Overheard in the ONL house:

Me: “What should we do with our allocations this month? All to Vanguard, or start focusing more on the cash cushion?”

Mr. ONL: “It’s really hard not to try to time the markets right now. But we also said that a year ago, and we’re up more than 10 percent since then.”

Me: “I know, but the last quarter has just been ridiculous. I don’t believe it will stick.”

Mr. ONL: “Yeah. Can we get a correction soon, please?”

That’s the conversation we just had, as we think about where to put the non-automated part of our April savings and investments. And I can definitively say this, at least for us:

Getting close to early retirement comes with a whole slew of conflicting emotions.

Excitement at how close we’re getting. It’s haaaapppppennnnning. Trepidation at the current state of the markets, and the possibility that we could be facing a crash or recession in the early part of our retirement, which is the biggest predictor of savings not lasting (sequence of returns risk and all). Thrill at knowing that the next time the snow starts dumping, we’ll be retired, and can ski midweek. Impatience to get to all the cool projects we have planned for our post-career lives. Nostalgia for all the career things we’re doing for the last time.

So far 2017 is flying by. I can’t believe I’ve already flown 36,000 miles and stayed almost 40 hotel nights. I definitely can’t believe that our investments are up almost 8 percent in just the last quarter (including our contributions).

United activity for the quarter

This time-flying feeling should be a good thing, right? How amazing to get to breeze through our last year of work quickly (not that the work part is actually a breeze — it’s still work!).

The super weird thing — one of those conflicting emotions — is that I’m actually wishing the year would slow down a bit. As it’s dawned on me that many of the work things I’m doing are happening for the last time, I’ve started to wish that I could stretch some of them out. Especially time with work friends, time with clients I love, time in places that work takes me, time doing my favorite stuff like presenting, and — not gonna lie — time in first class (free upgrades, of course — I would never charge clients for first class) and in nicer hotel rooms than we’ll ever pay for ourselves (Residence Inn, here we come!).

The huge upside of this nostalgic impulse is that it helps me keep the frustrating moments in perspective: “Awww, frustrating coworker. You’re doing that annoying thing that used to make me crazy. But now I’m thinking about what a great laugh I’ll get when I look back on how important you thought this was, when it really doesn’t matter. Bless your heart.”

Of course, at the same time that I’m feeling all of that, there is still some part of my brain that doesn’t believe this early retirement thing is really happening. I’m still completely invested in long-term planning discussions at work, when I could easily sit back and feel smug in my secret knowledge. I still talk to clients as though we’ll be working together for years, because of course they’ll still work with my company, just not with me. And I’m still trying to keep my revenue and billable hours high, as though those things still matter (they don’t). (I’m still doing pretty well at saying no to things I don’t want to do, though, and I’m not working long hours when I don’t need to.) And, yeah, those numbers feel as big and fake as ever.

So that’s the backdrop for what’s going on with us right now. And it’s the lens through which we’re looking at our finances, and assessing the bonkers market growth of the last quarter. Let’s get into the update!

The Time for Countdowns

We’ve been watching the months tick down on our little sidebar counter for more than two years now, and it currently stands at 9 months:

But we realized, that countdown is less meaningful than the countdown to when we give notice, because our work will lessen dramatically after we tell people we’re leaving. And while we’re still not settled on some key questions like whether we’ll give notice at the same time (more on this in a post soon!), or exactly when we’ll each do it, we do know that the latest we’d possibly give notice is mid- to late-October, meaning our real ticker is actually:

And when we’re thinking about countdowns, it’s impossible not to think at the same time about the countdown to when we can unmask ourselves here, and stop this anonymous silliness. We expect that to happen not long after we give notice at work, so sometime less than seven months from now, we hope before FinCon at the end of October. (We can actually be in pictures this year!) Meaning our full countdown currently stands at:

Countdown to giving notice: 6ish months

Countdown to no-more-anonymous-blog: < 7 months

Countdown to the end of work: < 9 months

That six months number especially is soooo sooooooon. Someone please pinch me. Is this real life?

—> Follow along with our adventures between blog posts — with so many more pictures! — on Twitter, Instagram and Facebook. <—

The Financial Update

Part of me wants to put an asterisk on all of these charts, like the asterisk on Barry Bonds’ record-setting home run season. Because, for real, are these gains going to stick? You’re welcome to give us the pep talk on not timing the markets, and how time in the markets is the most important thing, though of course we know all of that.

Knowing it rationally and feeling it emotionally are two different things.

We’re still staying the course on our investments, with a little more shift into cash with the money we’re no longer paying against our primary mortgage. But we’re not attaching ourselves to the current positions, which is a good practice no matter what the markets are doing. And we’re not assuming that we’re as close to our magic number as our current positions suggest. So with that, here we go.

(As always, we share relative numbers and percentages only. Here’s why. And, all of the axis units are not obvious numbers and many of the charts don’t begin at zero. Just to be tricky like that.)

