We’re keeping a close eye on the American Health Care Act (AHCA) as it and various iterations of it move around the Hill, and we’ll write more about the impact on early retirees when it’s clear what the fate of it and the Affordable Care Act (ACA/Obamacare/current law) will be. In the meantime, we’re discussing health care and where you might choose to live.

Ranking the States for Retirement

We have all seen those lists a thousand times of the best states to retire to. Florida is a perennial chart-topper for its low taxes and warm weather, and every year some trendy state will enter the mix as the current darling. (This year it’s New Hampshire or South Dakota, depending which list you consult.)

When you make a list that ranks places, you have to make some judgment calls about what people will find important. Not everyone will agree on their most important factors, so the number crunchers can’t please everyone, and I’m not trying to pick on them. But, they tend to focus disproportionately on one factor:

Taxes

Take this 2016 ranking from Forbes, for example, which color codes states entirely by their tax climate:

States with no income tax tend to rank in the top 10 consistently, year after year, almost regardless of what else is going on in that state.

The Weirdness of the Tax Focus Over Other Factors in State Rankings

The logic of focusing on taxes makes sense initially (taxes eat into purchasing power, right?), until you consider that the component of tax that gets the most focus in these rankings — income tax — matters far less to retirees than to those who are employed, because a large share of retirees’ earnings are less-taxed dividends and long-term capital gains, or untaxed Social Security benefits. In addition, states with no income tax like Florida, Texas and Nevada tend to compensate with higher property and sales taxes, which do affect retirees, offsetting the income tax savings.

But the even weirder part of this tax obsession is that retirees don’t actually care that much about taxes, at least relative to other factors about a place. In this Bankrate study, which is the best place ranking I’ve seen yet, they surveyed retirees on what they care most about. The answers:

Taxes are waaaaaay down that list, well behind cost of living and health care quality, as well as quality of life factors like culture and weather. Bankrate did the smart thing and built their list based on what people actually value, and came out with super different rankings than the other currently most cited list, the one done by WalletHub.

WalletHub’s #1, Florida, is middle of the pack in Bankrate’s ranking, reflecting WalletHub’s tax and warm weather bias:

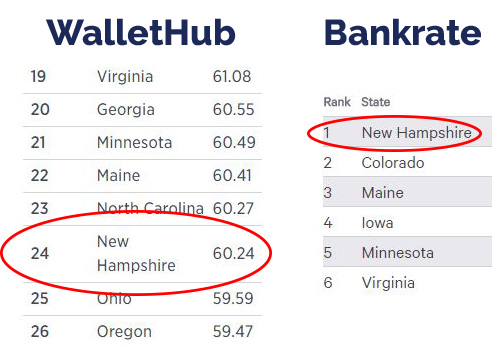

And vice versa, Bankrate’s #1, New Hampshire, ranked highly for health and well-being (and also taxes) is way down the list for WalletHub:

I did my own informal study, and asked friends on Twitter, in my Slack group, and in real life what they value most in choosing where to retire. Here are those highly unscientific findings:

Full disclosure: “Snow” appearing prominently is from people who want to escape the snow, not frolic in it. Booooo! ;-)

You have to squint a lot to even pick out taxes in that word cloud. Instead, the factors folks mentioned speak very much to quality of life and factors that impact health: the ability to walk and get outside, access to health care, and the ability to engage with friends and family around cultural activities, which is good for mental health.

I suppose it’s possible that people looking at traditional retirement now, late Baby Boomers, are after different things than those of us considering early retirement, mainly Gen Xers and Millennials, but I tend to think those generational stereotypes are overblown, and we’re all not that different from each other. Meaning: some of those rankings are focusing on the wrong stuff entirely.

Weighting Health More Highly When Considering States

I love that Bankrate gave health more weight than previous rankings did (and to be fair, WalletHub’s ranking, Forbes’ ranking, and others all account for health to some extent), but there’s also a lot they didn’t look at. Which is important because:

Health is the single most important factor for any of us in retirement, whether we think about it or not.

If we are unhealthy, our quality of life is terrible, negating all those other things that might have brought us to a certain place. And if we’re dead, then who cares what our tax rate is?

There are some easy indicators we can look at on health, like life expectancy, obesity rates, smoking rates and physical activity rates that tell us some useful info about states. For example, that the life expectancy by state is almost the exact opposite of the states that Forbes flags as “most favorable” to retirees:

Life expectancy is a complicated measure, and we don’t need to debate the merits of it here, but there’s certainly some correlation between the life expectancy of a state and the healthiness of a state. And, if I may be blunt for a moment, it’s just whack-ass backward to me that anyone would call a state with well-below-average health “most favorable to retirees.”

Here’s the deaths from heart disease map if life expectancy doesn’t do it for you:

No single measure is perfect, nor can it tell the full story, but understanding general health trends in a state tells us a lot about what we could expect to be surrounded by if we retire there. And remember: health is contagious, good or bad. Whether our friends and family are a healthy weight or not correlates to our own weight. Our social circles impact our happiness. And social cohesion in neighborhoods has even been shown to lower rates of stroke.

It’s Not Just Health — It’s Health Care Access and Quality

Note that the people who responded to Bankrate’s study didn’t just respond “healthiness” when saying what’s important to them in a state. They specifically called out health care quality, which is also tied closely to health care access. Because the doctors might be great, but if there aren’t enough of them to go around, or you can’t afford to see them because your health insurance is lousy, then those great doctors don’t do you much good.

We applaud those who include certain factors of health care access in their rankings, for example the Kiplinger ranking that factors in data from a United Health Foundation report that examines supply factors like number of per capita nursing home beds. If you need nursing home care and there are no beds in nursing homes, not many other factors matter.

