, why not stay for a bit longer and pad up the funds, so you can withdraw at less than 4%.

I think that as long as you are fine and firm with your decision, it will always work out. More power to you, ONL!

Thanks for the encouragement! Sticking out the year definitely feels right to us, especially since we’re not quite at a number that gives us comfort to quit at this moment. But we’ll be there soon!

I support you two in this sound and philanthropic plan for 2017. There is value in certainty, and your future should be solid with the added benefit of working until the end of the year. Not to mention the fact that you’ve made changes so that work is more bearable. As always, I’m extremely impressed and jealous. 2017 is sure to fly by and then the real adventures begin for the both of you :)

Thanks so much, Harmony! You’re so right… it feels like a relief just to have the date set, even if part of me would prefer it be sooner. Fortunately it’s only a few months’ difference at most. I hope you’re right that 2017 will fly by, though now that I made peace with this decision, I actually want to savor it all a little more. So — shockingly! — I’m not feeling in a hurry at the moment! (I know! Who am I and what have I done with Ms ONL?! Haha.)

I am uber-curious what you two end up doing because I am in the exact same situation. Hit FI last year, started contributing to a DAF last year, working until end of this year to hit final goals but could quit any time. Plan is to finish out the year, maximize final savings, add more to the DAF. Some days it feels easy to keep going because work is awesome and fulfilling. Other days the red tape makes me want to quit on the spot. I’ve gone back and forth so much! I love your step-wise thinking through the pros/cons. So we are just going to do whatever you do. Ready, set, go……

Well you know I love your plan, then! :-) And I totally understand going back and forth every day. Like one day I’ll think, “Ugh! All the travel! Can’t wait to fly less!” But then I think, “Wait! But I love flying!” Hahaha. It will definitely be an adjustment, and I’m not totally sure if I’m capable of slowing down. But we’ll find out soon, one way or another. ;-) Good luck in your last year!

I’m so glad that you set boundaries and work and they were respected in a way that is good for you and the company. I’m so happy to know that you are the type of folks who would take from the excess pile and create a DAF. That will also help you feel able to contribute to causes you care about in your first uncertain years of retirement. The money was already spent according to your taxes. The distributions will help you stay connected to the causes you care about. 100% approve.

Thanks, ZJ! Seeing what’s happening in the world right now, I couldn’t imagine putting ourselves willingly into a position in which we couldn’t marshal resources where they’re needed. We always want to be able to fight the good fight with both our actions and our wallets!