Property and Debt

We paid off our house in January of this year, so this chart won’t appear in future quarterly updates. We went from owing about half of the original mortgage balance in October 2015 to having it fully paid off 15 months later:

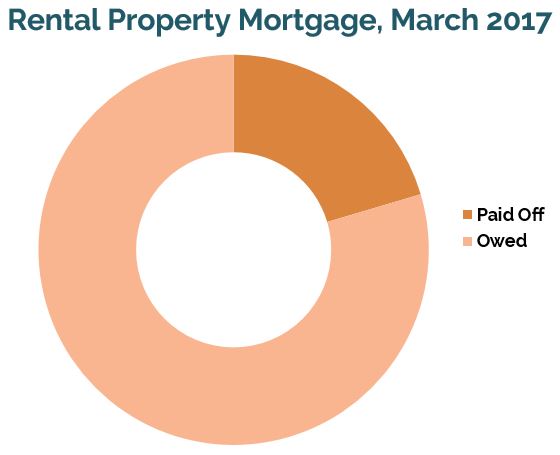

And our most boring chart, what we still owe on our rental property mortgage, which we are not paying off ahead of schedule (here’s why not):

Taxable Savings

Now that the house is paid off, taxable savings is by far the most important element of our two-phase retirement plan, given that our 401(k) balances are now high enough that we could lose 30 percent of their value, never recover it, collect conservative annual gains from the remainder, and still double our spending when Mr. ONL turns 59 1/2. Compound interest is magic.

Taxable savings is what we base our target number on, and it’s what we’re most focused on in this final year of work, including both our invested assets that aren’t tax-advantaged, and the two-year cash cushion that we plan to have before we quit.

Because some of you have asked, here’s what our current taxable funds allocation looks like, before we’ve built up the full two-year cash cushion we plan to retire with:

And after the asterisk-inducing first quarter of 2017, here’s where our taxable savings stand:

That puts us well in range of where we should be at this point in the year to hit our target, and possibly quite ahead considering that a large chunk of our income will come at year-end, what we’ve taken to call our “retirement thank you bonuses.” (Mine will be teensy, but Mr. ONL’s should be decent-sized.) But again, we’re thinking of this number having a big asterisk on it, so we don’t assume we’ll be continually going up from here.

Net Worth Components

As for total net worth, which doesn’t include depreciating assets like cars and is built on property value assumptions that are extremely conservative, here’s where things stand. To us, that’s a looney bin bump since the end of 2016.

And on the components, the big dip on mortgages reflects the home payoff, and the 401(k) line is where you see that big market increase that feels an awful lot like a bubble to us.

You can see that clearly here, in our 401(k) balance tracker. At the end of Q1, we’re already where we’d expected those balances to be sitting at the end of the year, including two more matches we haven’t yet received.

New Addition: Travel Points

Given that travel miles are an important part of our portfolio, we’re going to start including them in our quarterly update. So we are sharing some numbers after all!

And while it looks itty bitty by comparison, the notable thing about the Ultimate Rewards column on the right is that I only signed up for that card in mid-January, right before the online 100,000 point bonus expired. That’s what happens when you travel a lot for work, and the card offers 3x points on travel. (We haven’t decided if we’ll keep the card past this year, but we are not sad about having those UR points, especially for when we don’t want to fly United.)

– – – – – –

So will the numbers stick? Is a correction coming our way? Your guess is as good as ours! But man, we’d sure rather if that correction comes this year instead of next, if one is coming at all.

How was your first quarter?

I’m guessing that nearly everyone had a pretty great first quarter in the markets, but any surprises for you? Any predictions you’d care to share for what the markets will be doing in the near future? Any successes we can help you celebrate? Let’s discuss it all in the comments!

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: the process

Other than already telling my employers I’m quitting, I felt like I was reading my own thoughts in the first half of this post. I can feel your excitement as it reflects my own, but at the same time I totally agree that I am cherishing each moment at work knowing that for many things it will be the last time I ever do or deal with them. Awesome!

Oh I’m so glad to know that you’re enjoying your last while at work! I know it’s been frustrating for you for a while, and it’s awesome that giving notice has given you some rose-colored glasses. :-)

It makes sense that you are saying that you have emotions tied to the “lasts” at work (well…at least some of them!) I think it must be the OMY syndrome because now that I’ve gone back to work and decided to really retire this year, I’m not having those same feelings. I’m not regretting being there – but it is solidifying my decision this time. And they’ve announced my replacement (starting 7/1) and I don’t feel the least bit bad about any of it! Our first quarter has been especially good since I’m bringing home checks we hadn’t planned on. And we both got a Chase Reserve card and once we pay our taxes, we’ll add another 208,000 miles to our travel bank. We’ll be up over 750,000 total between our accounts and that is without business travel ;) We are hoping that will help us keep travel costs low in our gap years before my pension starts.

Wow, that’s a big achievement, to be able to see your replacement named and be okay with it all! I may very well struggle with that, but I also get attached to people and projects. ;-) And your UR point balance is SO awesome! I’m kind of wishing I’d seen the light on those sooner, but not like I have had time to really think about travel hacking! Haha.

