Early retirement is all about planning, and no doubt anyone on this path spends a ton of time thinking about that exit plan. But here’s a question: What if you get there and don’t end up liking the thing you exited to? Or it gets old over time? What will you do then?

Does your exit plan have an exit plan?

The scariest moments in my life have been those in which I’ve had to eliminate choices and commit to only one. I can see in hindsight that I wasn’t actually afraid of those life transitions — choosing a college, getting married — because I had the incredible privilege of going to an excellent university I adore and marrying a truly wonderful human I love with every ounce of my being. But that door closing, the removal of choices, touches some place deep and primal within me that fears a narrowing of my life’s potential path.

I know not everyone fears making choices that way, and that some people prefer exactly the opposite: knowing their choice and eliminating the other possible options. But either way, retirement could for any of us be very long. It could constitute a huge portion of our lives — 30, 40, 50+ years. That’s a long time, with more variables and unknown unknowns than any of us can account for in our plans.

Which is why it’s so important that your plan allows for this possibility:

What if you change your mind?

It could be for any reason: You decide you miss working. You realize the life you planned out for yourself isn’t what you thought it would be and want to change things. You get bored. (We don’t think it’s likely, but have thought through the “won’t you be bored?” question in depth.) What then?

And of course I know this is one of those “That won’t happen to me” moments. None of us want to think that we are fooling ourselves in planning for something we believe with all our hearts we want. But the truth is that we only know our future, retired selves a little bit. Maybe after detoxing for an extended period, and having work and work stress out of our systems for two, three, five, ten years, we’ll want something very different out of life. Maybe you will, too.

And if that happens, we’ll all be glad if we gave ourselves the latitude — financially, logistically, philosophically — to adjust our path accordingly.

Keeping Your Early Retirement Path Big and Wide

There is an unavoidable decision that comes with retirement, whether it’s early retirement or traditional retirement: leaving work, or at least mostly leaving the standard form of work. That is a huge deal, and a heavy decision we’re now feeling the weight of every day. (This is normal for us, by the way. Live with the anxiety in advance of actually doing the thing, and then move forward with no regrets. Like my pre-wedding freakout for no reason, even though I had zero doubts and have never looked back. That’s just how I roll, and Mr. ONL is wired similarly.)

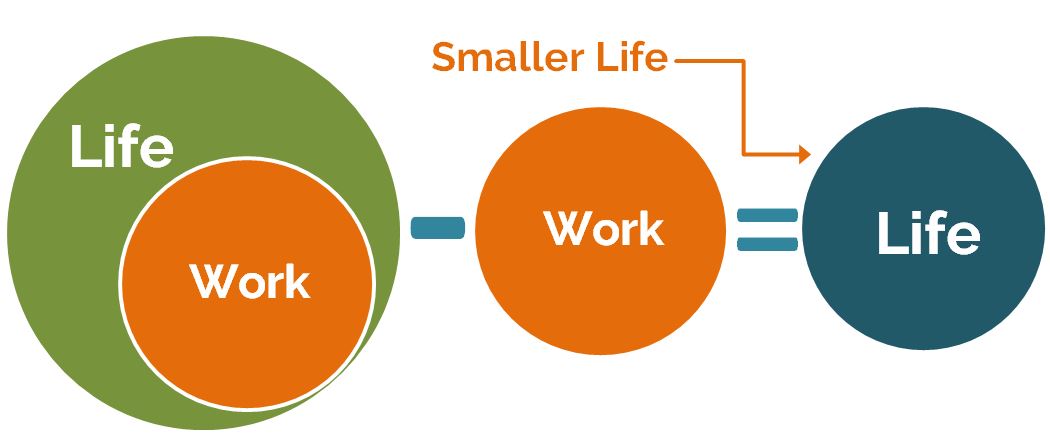

We’re huge proponents of being intentional in life to ensure that, when you cut off big sources of social interaction, mental stimulation or anything else fundamental (like, ahem, work!), you replace it with something else so your life doesn’t accidentally get smaller. Big life good, smaller life less good.