But this is where that whole health insurance question returns — hence the mention of the ACA and AHCA in the intro — because health care access varies greatly state by state, in large part because of political and policy factors that are rarely talked about when ranking states for retirement suitability.

State Policy and Future Health Care Affordability

Under the current health care law, the Affordable Care Act, states have the option to expand Medicaid, the federal health insurance program designed for the very poorest among us and the occasional child of an early retiree. Under the ACA Medicaid expansion, states can opt to cover families and individuals well above the federal poverty line, which would include many workers in low-wage jobs whose employers don’t offer health insurance. (Those who can’t work are generally already eligible for Medicaid even without the expansion, so the expansion almost entirely benefits people who are working.)

For states that opt in to the expansion, 100 percent of the cost is funded by the federal government, meaning states get to offer health insurance coverage to many more of their uninsured working residents at no cost to the state. After 2020, under the ACA, states have to chip in a little, but the federal government will continue to foot 90 percent of the bill for making health care accessible to wage earners whose jobs don’t provide insurance. Despite what is an obvious federal dollars windfall to states that opt in, not every state has chosen to expand Medicaid. (Put another way, this means states are paying for the expansion anyway through their federal income taxes, but then turning down the thing they are paying for.)

Source: Families USA, April 2017

If the new AHCA bill or some form of it ultimately passes, this particularly bit of policy won’t matter as much, because the AHCA dramatically scales back funding for the Medicaid expansion. But, what does matter about this is what it says about states and their views on providing health care to residents. States generally try to get as many federal dollars as possible, and campaigns ads for Congresspeople and senators frequently brag about how much pork they brought home to their state or district. Not taking the Medicaid expansion when doing so would provide health care to — in some states — well upwards of a million working poor, is a decision driven entirely by politics, especially given the leeway some states have been granted in using Medicaid dollars to fund private health insurance. This isn’t about debating those politics, but rather just noting that they are there and acknowledging the impact they could have on your future access to health care.

Without getting into the politics themselves, I’ll just assert this: It’s worth looking at your current or desired state’s view toward the Medicaid expansion as a proxy for future health care policy decisions.

Those that have expanded Medicaid may be more likely in the future to promote policies that make health care more accessible to more people, perhaps accompanied by a higher tax bill, while those who’ve opted out may take the view that it’s entirely an individual responsibility to provide for one’s own health care. Consider your own preference when making a choice on where to live.

Health Care Costs and Coverage (Could) Vary By State

Another factor to consider when thinking about health care proxies: Pre-ACA, health insurance was partially regulated at the state level — and it could be again.

Prior to the ACA’s passage, states had a tremendous amount of control over what services had to be covered by health insurance plans, and if the ACA goes away, that could once again be true. States could determine whether insurance plans had to cover mental health care services, maternity care and even care for autism. Make sure you know what you’re getting into with regard to a state’s view toward covering key services.

Finally, consider price differences across states. For example, though Medicare is a federal single-payer system, Part D which covers prescription drugs, varies by state in terms of cost and how much it covers.

Source: United Health Foundation

And this Kaiser Family Foundation interactive map provides a detailed look at what health insurance costs in every county in the nation by age and general income parameter — both now under the ACA and under a potential future AHCA. Incredibly helpful for ballparking out what a potential move might mean for your health care costs.

Health Care Access Aside from Health Insurance

Even if we assume everyone can afford to get the health care they need to stay healthy, access in an objective sense also varies greatly by state. Some states simply have more doctors, hospitals and nursing facilities than others. For example, hospital beds per capita vary:

There’s also high variation in number of beds in skilled nursing facilities, number of adults reporting not having a personal doctor, and the number of health professional shortage areas in each state. (And because we can’t truly disaggregate this stuff, it also matters how many people haven’t seen a doctor recently because they can’t afford to.)

Create Your Own Ranking

There’s no perfect state for retirement, and if there was, everyone would move there and drive the prices up, and none of us would be able to afford to live there anyway. Instead, it’s up to each of us to decide what factors we think are important, find the state that best fits that set of priorities, make sure we can live with the downsides of that place, and then forge ahead.

So if you care most about taxes, great. If you care most about being somewhere warm and coastal, awesome. And if you care a lot about your health and your access to affordable health care in the future, then it’s worth looking beyond the rankings to the whole range of other factors that could impact your health and well-being in your early retirement and well into your later years.

Some resources to get you started:

- America’s Health Rankings, with a full report on each state under “explore”

- United Health Foundation’s 2016 senior report, with state-by-state summaries beginning on page 80 (and a lot of this stuff is applicable to non-seniors!)

- Kaiser Family Foundation state health facts

How Do You Weight Health and Health Care?

How do health and health care factor into your decision-making about where to live in retirement? Or do they at all? Are you more swayed by lifestyle factors like how active a place is, or by health and access factors? What do you wish retirement place rankings would prioritize more highly? Any health factors you’re thinking about that aren’t included here? Fire away in the comments!

Source notes: There’s tons of data in this post from the Kaiser Family Foundation, which shares their data freely. They are my go-to resource for anything related to health or health care, and pretty much rock. Thank you, KFF! We are all indebted to you! Non-Kaiser state health factor rankings come from the United Health Foundation’s America’s Health Rankings 2016 Seniors Report, which is amazing in both its detail and readability by non-policy wonks.

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: we've learned

Interesting post and very, very good points you make. Healthcare could, if you are not careful, also rapidly eat away at your retirement nest egg. Making sure you have access to a good healthcare system, in combination with being careful yourself too, could make a massive difference in your post retirement expenses. It certainly should be a topic of interest when looking for a place to retire!