It might have been harder to see a replacement named if I hadn’t already left once too ;)

Yeah, I can see that! ;-)

Awww yisss…. looking good! Mr. Market has really helped out a LOT this year already. I just keep repeating to myself “paper gains, paper gains”. I’m not willing to cash out and lock the gains in, so I know I can’t count on them. A girl can dream though, right?

Now that you’re a pro landlord, you can still safely sock money into the markets, because you have other income to bolster you if your investments tank. But yes, enjoy dreaming about what those big gains could do for you! ;-)

I keep bracing myself for a correction while telling myself not to time the market, so I totally get where you’re coming from. I have extra cash from a side job coming in and every paycheck I debate whether I should hold it in cash until the market dips. (I have successfully convinced myself to throw it into investments as soon as I get it, but it is a constant struggle.)

Haha, yeah, you understand. ;-) And if you don’t need that money right away, like we do, then you’re safe to invest it! It’s all a question of your goals and timeline.

It’s great to see your asset allocation (even if only for the taxable part). I don’t know if I saw that in the past, but I haven’t been a reader forever.

I usually invest in ETFs, so I’m not super familiar with the funds, but it looks like you could have a lot of US overlap. It would seem to me that VG Total Market is essentially VG S&P 500 + VG Extended Market, no?

It looks like you only have 7% international assets? I’m not the asset allocation police, but that seems to be low compared to what all the experts suggest.

I’m so jealous of your travel miles. My wife has been raking them up for awhile, but I’m going to start cycling credit cards to build them up. With two kids, the flight costs add up quickly if we do a lot of traveling in the future.

I haven’t posted allocations in a while, so you didn’t miss them. The short answer to your Q is that we tend to be a bit more conservative than a lot of investors, and we are less bullish on international stocks. (Like China has to correct at some point soon, right?) We’ve been persuaded by JL Collins and others who show that even focusing on U.S. stocks gives you huge international exposure because almost every company on there is multinational. So I wouldn’t advocate our approach to others, but since you asked, that’s our reasoning. ;-) And on those miles, I’ll just say they were earned the hard way, except for the UR points. MONTHS of my life on planes. I don’t wish that on anyone, even if the mileage bonus is sweet.

I understand that investing in the US gives international exposure. If something bad were to happen to the US, they might not have the same US exposure.

My view is that while the US appears to be expensive (by CAPE and other measures), many international markets look like a reasonable value. Europe indexes have been relatively stagnant for years. Emerging markets have been hot this year for the first time in a long time.

It really caught my attention, because if Mr. ONL is looking for correction, there is one somewhere. If you look at major funds/ETFs covering multiple countries they don’t seem any more volatile than the S&P 500. I may be strange, but I view more international exposure as the more conservative move.

I am definitely not well suited to arguing investment strategies, as I am the total definition (and the same is mostly true for Mr. ONL as well) of the hands-off investor. ;-) I definitely don’t think we have the perfect allocation by any means, but we’re certainly comfortable with it for now. That said, once we’re retired and have more time to dedicate to such questions, we could certainly end up shifting things around, depending on capital gains and such.

I’m with you, Ms ONL. I’m pretty nervous about how high the market is. Makes the numbers look great, but you have to wonder when the bottom is going to fall out! I’m trying to think like Warren Buffet and be fearful, but at the same time I don’t want to dramatically alter the investment plan. We have a while before we as a family will no longer have income since I plan to RE long before DH, but I’d really like to be buy cheap stocks instead of expensive ones!

Haha, yeah, the numbers for sure look great! ;-) And I think given that you’ll have income for a while, it’s safe to keep investing, because long term your investments should still grow. I think a lot of our stress has to do with retirement proximity, and we wouldn’t be worried as much if we were still two to three years off. But who knows! ;-)

Holy miles hoarders :) Q1 was good to me as well mainly due to the equity markets. I was also able to max out my 401k in record fashion by doing so on 3/31 (thank you 3 paycheck month). Other than that things are just chugging along as usual, which is a good thing.

Haha, yeah, we’re totally miles hoarders, but we want to keep our income low in early retirement, so it’s better to save miles and spend on travel now, and then spend the miles once we don’t have income anymore. And that’s SO AWESOME that you maxed out already! Big high five for that!

I admit I’m holding some cash for now (and yeah, I thought the market would drop last year too because the fundamentals just don’t seem to be backing the rising stock market.)

Enjoy your lasts, though. It’s good that it’s minimizing frustration and maximizing your appreciation.

It’s totally the fundamentals of the market that have us feeling like we’re in a bubble. But we’ve been wrong before! Still, as close as we are to retirement, we’d rather sacrifice a few gains than lock in a big loss!

Hmmm…my biggest Q1 success is continuing to invest in little slivers. It’s tempting to squirrel it all away in savings in anticipation of a correction. But I’m not willing to second guess my game plan at this point. And that’s the accomplishment – not second guessing.

Congrats on an amazing Q1!