And in this case, talking about having an exit plan from your exit plan, what keeping that big life intact means is keeping your options open, so that you never find yourself forced to continue down a path you’re no longer stoked about, just because you closed off other options along the way.

Let’s get specific.

Exit Plan for Your Living Situation

We get so inspired hearing all the different living situations people cook up for themselves in early retirement: permanent nomad, full-time RV, small home base condo with most time spent traveling, permanent renter, mega landlord, expat — the list goes on. We have at least one friend in every one of those categories, and we check the box of paid off house.

Any living situation can be fantastic, and I’m sure I’m not the only one who has drooled over the blogs and Instagrams of those living the full-time travel life especially. Never more than when we’re battling back the latest encroachment of nature (read: vermin infestation) that seems to be a constant in the mountains. Not being homeowners and hitting the road sounds mighty tempting right about then.

But every living situation has its downsides, too: maybe those nomads will get sick of wandering and will crave feeling more settled. Maybe the RVers will get sick of picking up and moving, and the drill of emptying that icky black tank. Maybe landlords will get sick of dealing with tenants. Fill in the blank for whatever living situation you’ve chosen for yourself — what’s the potential downside, or the thing you could get sick of?

The good news is you’re allowed to change your mind. You’re allowed to change from one living situation to another, or to move from one place to a different one. Unless you’ve boxed yourself in financially, and made it so you can’t afford to do another thing. That’s the exit plan you need to be sure your plan includes. If you get sick of roaming the world forever, do you have the funds to pay rent forever at some higher and ever-increasing future rate? Or the resources to make a down payment, get a mortgage without W-2 income and make payments without fail? If you get sick of living where you retire, do you have the resources to move somewhere else that might be more expensive, or have you based your plan on living in the cheapest places only?

This exit planning is what led us to go with the most expensive option as our starting point: buy a house and pay it off before we pull the plug. We know we could have retired a year or two ago if we were comfortable making mortgage payments in retirement, because we would have funneled more money into savings instead of paying off the house ahead of schedule, but we chose this option because: 1.) it lets us live at the absolute cheapest level once we’re actually retired (no rent, no campsite fees, no hotels or Airbnbs), and 2.) any change of our living situation would be a downgrade, meaning we could afford it.

If we want to go full-time RV from here, we can, with funds to spare. If we want to travel forever, we could rent out the house and benefit from geographic arbitrage. If we decide we hate owning and want to rent, the proceeds from the sale will pay for a lifetime of rent.

We love where we live and have no plans to leave, but we could see moving to the beach once we’re old, our knees are shot, and we don’t feel like dealing with the cold anymore. And while we couldn’t necessarily move painlessly to the most expensive beach towns, we take comfort knowing we could move to any of the rest of ’em and be fine financially.

Exit Plan for Your (Lack of) Work Situation

Many of us going into early retirement say we never intend to work again, or at least we never intend to have to work again. And let’s hope we’re all right. There’s the chance we might need to out of financial necessity, and we discourage everyone from taking the cavalier attitude that you can “always just go back to work.” (Long post on the topic here, but short version: When you’d most likely need to go back to work is when others would need work most desperately, too, and discrimination against people with resume gaps and who are older is real.)

But what if you actually want to go back to work? I get way more emails expressing this exact sentiment than I ever would have expected, enough to think that it’s conceivable we could fit into that category one day, as hard as it is to imagine that now. But maybe we’ll turn 50 after a decade of being perma-kids, and wish we could play adults again. Stranger things have happened.

And in that case, we’ll have to prove to employers that we’re worth considering amidst their stacks of resumes, a task that I assume won’t be made easier by our big employment gap, our lack of current and relevant skills in whatever technology exists at that time, and our ages at that point. What then?