Gracias. :-) And agreed on all fronts! Health care expenses are STILL the leading cost of personal bankruptcy, even under the AC — even for people with health insurance! — and none of us should bank on that changing anytime soon. There’s much we can each do to increase our chances of good health through healthy habits, but we can’t control everything, so access to high quality, affordable care remains essential. :-)

Great post. I wonder why Washington State ranked rather poorly on the first map, despite having no state income tax. Could it be the relatively high sales tax? Because that’s probably less of a factor for us minimalist, frugal FIRE folks. ;)

I’d also humbly suggest that people need not look exclusively within the US for post-FIRE destinations. Obviously being near family and friends is important, but there are a great many places with low cost of living and high quality/good value healthcare in this great big world of ours.

Thanks! Exactly right — high sales tax, and the highest liquor sales tax! http://www.seattletimes.com/seattle-news/data/washington-taxes-more-like-florida-nevada-than-our-neighbor-to-the-south/. It for sure matters less to frugal folks, but it’s not escapable entirely! ;-) Of course you are totally right, too, on not only looking within the U.S., so consider this post for those who plan to stick around, at least for a while. :-D

Oh that’s right! I’m not a big drinker but I recall now from when I lived in Seattle that the taxes on hard alcohol are insane! Something close to 50% of the sticker price, if memory serves. Could still find a decently priced bottle of wine at good old Trader Joe’s though… boy do I miss that wonderful place!

Trader Joe’s is pretty wonderful. :-)

Thanks for sharing this…and for teaching me my new favorite phrase: “whack-ass-backward”! Love it!

Really great info – especially given that I’m two months and a day from “retiring” and getting myself ready to talk with the friendly ACA folks as I go through getting prici ing for health insurance for my family and me (and this can be done two months prior to you needing insurance). So, tomorrow I can call them/get a more accurate price from the website. Your timing was excellent on this post!

Hahaha — you’re welcome! ;-) I hope your health insurance sign-up goes smoothly, though as you know, we all need to be prepared for a rug pull and a new system, so buckle up! :-)

Thanks for or bringing up the importance of health care in retirement decisions. I’m 12 months & 10 days from retirement, tho I achieved FI last month. Why OMY? I’m writing about that next week, but the #1 reason is concern about health care cost inflation. I like the thought of “state rankings” by that metric, and give you credit for coming up with the innovative idea.

Ha — you know I will work health care into anything I can think of. ;-) Congrats on hitting FI! And it’s not OMY if you are working on the distance between FI and ER — we hit FI a year and a half ago but that’s the “needs plus only a few wants” number, vs. the “wants and needs” ER number. ;-)

I’m sure you wrote about this but would you remind me: how did you measure having reached FI for yourselves? Is it based on some % SWR (with which you would meet your basic expenses)? If so, what SWR (or whatever) are you using? Thanks.

Hi Nancy. We didn’t base our measure of FI on 4% or any other SWR, just because FI was only relevant to us as a milestone, not as a sign that we could quit our jobs. The specifics are that we realized in Jan ’16 that we had enough taxable funds saved to pay off our house, pay off our rental property, cover our most basic needs with the rental income and have a little left over — plus we also had the big 401(k) nest egg for later years. Not an entirely precise definition, but that’s okay because we’re far more precise in our early retirement number. ;-)

Love this kind of stuff!

We haven’t really considered healthcare quality or access before, I think partially because the places we’re starting to gravitate towards are much better off already in terms of health. No guarantees that will continue to be true, though. :(

:::yawn::: No, no I’m awake! Definitely didn’t fall asleep at my desk! ;-) And you’re totally right — no guarantees on any of this stuff, but we can definitely ID some trends and indicators that could be important in our decision-making, then just do our best. :-)

Great post!! Definitely good to think holistically when deciding on the best state. I like how some people feel that being able to go outside and enjoy mother nature can be more important than taxes. We should make decisions based on what we want, while amassing a net worth to live how we want!

Thanks! And couldn’t agree more. There’s no one right set of factors or priorities, and it’s up to each of us to decide based on what’s important to us. Fortunately, FIRE folks tend to be thinking along those lines already, rather than following the herd. ;-)

Ms. ONL,

You make a good point regarding no state income tax vs. a higher property tax rate. We are experiencing this issue in Austin, TX. Yes, we have no state income tax, but in the 20 years we’ve lived in our small 1950’s house, our property tax has quadrupled. Because of this, we are already priced out of our neighborhood, and may choose to move once we are both retired to find a more affordable option.

I’m sorry that’s happening for you guys! It’s a good illustration that short-handing income tax as “tax favorability” doesn’t tell the full story! (I just added links to the post with data on high sales tax and high property tax states, and I suspect you already know that Texas is a top five property tax state.)

Thanks for the reminder. We do tend to brush right past health care when thinking through moves. I think for me, it is that I have never lived somewhere with bad health care access or quality, so it is hard for me to think of the potential negatives. Definitely should be something I think more about before making another jump.

The politics of the ACA are super interesting to me. Like you noted, the votes didn’t seem to align with the benefit of the residents. You have to pay federal taxes whether you take the expansion or not. If you choose not to take the expansion, then your citizens are paying for health insurance for citizens of other states. Seems like an odd position to take as someone who is supposed to be looking out for the best interests of your constitutions.

I think a lot of us pursuing FIRE are like you in always having had good health insurance and not really contemplating this stuff. But when we lose our employer-sponsored coverage, it’s a whole different ballgame, and it’s worth knowing the playing field!