Dude, that totally counts as a success! Wohoo! And given that you’re in this for the longer term, you are totally good to invest because you know it will grow long term, regardless of short-term fluctuations. That’s how I view our 401ks… we don’t need that money for a long while, so who cares if it’s down now or soon.

Q1s been wonderful, and we’re soaking it all in. We know that the market will down up and down, so we might as well enjoy the up while it lasts. We’ve been told that it’s better to retire in a down market than up, but hey – whatever. We’re doing good and feeling good, and that’s all that matters.

We are super excited for you guys to call it quits and drop the cloak so I can call you by your real name. I love the name of your blog, but “Ms. ONL” just doesn’t have the same ring to it as your name. :)

Back in college, I was given some remarkably sage advice by a completely doped up team member in one of our class projects: “Free your mind, bro”. At the time, I was frustrated and update at how useless I felt the Masters classes were, and I just wanted to get back to my life outside of school. Apparently, it showed! But really, my baked team member reminded me once again that things will be okay. They always are, regardless of the circumstances.

Up market or down market, whatever. You guys are totally kicking ass and saving a butt-load of money. Live it up (if only in your own minds) while the market is making you money hand over fist. Yes, it’s possible that a “correction” will sweep through and blow it all away, but none of us can control any of that.

Just let it ride and free your mind.

…because there is just WAY too much fun and excitement to be had in your very near future – free of full-time jobs. :)

Wow, a few glaring typos in my comment. Sorry about that! I need to take more time to type out my message…there’s no rush!

Hahaha. We’ve all had those moments. ;-) But you’re right… your moments of rushing should now be few and far between!

Laughing about your typo follow-up… you must really be freeing your mind! LOL

We’re still figuring out what our approach will be to spending when the markets are up… I don’t ever want to get attached to paper gains that are unlikely to stick, or worse, to spend accordingly and then put ourselves in the hole when the market corrects. Ah, one more fun thing to think about! ;-) I think a difference between us, and one where I’m envious of you, is that I obviously overthink all the possible outcomes, and the result is that I’m always trying to protect future me from worry or stress. So while I know that we’ll figure things out, I also don’t want future me to even have to worry about that stuff. I admire that you can avoid both the current and future worry and just enjoy the ride. :-)

Ha! I must have sounded baked when I wrote that comment, but I promise I wasn’t. It was early, and I always like to visit your blog before I actually do anything else for the day. Time gets away from me sometimes. :)

I’m touched that you read ONL before coffee! (Or before whatever you do in the morning.) That’s a pretty great compliment. ;-)

Being already retired on a pension but one without any cost of living increases, our big concern is living below our means and saving for future big expenses and the eventual collision of our income with the always rising cost of living. We have our savings in tax free savings accounts and the bump in interest rates is sweet for us. More please! The Registered Educational Savings Plans we have for the kids have taken a big leap thanks to the Trump bump. You may recall, we spend our winters in a travel trailer pulled by a pick up truck. Last year, on our trip back from the USA, we spent too much money and the Canadian dollar tanked next to the American one and we ended up with a $3000 hole in our budget. Rather than touch our precious savings, I took a short term job to pay that off. This year we were frugal and we allowed for the low Canadian dollar. We ate out less. (Better for our waistlines too.) We also traveled home very slowly staying at least two nights in each campground. We stayed at Army Corp of Engineer, Federal and National Forest Campgrounds where we paid $8-$12US (with the senior pass) instead of $39-$79 a night. We discovered these places are far far nicer to stay at. Huge sites, beautiful views, wonderful exposure to wildlife. One of the main reasons the trip was so lovely was we had no internet at these campgrounds, most had no TV and limited satellite radio as well. So we simply checked in on a public WIFI for a couple of hours while traveling between campsites every other day. I got more written on my novel in that month than in the last two years and we got out canoeing walking and biking every single day. Since these campgrounds are usually used mostly by locals we got to meet all kinds of interesting people from each area we travelled in. We also missed two crises with the kids which they solved themselves before we got back on line. I did not have to listen to the absolutely insane screaming hysteria over every single Trump tweet from the left. The result is we got back home on budget and had the best trip yet and my chronic indigestion is much improved. This quarter we are planning to finish the interior (last set of windows, kitchen upgrades, interior painting and new flooring) of our little house. I started my garden plants Saturday. There is still snow on the ground here but it’s melting fast.

Registered Educational Savings Plans are for our nine grandchildren. Our plan is to do what we did with our kids, which is help them cover major university costs but not give them enough so they can won’t appreciate what it costs. They will need to work summers and such but they won’t have to take out student loans if they are careful. If they don’t use the funds we will spend them on ourselves.

So wonderful that you’re doing that for them! What a gift.

You make such a good point about keeping an eye on inflation and prices, and not just blindly following the 4% rule, for those who don’t have a fixed source of income like a pension. Like if we were fully retired now and took 4% out of our funds while the markets are up, we could easily be lulled into a false sense of security, when really we should be socking some of those gains away for a rainy day.

That is some mileage. Back in the first half of the decade I traveled enough to save up those types of frequent flyer points. I’ve since used them all though. It probably took me 7 years to burn through 800K in united points. That should facilitate your travel for years to come.