I don’t have answers on this one, mainly because this is a new exit plan from our exit plan we only recently realized we need to consider. But we know it could mean taking some masters-level college courses to gain new skills, taking a job that’s entry level or unpaid, or having to hustle harder than we might prefer to cobble something together.

But in the meantime, it’s a good reminder that burning bridges is never a good idea. We’ve never wanted to write a scorched earth farewell letter to our employers because we genuinely like and respect them, and are grateful for having spent our careers with them. But even if we weren’t walking away with such warm feelings, we’d still be focused on keeping options open for the future, maybe doing one small project a year with a former client, or offering to advise our companies if they need our specific expertise in the future. Whatever it looks like to ensure that we never put ourselves in the situation of having no leads and no current qualifications should we need to divert our paths.

Does Your Exit Plan Have an Exit Plan?

As always, I’m curious: Anyone else thinking along these same lines? Who has an exit plan for your exit plan, and what does it look like? What are you giving yourself the latitude to change your mind about? For others, does this spur any new thinking for you? Anything you now realize you want to tweak in your plan? And what other life stuff might you want to build more flexibility around, beside just living situation and work? Let’s discuss in the comments!

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: the process

Over 15 years ago I got a lot of:

“But you don’t have enough money, you’ll be so bored, you’re too young, your skills will be outdated, and you’ll lose all of your network to find another job!”

Um, thanks?

15 years later, those people are still working. Those who are still alive, anyway. I think my choice was worth the risk, and once I caught up on my sleep I saw plenty of opportunities to earn enough money– if I wanted to work.

One layer of exit plan is better than no plan at all.

I like your graphic. Can I suggest an addition to your work/life Venn diagram? The “Work” part could pass across the “Life” circle, taking a progressively bigger bite, leaving it looking like a quarter-sun crescent during a solar eclipse– or even fully eclipsing the “Life” circle (perhaps leaving a small corona). Once that “Work” circle finishes passing across the face of the “Life” circle, then one’s life will be restored to its full shining glory.

Doug, I love your answer. You’ll never find out unless you try.

So true!

This is a timely idea, given the tiny sliver of a crescent moon we have right now! (That seems to represent the “life” portion of our lives right now — so excited to see that slice get bigger soon!) And that diagram came from an old post with a bunch more, if you’re curious: https://ournextlife.com/2016/09/21/life-vision/. ;-)

A beautiful answer Doug – I especially like the image suggestion.

Excellent!

Didn’t you write previously that you wouldn’t rent out your house if you were traveling, because of the “ewww” factor of people sleeping in your bed (or something along those lines)? If you were to travel extensively aren’t those additive costs that you have to plan for?

I mention it because it seems like a possible change of the master plan. (I’m not criticizing, I’ve changed my plans for the day 4 times already and it’s just 6:30AM.)

I understand that’s not really the point of the post, but I think the whole point of financial independence is that you can exit plans on top of exit plans.

I’m a firm believer that smart people (and you clearly fall into the category) can always find a way to add value. There will always be a market those smart people.

Hahaha — YES, I feel an overwhelming sense of “ewww” when I think about renting out the house, so mentioning it here was more along the lines of if we decide to travel full-time, not doing anything like short-term or seasonal rentals, which make me feel practically itchy thinking about them. ;-) Thank you for remembering one of my more petty character traits. Ha. No change to the master plan (still not planning to need work and definitely not planning to monetize the house) — but if we decide we just can’t stay put anyway, then we might as well put our largest single asset to work for us. ;-)

The closing doors point is well made.

Pursuing geographic arbitrage is great when the future location works. As time passes however it can become a one way trip, as housing prices/rents tend to increase faster in more in demand areas closer to employment/education/cultural/whatever opportunities.

We’ve all met a variant of the cliched old expat bar fly in South East Asia pining to go back home, but unable to afford to go back… and shitting themselves about what happens once their health starts to fail.