And yeah, I’m with you on the politics of the Medicaid expansion in particular. Paying for other states’ health care but eschewing it for your own “on principle” is hard to fathom.

For many of the reasons you highlight, we will be entering our next phase of life in the Granite State. Good healthcare (although not up to the spiffing excellence of MA – not many states are to be honest..), low taxes, geography aligned with our passions and close enough to major East Coast hubs to enable travel to EU and beyond without too much hassle. Although NH has places where real estate taxes are exorbitantly high, we chose a town where our real estate taxes are 30% of what we currently pay in MA. For a home of similar size and twice the amount of land. How nutty is that?

Healthcare will be the biggest line item on our family budget in years we are required to hit the maximum out of pocket. Lower taxes will help for sure but I would agree they will not be the only answer to the $$$’s needed to support good health coverage for a family of four.

Like a nicely diversified portfolio, it will invariably be a diverse set of factors that goes into the decision matrix to define where individuals/families ultimately plant their poles and set up camp in early retirement.

Aha! I have been wondering if you would divulge where your mountain home is! Glad to know where those beautiful pics you’ve posted were shot. :-)

And so, so true that there are many factors that should go into these decisions. Sadly, retirement place rankings rarely acknowledge that, or that people could value those factors differently! At the very least, they ought to look more closely at health care costs and access and factor that into cost of living more substantially.

Ugh, property tax… I am not surprised TX is a top 5 property tax state, given our experience. Harris county loves to raise it the max each year (10%) and like the other commenter, my boss was talking about a lot of his neighbors (ten on his street) are moving out of their neighborhood to downsize and reset their property tax assessments because they’re getting priced out of their area.

I tried to warn some of our friends about that before they bought in that same locale, but whatever. Fortunately this year, our protest was accepted and they knocked it down to lower than what we paid last year. Yeah, their system really makes sense… When we looked around Canyon Lake, it looked like a lot of properties had their taxes “stalled out” and everyone we could find wasn’t just jacked up 10% year after year. It is a slight worry of mine though. I’d much rather pay state income tax than get hosed on property tax every single friggin’ year…

Beyond that, staying around here we have great access to health care, and are only 3.5 hrs away from the best cancer institute in the country. Fingers crossed we never need it. :)

There are a ton of other factors to consider when choosing somewhere to retire to though. Thanks for pointing those out.

Yeah, regardless of how you feel about income tax, at least it’s fairly predictable, and it only goes up if you can afford for it to go up. You know I believe in taxes more than a lot of FIers, but property tax has always seemed especially problematic just because gains in value may or may not translate into someone having more ability to pay those added taxes — paper gains aren’t actual liquidity, after all. And in some states, there are tricks to avoid getting reassessed that the wealthy totally exploit. So yeah, it’s problematic!

This is a good point! I didn’t think about retirement locations in terms of “health.” I thought this would focus solely on the quality of healthcare, but you’re right about all-around health. Areas that emphasize healthy diets and exercise tend to have a stronger population. And it’s easier to do these things when it’s already in the community mindset too.

Absolutely — tons of factors are important here, and there’s no perfect place. But there are places that have a stronger culture of health and a stronger commitment to providing excellent access to care. All worth considering!

Your tweet was right – I DO love this post!

My parents are in their 70s so I get a first-hand look at what’s important to retirees. They both have chronic health problems so access to quality health/medical care has always ranked at the top of my list. It’s also why I will probably stay in MN, rather than go somewhere warm or with lower taxes. Our medical care is first rate, with lots of clinics/doctors, including the Mayo.

MN also has great parks and wonderful lakes. So much to do (for free!) outside year-round. The quality of life is really good here.

And as long as we stay blue (not to get TOO political), the focus will continue to be on healthcare, the environment, and education. With it starting to lean more right, I worry that people are being short-sighted just to save a little money through slightly lower taxes.

Thanks for a great post. I love how much research goes into these :)

:-) Glad this one spoke to you — I thought it might! ;-) It’s so awesome you’re happy with where you live and feel comfortable staying put. I think about folks who move somewhere for cost of living or quality of life only to discover that the health care landscape is bleak there. You know you’re in a good spot for lots of factors — so long as you can handle the cold, snow and mosquitoes! ;-)

Ha! I actually like the snow and my only problem with it is the 2 hour commute that goes with it. Totally not an issue in retirement so I’ll LOVE the snow then! I feel bad for all the people in states that don’t have distinct seasons. Each one is beautiful and I love watching the seasons change, even if that does mean cold winters and mosquitoes in the summer :)

Forgot to mention that MN taxes SS payments, which is a bummer since so many seniors depend on that money. What’s funny is that I complained about it to my parents a year or so ago and I was more upset about it than they were! They really don’t have a problem with MN being a higher tax state, which speaks to what retirees really value.

2 hour commute?! Holy wow. You’re making me extra grateful to work from home, at least when I’m not commuting to the airport. (I call that my commute, though thank goodness it’s not every day!) And I agree with you on seasons, though I could live without mosquitos, especially those evil Midwestern ones! ;-) That’s interesting about your parents not caring about state taxes — I assume it’s different for everyone, but yeah, there’s more to life than getting upset about every penny!

I don’t completely disagree with the chart about longevity, but I think there might be stuff going on that aren’t necessarily applicable to outsiders moving in. For example a cultural diet or heredity (if people don’t move far from home). I’m not saying there’s zero value, but it should be balanced.

I was hoping to hear what your personal ranking is. I would guess either Colorado or New Hampshire as they seem to have high healthcare and skiing. I don’t know the Colorado area as well, but as a Bostonian, I can say that there are great hospitals there (if you have a longer-term condition).