So you know… I’ve earned those miles the hard way, with literally months of my life on planes! ;-) It’s awesome the miles lasted you that long! If ours can do that for us, we’ll be pretty stoked.

I see a trend with your “sequence of returns risk” stress. :) I have gotten more comfortable with this lately with the following plan…. have 18-24 months of cash on hand to meet anticipated budget. Try to keep said budget within the 3-3.5% rule. Replenish that cash while market is historically well above the historical mean with dividends from investments and continue to repeat until you feel sequencing risk is reduced. During that time, *perhaps* even consider selling some of the stocks to replenish the cash but keep an eye on the tax liabilities. You have income coming in from a variety of investments and not just dividends so I’m guessing you will make it through this well above the historical mean stock market just fine and then you can relax about the sequencing risk when the market does adjust. Easy right? Lol…

I don’t see any way around the SOR stress. ;-) Also, it’s probably worth doing an updated post on this, but we aren’t doing the 4% rule (or the 3 or 3.5%) in early retirement because most of our holdings are in the tax-deferred stuff (the charts show that huge gap). So we have a smaller margin of error in the early years than we’ll have once we reach 59 1/2, which explains that stress. The pool that will fund our first 18 1/2 years is just smaller overall and won’t have the kind of time to grow, so yeah, you’re right big time. :-)

I understand your stress but I think if push comes to shove you might want to consider the flexibility of the backdoor IRA for a couple of reasons…. 1) if you actually aren’t working, you can convert a certain amount without tax consequences and it gives you more potential tax savings in the future by reducing required minimum distributions down the road. 2) it provides a bit of a hedge for the taxable stuff. BUT, like I’ve been saying, I think that perhaps we don’t really figure out any of how this works until we actually do retire. 2018 will be my first year without any income other than interest and dividends and until I get to that point, I don’t know exactly what my tax management strategy will be. I will employ said strategy after I see 2017’s passive income income numbers. I will say this – I was a skeptic on the IRA conversion when I first started learning about them. I was like “holy crap, that’s way too complicated, blah blah, the tax liability, blah blah” but the more I dug in, I gained a greater understanding of both the short and long term benefits of it, and it will be part of my strategy, though for the aforementioned reasons, I don’t know what part. And it’s not so I can “spend” that money, per se. I’m similar in that I have built some higher spending requirements into my older years. I know that the big picture stuff is in place and that I have lots of cushion in my numbers and I’ve controlled for the things I can control. Now is the time to jump off the cliff and see what happens. :) To make a short story long, I don’t think you should stress so much about the SOR risk.

Fortunately we’re now looking at other income streams in retirement (NOT ads on the blog!), so we won’t be totally at the mercy of the markets, and that makes me feel better. ;-) I am completely aware that this is dumb, but I just like to keep money hidden from myself. If we do the backdoor Roth, even if that money is not intended to be spent before “real” retirement, I worry that we’ll spend it if it’s accessible. Our whole savings strategy is built on this idea of hiding money from ourselves. ;-) But, obviously, we won’t be stupid and impractical. If our plans are failing, we will pull money out of our 401ks before we starve! ;-)

Ok. I understand the whole idea of “hiding money from yourself”… but I would think this blog makes you accountable to yourself and your readers. Now that you have mastered money, do you really believe you would go back to living like a baller? I keep minimal balances in my checking account because I want my dollars working for me and any dollars sitting there are pretty useless. I stash it away in a variety of different investment vehicles but I guess I don’t get caught up on the details of whether it’s a retirement account or not. The retirement accounts have only a finite amount you can invest in them every year anyway. I get it. I just think you got a better handle on things than you let on… and remember those back door IRAs without tax consequences aren’t accessible at a snap so that’s why I’m keeping it as a handy tool in my arsenal! I really don’t want to have to work for an income ever again, blog or otherwise. i want to keep money out of the equation of how I spend my time.

You raise a super great question, and the truth is: I don’t really know. We haven’t tested ourselves, and it’s possible that we would be super disciplined about money now, or it’s possible that there would be a very slow slide back to maybe not our old baller levels of spending, but certainly to a level of spending that will make our cash run out too soon. We feel like we still have a lot to learn about ourselves financially, particularly how we will handle having a sort of fixed income or at least a constrained amount in retirement, and we will probably do a lot more learning and experimenting when we get there. For now, we are just trying to do no harm. ;-)

I think that once you get control of your money and have a more utilitarian (not sure that’s the right word) view of it, a major mind shift has already happened. You may not be confident, but given your analytical bent and mindful blog posts, I don’t think you have anything to worry about. I don’t quite know how the mechanics will play out, but it’s going to be a bit of adventure figuring it out. I look forward to seeing how it goes down with you ONLs!

Aw, thanks as always for your support and enthusiasm! Likewise, I can’t wait to hear how it all goes down with you even sooner! And even if utilitarian isn’t the perfect word, I totally get it, and love that way of looking at it. If everyone would see money as a tool, not a reward, we’d all be in better shape to pursue our dreams!