The stale skills you mention is certainly another challenge. Those folks who were current on the 2003 tax code or last worked as a Visual Basic v4 programmer are going to be virtually unemployable in their chosen professions today.

So I think having an escape plan is a good thing, mitigating risks such as the markets dropping their guts and taking years to recovery… or a natural disaster washing away the beach front house.

However I fear many of the (predominantly white collar folks) who push the FIRE button overestimate how easy it would be to put the genie back in the bottle and return to their old lives should the wheels come off their retirement, particularly after an extended break and possibly at an unattractive employment age.

That said there is always work out there for those willing to do it, however the premium they once charged for their time may no longer be as great as it once had been.

This is one of the reasons I do seasonal work in between extended breaks, keeps my skills both saleable and relevant, my network of contacts current, and makes me appreciate how good being retired actually is once I start taking it for granted.

Yes, exactly! Thank you for offering a less varnished version of exactly what I was trying to say. ;-) It is all these things that we need to think about, and always leave options open for ourselves if we don’t want to risk turning into some version of that sad sack expat who can’t afford to do what he’d really rather be doing.

As for why you work, I especially love the appreciation for retired life. We talk about that sometimes — the yin and yang, and whether retired life will seem that special when it’s no longer the counterpoint to our stressful work life. We may very well end up craving a little work, too, just to give us that contrast!

The yin/yang observation is brilliant and fits exactly. We are a little (well OK, a lot) older than you guys. We both have interesting jobs and have lived as expats for almost 20 years (but with a house in the states) in some fabulous places. We first realized a yin/yang situation years ago when we lived in NYC (with exciting but stressful jobs). We were fortunate to have also owned a small house outside of the city where we could go for weekends. I remember how I kept trying to decide which I preferred more, only to realize it wasn’t as either/or but a both/and. Part of me envies people who are clear they much prefer mountains, or the beach, or the city. Quite simply, we like each of them. I think the magic will be in the balance (and the freedom to choose what suits). Thank you for your inspirational blog and your thought-provoking questions!

Glad you enjoyed this! If only both/and was affordable! ;-) We had our city place for a while after we moved to the mountains, and we found it just wasn’t a good use of our money. But we still miss the city and would also love to live at the beach at some point. So we’re trying not to decide things FOREVER, but just one chapter of life at a time. ;-)

I really needed that graphic. Thanks! I’m still figuring out how to spend some of my time. Boredom does creep in occasionally. But oh how I love reading blogs instead of prepping for a stressful meeting.

That graphic was from an old post you can check out if you want more: https://ournextlife.com/2016/09/21/life-vision/. And yeah, I’m pretty envious of folks like you who have time to read more blogs! Even if it comes with some boredom. :-)

I agree with the thought of having alternate plans, and I also strongly agree with not burning bridges with your current employers. I retired a few months back with no intention at first of returning to paid work for a long time, if ever; however, my former employers offered me a chance to come back as a contractor part-time, and I’m going to take that opportunity. We don’t “need” the income, but it will be nice, and also it’s only a year commitment. I don’t (or they don’t) have to renew the contract after the year is up. So I think it’s a win-win. They get my skills/knowledge, and I get a part-time gig. Plus, I will have had six months off for my extended break.

If you enjoy the work and it doesn’t stop you from doing other things you’re fired up to do, then that’s great! Congrats on keeping your old employers on great terms and being so in demand, even in retirement! :-)

I believe the best exit plan to an exit plan is a financial cushion between what your require to retire and what you actually have. It allows you to change locations or lifestyle… but it also allows you worse to worse to volunteer your time to some charity in your chosen field. If you don’t need he money then there are way more options.