I completely agree with you, and there’s no perfect measure on this stuff. But the indicators do tend to cluster together — states with lower life expectancy also have higher rates of premature death, lower rates of physical activity, higher rates of smoking, higher rates of obesity, etc., which simply speak to the culture of health in a place. Obviously we each need to decide how much that matters to us, and that’s why I linked to the research showing that our weight and other health factors tend to be highly correlated with those around us, even if we don’t share those same cultural or genetic traits as transplants to a place as the locals might carry. ;-)

And as for our ranking, all will be revealed soon! :-D

Your words from above: “For states that opt in to the expansion, 100 percent of the cost is funded by the federal government, meaning states get to offer health insurance coverage to many more of their uninsured working residents at no cost to the state.”

If 100% of the states opt in to the expansion and no state has to pay, who is getting the bill? Same place as always – taxpayers.

I’m all for getting healthy – and I need it. I’m near 50 years old and horribly over weight, but I’m not sure it’s the government’s responsibility to pay for my negligence. As much as I disliked Obama, I don’t recall him forcing me to eat and drink massive quantities of pizza and beer rather than take a nice stroll in the evening with my wife. And I understand I have it easy. I work for a non profit that is supporting a group trying to help out with a food desert in Dallas where folks without access to a car have a 3 hour round trip bus ride to the nearest grocery store. That is unbelievable in today’s day and age – but true. I am certainly right wing on the political spectrum, but I’m not heartless. I realize some people need help.

I really enjoy your site and the multitude of others extolling early retirement and I am on my path to join you soon – please look for me – I’ll be the fat one with gray hair. I just worry about our country’s debt and what it will mean to my 10 year old niece and 12 year old nephew.

Healthcare may not be the place to make a cut in costs. Maybe by not expanding Medicaid it will cost us more later. I don’t know. But nobody seems to want to make a cut anywhere. Medicaid, food stamps, free lunch programs at school, subsidized cell phones, $16 million MOABs, incredibly frequent trips to Mira Lago, the list goes on endlessly. Who pays? and when?

I’m about 50 – I’ve been around long enough to know that at some point the music will stop and someone will get handed a bill. The final straw that broke Britain’s hold as the world reserve currency was in the 1950’s over the Suez canal crisis. Until the mid 20th century, they were where the US is now. Everyone needed the pound – right up until Britain’s debts necessitated a quick propping up of the currency by a quick loan from the US. President Ike said No – unless Britain backed down over their Suez stance.

How long before a China or some other country does that to the US? I know Democrats and Republicans are having trouble getting along right now but do we really want another country telling us what to do because we weren’t smart enough to tighten our belts?

I don’t know – just ranting I guess.

Again, I really enjoy your site and am looking forward to your big reveal. Keep up the good work!

Tim

I think my point is that taxpayers are ALREADY footing the bill for Medicaid expansion (and for the ER care that uninsured people rely on in non-expansion states), so why not insure more people in a state? The question of whether we should be footing the bill at all is a totally different one. :-)

I do think, to your point, plenty of people on both sides want to make cuts — they just can’t agree on which ones. I’d be perfectly happy cutting out the cost of those Mar a Lago trips. ;-)

And food for thought on a few of the items you raised:

1. National debt is not the same as personal debt, and there are plenty of smart people who don’t think it’s actually a problem so long as it doesn’t rise *too* quickly. I wrote about that here: https://ournextlife.com/2017/01/16/debt-is-a-funny-thing/.

2. Opinions over who is to “blame” for obesity vary a lot. If a little kid is obese, no one thinks that’s their fault, right? They blame the parents, the lack of local parks, crappy food at school or food deserts, etc. But as soon as that obese kid turns 18, suddenly we think it’s all their fault even if they’ve been set up to fail at maintaining a healthy weight from birth. I admire your taking personal responsibility for your weight, but I think it’s a really complex issue with some factors that you have no control over. Here’s a recent article on the blame game: https://www.nytimes.com/2016/11/01/health/americans-obesity-willpower-genetics-study.html.

Thanks for your kind words about the blog!

When discussing bankruptcies, it’s important to note these studies only mention unpaid health care bills and not all the other bills these people aren’t paying. Healthcare unpaid bills alone generally do not cause bankruptcy. They can, but it’s usually just one of many unpaid bills. Working in healthcare many years, I assure you a health invoice is one that people ignore first, because by law they get treatment in the ER whether or not they pay. They don’t generally treat bills for health as something to take seriously.

As for life expectancy, I don’t like this measuring stick because it’s so grossly over weighted to infant mortality. The less infant mortality, and the better your numbers will look. What a better measuring stick to me is life expectancy at age 65.

As for the lower 48 states, getting healthcare we can pretty much determine is similar with more difficult access in rural areas. Puerto Rico actually would be a place I wouldn’t retire to since they lack enough doctors to serve the population.

Taxes and cost of living are very closely related. People vote with their feet and the states that are friendlier to families, like TN, get more people. States that have high taxes and aren’t friendly to families get fewer, or at least fewer new ones and more leaving. I also disagree that today’s retirees rely on dividend and interest income. Most retiress I know have taxable IRA’s they withdraw from as their primary source of income (as will I as part of our income) and social security as a secondary source.