Have you seen this new article! I just read it… and doing a little more analysis on my plan in the next few weeks. I’m not changing my retirement date!

Was there a link you were sharing? It didn’t make it through!

Let’s see if this one works…. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2920322&__s=xg6kzwhs9yiaw7f5jg9c

Thanks!

The article is a much more in depth look at Safe Withdrawal Rates. It’s pretty awesome and might ease some of your anxiety.

Ah, gotcha. Mr. ONL is the withdrawal rates guru over here. The tough thing is that we’re not using any set percentage but are using our own model since we have the two-part retirement. I really do suspect I’ll be less anxious about it all once it’s less of this big unknown!

I bet you all have thought through a lot of the key points presented in the article. I appreciated the in-depth analysis in the paper – it’s worth a read. One of the takeaways I’m pondering (and one I had already been thinking about and couldn’t make up my mind – much like – to pay off the house, or not to pay off the house) is about the planned chunk of cash I had and if that did or didn’t protect me in the downside scenario. I go back and forth with what I should have but his compelling argument on that piece is to not get too comfortable with that chunk of cash – it’s not earning you anything anyway! I always appreciate insight that is unique and based on compelling evidence.

Okay, I’m definitely going to read it! Someone who has good thoughts on the cash cushion in particular is welcome on my reading list!

My first quarter went surprisingly well. I did a pretty good job of reducing my discretionary spending over last year, saw the last of deferred compensation from my last job, managed to spend only a small bit more than my net income (which I estimate to not have anymore of this year) and still my net worth went up 1.3%, mostly thanks to the crazy markets. I can track the different sources on my now old 401(k) and it looks like the Rollover I did two years ago is finally worth more than it was then.

I love all of your charts even though they have no numbers on them. Congrats again on paying off your mortgage and having the good problem of what to do with your extra cash-flow! I’ve been working on figuring that one out as my husband buys into the condo. I ended up picking a money market fund to put some of the money in so it’s at least squirrelled into my Vanguard category in my spreadsheet and not my cash category so that I am more likely to only let myself withdraw 4% of it. It’s a bit terrifying getting equity out of the condo after I thought I’d locked it in!

I bet that is tough to lose equity, but you’re still keeping it in the marriage, so it’s not really going anywhere. ;-) And overall, that’s so awesome that things still went up despite not having regular income. I think going money market right now is smart — we might consider doing the same thing just so it’s not earning barely above zero!

Oh yeah I love that it’s staying in the marriage and that we’re building equity together – that’s really fun to watch change over time :) I suppose the feeling I have is a bit like taking money out of investments – you spend all this time feeling like it’s supposed to stay there and it’s weird to reconcile eventually taking it out, even though that’s what it’s there for.

Oh I totally get that! I will be a borderline basket case, I’m sure, when it’s actually time to spend our investments. “No! That money is always supposed to be there, not go away!” ;-)

You guys are so close – congrats! How do you deal with market fluctuations? I only recently opened up my first investment account because I’ve been paralyzed with fear of losing even my modest savings (I guess that makes me risk-averse!). I would love to know how you guys stay rational about money and markets!

Thank you! Oh man, market fluctuations are tough, but we’ve gotten better at handling them with practice over time. Two suggestions: 1. Track less. Like just force yourself to look less often. and 2. Remember that with savings, you’re GUARANTEED to lose spending power, because inflation outpaces savings account interest rates. At least with investments you have a good chance of your total value going up, which is impossible with savings. Understanding that helped me get a bit less risk averse!

I didn’t know that about savings! That’s super helpful- thanks!

Good luck! I know it’s a hard leap to make (that was totally me before I made that connection!), but I’m proof that it’s possible to get comfortable with investing. Just give it time…

My first quarter growth was really strong but I have the weird nervousness now as I enter into my transition to FIRE. Only I am retiring to pursue my desire to write and do adventure photography with the wife still working (she is beyond RAD and cool with our plan) . Like you I wonder what will the markets do? Should I deposit my last few paycheques into retirement accounts or pad the cash. I am considering the cash direction then my savings accounts can continue to grow untouched for about two years (yes I have too much cash sitting around) I personally feel that whatever direction things will go that you will excel at it. The two of you are go getters and failure isn’t in your vocabulary .

That is so lucky for you that your wife is willing to keep working! If we weren’t so dead set on retiring at the same time, we could for sure make the transition smoother for ourselves. But we’re both stubborn like that. ;-) And I should probably right a post about this, but failure isn’t actually what I’m afraid of, because I think you’re right that we’re resourceful and we’ll figure it out. I’m afraid of being stressed about money all the time, or feeling like we have to forgo the fun stuff that we’re retiring for in the first place. So… fear of fear instead of fear of failure? Hahaha.

We own a rad surf/skateshop and we love the life it provides. She loves being there everyday so its not truly work in the common sense of the word. Although it comes with its own unique challenges :)

Let’s change it from FEAR to calculated Optimism for the unknown lol

Oh, that’s so awesome! And yeah, I can see how having something that you built and own would feel very different from working for the man. And sounds good on Calculated Optimism for the Unknown (though maybe we need a snappy name that turns into a good acronym). Go! ;-)

Our Q1 was fine. As i do not keep detailed Mrs, i can not tell you our return. My main index to track progress went up. That is all that matters.

And here is my market predictions: it is very unlikely to stay where we are. It will go up to comedown and then go up again. Long story short: i have no Idea.

I also feel the pain to invest the money. For now, it all goes into my options portfolios…

I’m surprised you don’t keep a detailed spreadsheet, only because that seems to be such a source of joy for most FIers! ;-) And yeah, our prediction is similar! We think it won’t stay high, but really have no clue. Haha.

My spreadsheet is detailed in what we own, what it is worth. I just do not try to calculate the total portfolio returns. I do it for options out of curiosity…

Ah, gotcha. And it’s so funny… I’ve read your post on options before, but because it just sounds like so much work, my brain completely blocks it all out. So it all still sounds so mysterious to me. ;-)

It is done on purpose to keep most people out of it…! It takes approximately 10 minutes a day. That is more than etf investing.

Ha, I have no doubt that you are right! The 2008 crisis was an important reminder that many financial instruments are made to be obscure or confusing on purpose!

Options are not that bad… ! They are more like the cookie monster. When you want to learn more, I started a basic series: https://ambertreeleaves.wordpress.com/some-exercises/ I plan to write more. It has a link to the lingo that obfuscates options.

How about we can learn about options after we’re retired and have more time to learn? ;-)

Let me know if i can help!

:-)

Hi Ms. ONL! Found your blog a week ago and have been making my way through it with delight since then. Congrats on being so close to early retirement! I’m a 36yo lawyer (and traveler/adventurer/mom…) in a HCOL area and really identify with so much of what you say on here. We’re potentially about a year away from FIREing and cannot WAIT for the freedom you’re about to experience! Question (not particularly on topic): have you thought about what you’ll do if/when your company puts the hard sell on to keep you on part time or in some capacity, once you break the big news? Sounds like a likely scenario given that you seem to be highly valued there. Sorry if you’ve already posted on this – I’m still making my way through the blog! Thanks for the awesome content and I look fwd to commenting more going forward!

Hi there! So nice to connect with you! We have tons in common! To answer your Q, we haven’t done a specific post on it (though maybe we should!), but the short answer is: We wouldn’t be open to additional full-time work, pretty much at any price, and it’s unlikely that my company would let me do any significantly reduced arrangement. (They would offer, at best, 70%, which I’m not willing to do.) Mr. ONL’s company might be open to a 25-30% arrangement, and we’re thinking that through, because with health care in flux, it might very well be worthwhile to do that to get health care for a bit longer. But TBD!

Thanks for replying! I hear you on the health care perk. Sounds like you’re on pretty solid financial footing so maybe you guys’ll feel better about a clean break (to make room for all those exciting activities outlined in your planning posts)…but good to keep in the back pocket, especially if things go crazy (crazier?) on the political/markets front as the year proceeds. ;-)

You’re welcome! And yeah, it’s all so hard to predict! But we’ll share whatever we decide. Stay tuned. :-)

Pulling first quarter numbers today – but everything is looking good! 3 paycheck month always helps :)

Those miles! Such an awesome early retirement tool – nothing like free tickets and hotels!

Looking forward to reading about your transition over the next year!

I do love the predictability of paychecks on the 1st and 15th, but man, those 3-paycheck months used to be nice! And yeah, before you get jealous of those miles, remember that very few were earned through hacking, and most were earned the hard way — think about how many months of my life (not exaggerating) I’ve spent on planes! ;-) Hope your newly expanded family is doing well! xoxo

Getting closer….. and the great progress in Q1 makes it feel so much closer, I am sure!!

Our Q1 was stellar. In fact, I had to do a double/triple take in Personal Capital to truly believe what I was seeing. Our NW increased by 10.6%. Now, the markets played a big role in that (especially our international holdings such as emerging markets, VEMAX and SP500 funds such as VIIIX). Add to that a a huge bonus (44% of salary gross) I received in March and some restricted stock exercise (32% of salary, gross) and our automated monthly savings to various institutions. A little bit of real estate market favorability helped also but that was minor. Of course, that is not going to continue over the next three quarters but it has reinforced the notion of enjoying it on the UP and staying calm through the correction(s).

Onward to earnings season and the inevitable frenzy of valuation chatter and impact on the indices.

Congrats on a great quarter… and those massive windfalls! Wowie. And you’re right… might as well enjoy these numbers now, even if they are a bit inflated. ;-) And stay braced all the while for the correction, whenever it may come. Hope you guys are doing well in all areas non-financial, too! :-)

I can’t believe you are only six months away from officially giving your notice! I feel like you guys just started with your whole early-retirement thing and now, it’s almost here!!! :) Keep going, the finish line is almost there!

I know!!!! It’s craaaaaaaaazy!