One of my favorite studies to watch, the United van Survey:

https://www.unitedvanlines.com/contact-united/news/movers-study-2016

Another thing I think you ignore is the prohibitive cost of health insurance and health care in nanny states like Wisconsin, where I am from. Our in law’s pay considerably more up there for basic doctor visits and Pediatrics than we do here in TN, a state which may never expand Medicaid. Yet we continuously attract more families, retirees and people than most states that expended Medicaid. This is an interesting chart to compare two of the states I have lived most of my life in. There is quite a divergence in population growth:

https://www.google.com/publicdata/explore?ds=kf7tgg1uo9ude_&met_y=population&idim=state:47000:21000&hl=en&dl=en#!ctype=l&strail=false&bcs=d&nselm=h&met_y=population&scale_y=lin&ind_y=false&rdim=country&idim=state:47000:55000&ifdim=country&hl=en_US&dl=en&ind=false

Obesity is a personal problem and one that even affects Colorado. Nations that don’t rely so heavy on the automobile have much lower rates of obesity. One trip to Europe and this becomes obvious right away. I recall, although America was well on its way when I was growing up, having much less obesity in the 80’s than we do today. In my parent’s generation, they walked to school daily and took the street cars. Obesity was quite rare when they were growing up,, and fast food wasn’t very widespread at all until later in their lives. They too, fell victim to an overly reliant lifestyle on the automobile, the number one health killer in my opinion.

Thanks for the topic.

It’s interesting in that United Van study you linked to, many of the top inbound states are considered “high tax” (Vermont, Oregon, Washington state, DC, etc.). I also think it’s a mistake to look at people with mobility and those on Medicaid as being the same populations. Most people poor enough to be on Medicaid can’t just pick up and move to follow a job, a different tax situation, etc. (See http://content.healthaffairs.org/content/33/1/88.full and https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2753743/) And re: the state-by-state comparison you’re drawing, something tells me you’re nowhere near Medicaid eligibility (in TN that would be under $17K a year for a family of two assuming you are parents, $25K for a family of four — https://www.tn.gov/tenncare/article/categories), which means it’s not apples-to-apples. The costs are different (and much lower) for lower income households under the ACA, so it’s not fair to extrapolate your costs at your income bracket (and with employer-sponsored coverage) to what they would be if TN expanded Medicaid.

Healthcare has always been a top retirement consideration for us. From ‘our plan to retirement’ post, the second thing I posted when I started my blog: “Our family must have access to healthcare that does not require us to hand over a kidney and our first born child in order to have a wisdom tooth removed.” Other considerations included the place having a good walkscore and public schooling system. Taxes didn’t make the cut.

It doesn’t surprise me that you’re so focused on health care, though it does surprise me that you’re the first to raise public school quality as a priority. I know the FIRE space has fewer kid-havers than average, but there are still plenty of parents like yourself in the ranks! Maybe you need to do a version of this post focused on school quality in both K-12 and higher ed, especially since so many FIers want their kids to pay their own way through college, making in-state options extra important.

Fantastic post! Thanks for your detail on this important topic. It is sad to think of how the U.S. health care system has morphed over the last 20 years. Quality private-practice physicians and not-for-profit hospitals are becoming extinct. Hospitals, drug companies and insurance companies have become aggressive marketing machines focused on corporate profits and gaining “market share”. Health insurance language is riddled with loop-holes, e.g., deductibles, co-payments, co-insurance, medical necessity, pre-approval, out-of-network. For today’s consumer, it is truly becoming buyer beware!

As I approach my last year of work, (and last year of employer paid health insurance), I hope and wait for a reasonable resolution of the national healthcare debate. In the meantime, I am making a list of things I can do to control my healthcare expenses. I’m working to become a more educated healthcare consumer. I try to be more collaborative at doctor visits (as with so many things, more is not necessarily better). I am also trying to learn and adopt the healthiest lifestyle habits to get to, and stay in, excellent health. Finding the best state for retirement has just been added to the list!

Jeff

Thanks, Jeff! I do think we see good intentions in a lot of the proposals put forward (like the limitation on insurance company profits in the ACA, to avoid expanding what you’re talking about), but almost nothing has been allowed to function as it should because of partisan bickering and the profit-driven side of health care. Sigh. In your own personal health care, I applaud you for empowering yourself and taking a more active role! That will suit you well as we ride out the next however many years of uncertainty!

Alaska is looking pretty good after all that…. especially since we’re like the greatest state ever in terms of taxes (or lack thereof). But I guess the weather part tips the scales against us…. :)

I bet it’s that you’re So. Far. Away! And maybe that whole dark-around-the-clock thing in winter. ;-) Lots of people live in cold places, but they have easier escape options than you guys do!

Mrs. ONL,

You’re my favorite FIRE blog, hands down!!! I’ve been kicking myself for the past month since “finding you” … Where have you been all my life??? Just kidding. Seriously though, your posts are well written and researched, and frankly, just spot on for me and my family situation. I can relate to almost every post you’ve written, and also many of your blog friends who chat with you in your community.

I’m 15 years older than you, and have an awesome hubby and 2 kids, with the last one off to college in 4 years. My FIRE date is < 4 years and counting down. I'll be 55 when I retire (not quite an "early retiree" by most Millenial standards). Hubby has been retired for 3 years, and loves life as a stay at home dad. We're FI already, but I'm still working because we're uber-conservative, want to leave a sufficient inheritance to our kids and extended family, and I'm still OK with my job (I don't hate it desperately like many folks who can't wait to Escape Alcatraz). Additionally, we aren't MMM fanatics and like the freedom to spend on needs AND wants. However, we are very conscious to ask 3 times whether a WANT is really worth the spend, and if it is, then we buy it. On the flip side, I don't want to have to find a side gig to earn money down the road, so our portfolio has to last beyond our lifetimes. The FIRE community has helped me think more broadly and plan our FIRE more clearly.

Specific to this post, we've decided to remain in So. California despite the HCOL, state taxes and property taxes because Health Care (availability, cost, and continuity) was our #1 priority. In spite of SoCal's negatives, we decided this because we've lived in CA our entire lives and don't know anything diff in terms of HCOL and high taxes … so we built our FIRE plan with those in mind. We did consider a move to Nevada to save on state taxes, however, the health care available and the cost turned out to be prohibitive, and essentially negated the entire amount of state tax savings, and then some. We're KFF devotees and Nevada doesn't have it, so that was the deciding factor. Like you, we will always have a "home-base" and will never be retired traveling nomads.

Keep up the motivational writing, you have a life-long "friend" for as long as you're still blogging post FIRE.

Triple-Nickels

Thanks so much, TN! ;-D What a sweet note. :-) I definitely love hearing that you guys are more conservative in your approach and you’re budgeting both for plenty of wants, and for you money to outlive you. I wish fewer people saw it as a tragedy to have money leftover at the end — leaving a financial legacy is a beautiful thing, too!

And it sounds like you guys have made a great decision on where to keep your home base, based on careful consideration of a whole bunch of factors! Kudos to you for that! So many people write off “high tax” places without really thinking through every aspect of what it costs to live in a place, or what quality of life will be like if they live there, and some places just might be worth paying a bit more in some areas!

So glad you found us. Thanks again for your lovely note! :-)

Great work again!

I will avoid discussing the general issues around health care in the US and the issues state to state, outside of saying until both sides are willing to act like adults and agree on something together instead of passing one-party promises. Until then I’ll go under the assumption I can at least buy an individual policy with some large out of pocket maximum from the big four insurers (Anthem, Aetna, United Health, Humana)

Then my consideration on health care goes to access to beds/specialists. It wasn’t something we ever thought about until my better half started dealing with a rare injury and a lot of secondary conditions. I don’t now how long this would have taken to diagnose/treat if we didn’t live in a Top 10 metro area and have multiple large teaching hospitals nearby.

Long term, it may cause us to reconsider where our primary retirement occurs. We might love moving to Hawaii, the beach, but could need a more populated area with better access to care. Flying when sick from Hawaii to LA then staying there is both miserable and not cheap!

Some of the mid-size college towns with teaching hospitals attached become attractive.

Thanks! :-D I’m glad you have an appreciation for how fortunate it was that you guys are in a big city with lots of specialists — as we have learned in moving to a smaller place, not everyone has those same options! I think it’s a great point that college towns with teaching hospitals provide a good option, assuming demand doesn’t vastly outstrip demand there. There truly are widespread shortages in both general internal medicine and key specialties in so many places that it’s got to be a consideration! I don’t blame you for wanting to live in Hawaii — but also for wondering if that puts you too far from the health care you want to have nearby!

Healthcare is just messed up! Thanks for shining some light on things to consider on the topic. Hard to believe, but we spent $35k on healthcare last year when in the retired mode. Premiums for 3 of us were $15k. My wife ended up in the emergency room so there was the full $6.5k deductible. My son had to have shoulder surgery for another $6.5k deductible. And a few thousand more on PT, meds, dental, etc. And to top it all off, we had to change practically every doctor we previously had. While a big supporter of health care for all, the current approach is just broken. We have moved to a much, much better path this year … but of course as Murphy would’ve predicted we haven’t had the need for any of it yet. The protection we are after is in case of something catastrophic, but don’t underestimate the drag that healthcare costs can play. And we’re active and healthy! Look forward to more perspectives on options as this plays out. There are options with the big insurers, but you have to be creative.

Wow, that’s a big hit you guys took last year! Though I’m glad that Murphy’s Law is applying to you all this year, in the sense that no more major health issues have arisen! (Knock on wood.) This is definitely a topic that we’re all going to have to keep adapting on, and I’ll keep writing about it. :-)

Healthcare costs was one of my concerns before retiring. Based on my research, and after 5 years of paying for my own healthcare, I’ve found the cost per person to be between $500 – $700/month for a gold – platinum plan. It is what it is. And at least it’s a business expense!

Sam

And let’s hope it stays in that range moving forward! The big X factor is that it could go up significantly more if the ACA goes away, because the ACA caps insurance company profits at 10%. Without that cap, they can raise rates however much they feel like it.

I was surprised by AZ’s hospital beds per capita, and that leads to another point: living in a larger city usually means access to better healthcare. Much of AZ is very rural, and small towns can’t support a large medical center or specialists. However, the Phoenix metro area, with approximately 4 million residents, can support what seems like a hospital on every corner (especially with all of our imported retirees).

I have heard patients describe this trade-off as “the price of fresh air,” so it still boils down to priorities.

It’s a great point, and I only looked at the state level for this post, not the city or rural area level. As you note, those vary tremendously. But even within cities that seem to have health care everywhere, it’s still not always true that there’s enough to go around, nor that every provider accepts every kind of insurance (as I’m sure you well know!). Sometimes there’s the illusion of widespread access, but the reality can be different.