I think operating from a stand point of wanting things to slow down is much better than the alternative of, ‘good god, get me out of here!’ As to the market, i have no clue and as i’ve gotten older am convinced i never will.

What about the rising interests rates? You must be a bit excited about there being a potential for you being able to get a reasonable return in a bond fund or savings account in the next couple of years. I remember walking into a bank in 1999 and seeing a 6% CD being advertised. My thought was, ‘why would anyone do that!?” Young and dumb. I would love a 6% CD now.

Oh my goodness, yes. I feel so thankful to be in that slow down place instead of the opposite, and I can’t say whether it all will last, only that I’m not in a huge rush right now. ;-) And yeah, I remember those high interest CDs, too! But mortgage rates were like 8-9% then, right? So it all balances out, I suppose. I’d LOVE to get better savings account interest, so am all about rising rates. (Especially given that we don’t plan to have a mortgage anytime soon.)

I’m starting to go through the same emotions as well. “Ugg, I have to make it all the way through 2017?!” has turned into “holy crap, 2017 is already 1/4 of the way over!”

Yesterday was the first Sunday that I’ve actually looked forward to the start of the week since I started my job in 2014. I’m feeling more energetic and I’m excited to crank through another workweek so I can check the days off my calendar. 131 work days left.

I am *thisclose* to having my house ready to sell. (so. much. cleaning!) I think selling my house will really be the big oh-my-gosh-this-is-really-happening moment for me.

I was originally going to take off a couple extra days this month, but now I think I’ll just plow through them. If I push a little extra now, I’ll be able to coast through the second half of the year. Now I just have to figure out how to keep this big goofy grin off my face when I’m at work.

Oh man, I hadn’t even thought about the goofy grin problem! We work from home, so are mostly invisible to our colleagues, but yeah, that would be a real challenge! Do you know how much notice you’re going to give when you quit? And thanks for saying you can relate… been wondering if this is some weird cold feet thing, or if it’s normal to get nostalgic in advance at moments like these. ;-)

I figure I’ll give a month’s notice. One member of my department announced his retirement in March and he’ll be done in September. Even with that much time, they still won’t post his position and start the hiring process until after he is gone. They’ll do the same with my position whether I give two weeks or six months. I figure with a month, that’ll be enough time to wrap things up and my boss can figure out scheduling for upcoming projects without me. I feel a little bad leaving three months after my coworker, but not bad enough to not do it :)

Your “frustrating coworker” comment made chuckle because I can relate to that one way too much. All the noisy coworkers around me when I try to work (seriously, who puts programmers in cubicles right next to the techs that answer phones?!), the people all stressed out about some project that really doesn’t matter, etc. Now I think about that stuff and just shrug it off. Even today, I was working with six coworkers to help them prepare to use a system that some of the other departments are using. I was stepping them through the process and helping them figure out how best to set up the program for their use. One coworker commented a couple times how calm and patient I was “even with six women asking [me] questions at the same time.” Yes, I’m starting to feel like I did as a teenager/early-20s when I never let anything get me riled up.

I think a month sounds ideal. Not too long, not too short. :-) And that’s awesome that knowing your exit date is making the noise in your office more tolerable. I’ve always hated work drama, but now it’s a lot more amusing to me. ;-)

Damn you guys got a lot of points! That can only you travel a ton… Can’t say I envy you o that front.

Oh yeah, so much of my life on planes. Those miles were earned the hard way! ;-)

I had a pretty good first quarter. My investments were up 14%, which is pretty nice (beating the S&P benchmark by quite a bit). Can’t wait to see what Q2 has in store.

Awesome! That’s a pretty kickass quarter to beat the S&P by that much!

I’m so excited for you guys! I’m also hoping that your colleagues will be just as excited for you, but it will be hard for them because unlike other graduations, they don’t get to move on to the next step too. We’ll throw you a giant online fiesta, and with your free time and travel miles you can bop about the country/world so we can all celebrate with you in person :)

Thank you! And you don’t know how much I love the idea of an extended celebration around the continent with our blog friends! ;-) I totally think most of our colleagues will be thrilled for us (and probably a bit envious, understandably). Can’t wait for the virtual party!

Hello and congrats. I just found your site.

I’m curious why you are not in tax-exempt bonds given your incomes?

Cheers

Hi John — Glad you found us! We have some tax-exempt bonds in our total market bond fund, but we haven’t loved the performance or the carrying costs of those particular bonds or bond funds. But truly, there’s no good reason except that we’re lazy investors and don’t attempt to minimize taxes because we believe in paying our fair share while we can afford to. ;-)

Anticipating so many lasts without being able to tell folks that it is a last for you must be so difficult. My Q1 was good. I’m just continuing to plug away at the debt. I was able to finish maxing out 2016’s IRA finally.

Wohoo on your IRA! :-D And fortunately we do tell SOME friends, just not the work ones for the most part. :-)

“Bless your heart” made me laugh out loud. I think that ALL THE TIME now that I’m getting closer to FI. Love your site – just found it!

Hahaha. ;-) So glad you found us here!