Healthcare costs and access are the driving factors in Mr. MR and my decision of when and where to retire. I am a young cancer survivor, who at least under the ACA would have healthcare access without high-risk premiums and lifetime caps. Who knows how that will change in future. However, even if those protections stay in place, we are certain costs will still be high. In fact, I have three very active and seemingly healthy acquaintances between the ages of 30-50 who were diagnosed with cancer within the last year who, despite having ACA insurance, are looking for help to pay their medical bills. Considering we would like to “early-retire” this year and that future premium and out-of-pocket costs will likely continue to increase, especially as we age, we have decided to apply for my husband to get permanent residence status in Canada (I am a dual citizen with all my family in Canada) and hopefully move north next year. Premiums in the U.S. are already at least 4 times higher (i.e., thousands of dollars) annually than what we will pay in Canada, and that even doesn’t factor in the additional out-of-pocket costs here. So, we feel like if we were to stay in the U.S. we would need to work an extra year or more just to pad our savings to cover healthcare expenses. Despite some reluctance to relocate (and file taxes in two countries, ugh!), the trade off of working longer in order to stay isn’t worth it to us. B.C. mountain towns, here we come…. :-)

You know you are the envy of us all, right?? ;-) (I’m not joking!) The ability to access high quality health care in essentially any other country is huge, and you happen to have access to one of the best. Enjoy those BC mountains, and share stories so the rest of us can live vicariously through you! ;-)

We are seriously considering relocating to the Canadian offices of my husband’s company and establishing permanent residency for similar reasons. We have been mostly healthy to date, but other members of my family have fought cancer and the possibility feels too real to ignore. Good luck in your move and with all of the headaches associated with filing US and Canadian tax returns. Are you moving all of your investments into Canadian accounts, or keeping your US accounts?

Oh man, we’re super envious you have that option! I’m not saying we definitely want to bail on the U.S., but just having options is such a gift!

That was a great post. Many people and especially early retirees are closely watching what will come of the ACA. We are a few years away from FIRE. We mostly talk about weather and taxes when we talk about possible places to live when we retire. I guess the cost of health care based on location is another key component to the FIRE picture.

Thanks, Dave! And you’re so right — health care is another important piece of the puzzle. I hope by the time you guys are ready to call it quits, things will be a bit clearer!

Good points to consider. Also valid for Belgium. Not so much the weather part… The tax part and health care are still mainly central, it starts to be regional more and more…

You run a slack group…cool stuff

That’s interesting! I would think this problem is more limited to the U.S. Good to know it’s not entirely just a problem here!

In Belgium, the Dutch and French speaking political parties think they can do it better regional… Gives weird situations… Driving license is now harder to get where I live. And nothing holds you back to go to the other area and take your exam there. Thumbs up political people.

Same is ongoing with parts of health care

Ah. Well that is weird, especially if you can just travel to another area and get what you need!

While I’m often envious (in a good way) of people who are SO close to ER, every time I think about healthcare and high CAPE ratios, I’m happy I have another 8-10 years till FIRE. I think I’d be too afraid of the current situation to actually pull the trigger, as a doomsday scenario of brutal healthcare changes and a back to back double digit loss years in the stock market would consume my thoughts.

It’s a big advantage to have so many “proxies” in the FIRE space for those who still have 5+ years on the journey. If folks can pull the trigger in these conditions, then anything is possible!

I’m totally with you, Todd! I think it must be a huge relief to know that you still have a few years to let all of this shake out before pulling the plug! It’s honestly made us think hard about whether we truly need to retire now, and while we’re committed to leaving by end of year regardless, we know that choice is going to come with its own stress!

Wow, that was an impressive attempt to tackle a very complicated subject!

One thing I have noticed about the tax comparisons like the ones from Forbes and Kiplinger is that they skew towards income and sales taxes and don’t handle property tax burden very well.

In my case the property tax for my big city Texas house runs almost $10k/year. An equivalent house/location in the Denver area would run me under $2k/yr. Also, considering my slightly above MMM levels of spending and exemptions I would pay almost nothing in Colorado state income taxes.

So you can see that no income tax Texas is far worse for me tax wise than an income tax state such as Colorado.

Totally right on the income tax bias, in large part because property taxes are much harder to project. They’re based on irregular assessments or may have local caps, and it’s harder for them to project backward to know what your purchase price might have been. But you’ve given a perfect example of why we should all be skeptical of those analyses and rankings!

Health coverage is such a large priority to our family that we are seriously thinking about relocating to Canada during our final working years with the hope of establishing permanent residency and eventual citizenship. There are other factors at play, including proximity to family near the Canadian border, but the security of universal health care in early retirement is primary. I’ve seen too many healthy people struck by random health catastrophes to give up employer-sponsored health care without a viable alternative that isn’t subject to the whims of lunatics in Congress.

If you have that option, I don’t blame you for exploring it! Health care is a huge freaking deal, and we don’t seem to have the political will on either side in the U.S. — at least yet — to tackle it for real.

Access to a doctor I don’t have to drive to is a really important factor in my current and future life. I hate driving now. I can’t imagine I will like it when I’m 80. For me, the biggest factor in where I want to live is the presence of LGBTQIA legal protections and other queer folks.

YES. So important, and not something those “best places to live” lists really factor in, not to mention that that’s a much more local question than just which states are good for whatever reason.

So hyper-local. There are definitely places in my city where I would not hold my girlfriend’s hand.

Totally. And there are states where the services available in cities vary dramatically from what’s available in the rural areas.

Thanks for such an informative post! Can you do an update in about 4 years? Lol! At this point we are basically assuming while we shouldn’t have a mortgage in retirement, healthcare might very well take up that chunk of our monthly budget. It’s frustrating and confusing, ever more so since we’re both federal employees with very good and very affordable insurance. When we jump ship, well, that will be one painful belly flop.

Honestly, I am trying not to think about it too much yet, since we’re still far enough out that a whole heckuva lot could —

and will — change. I’m just gonna pretend that we’ll have universal healthcare by then!

Sure! ;-) And you’re so right — a ton could still change before you pull the ripcord! So while it’s good to keep an eye on things, for you guys, I wouldn’t get too tangled up in the details. ;-)