Amen to all of that! :-)

Since this morning is my first morning of retirement, I hate to even write about an exit to my exit plan! But yes, I do have that plan. Having a doctorate and 28 years of experience in education allows me to do all kinds of jobs. I could go back to teaching chemistry or biology, I could teach at the elementary level, or I could be a school administrator again. I can find a job almost anywhere – even overseas! I can also teach at the college level. We have a ton of other experiences too – that would likely pay less than being an educator (not that we get paid that much!) – but to supplement if and when needed. For now, I’d like to just not think about work for a week…or two? Too scared I’ll get pulled back in!

Please don’t think about work for a GOOD LONG TIME! :-) And congrats again!! Wohooooo!

We’ve now Twitter chatted about this, but I think this question is about whether you WANT to go back to work, not whether you NEED to, and that’s something your gut will tell you, I’m confident. ;-)

Congrats on your first day of retirement, Vivki! It sounds like you have lots of options if you do later want to use them. Enjoy!

Thank you :)

I agree with some of the commenters that this is a place where money matters. Having a financial cushion enables a lot of freedom, and that’s part of the point isn’t it? That’s why I would never cut expenses to the bare bones and then retire once I hit the 4% rule. Way too risky since there is no financial flexibility in the plan to adjust to a changing world (e.g. poor investment returns, higher taxes, higher health care costs, etc) or changing personal desires.

But if you have some cushion and could cut expenses on top of that, you have a huge amount of flexibility. The only constant is change and it’s more likely than not that our view of a perfect life will change over time. Retirement is a starting point…..it won’t be static and I for one and glad about that.

What is encouraging is that with a cushion (e.g. 3% withdrawal rate), it’s highly likely that you can adapt to unpredicted future desires. In fact the data is even more encouraging for early retirees…….it turns out that expenses are often lower than expected (by choice) and future income is higher than expected.

I wouldn’t spend too much time making back-up plans of back-up plans. You have a nice financial cushion and you’ll be fine. Predicting the future is not something you, or anyone, can do, no matter how much you think about it. Trying to do so will probably just create anxiety. Just focus on enjoying the moments. Your lives will continue to change and you’ll adjust just fine.

I’m laughing because this was not a contingency post, though folks are forgiven or reading it that way, given my near obsession with the topic! This is about having the cushion to change your situation if you end up not loving the life you’ve planned for yourself, like if you live in an RV and decide you want to buy a house later, or want to move somewhere different, or go back to work because you miss it. ;-) But I think your central point applies either way: having a bigger-than-necessary cushion in the answer!

Also, what data are you seeing on early retirees and returns? Everything I’ve seen is anecdotal or small sample size, so not what I’d truly call “data,” as well as being rife with recency bias. But I’d love to see what you have seen!

We took a slightly different path. Instead of paying off our house, we refinanced it into a new 30 year term with a new 5 year ARM. This still provides a lower payment and lets us retire fairly early.

We can’t wait for the freedom that awaits to do nothing all day :)

Say more about how that helps you have the flexibility to change your mind if you end up deciding you want to have a different living situation? Not sure I follow. ;-)

I think the fear of possibly wanting to get back into some sort of career is the biggest thing holding me back from RE at this point. I’m not a great networker and am just not confident I could get a job as good as the one I have if I ever left. (Not that the job is perfect, but the combination of high pay and considerable autonomy are hard to match).

I do hope that the opportunity for flexible work and unpaid volunteer options will fill a need to “be productive” and contribute, but not knowing how that may shape up keeps me in the office. I am going to 80% time in a few months, so hoping that will free me up to identify a next act, but it really is difficult to say what will be appealing/motivating once the constraints of a real job are gone.

I can definitely empathize with this! If I didn’t have this blog and the projects coming out of it, I don’t know how ER would feel to me at this point in time. Most likely I’d be freaking out about similar questions. But of course if you don’t NEED the work, it’s good to remind yourself that any type of job can be fun and fulfilling in its own way. One of my favorite teachers from high school started working at Starbucks after he retired, entirely for fun, and he LOVED it. He loved chatting with people of all ages all day, and the low pressure. I remind myself of that often!

So are you saying that perhaps I shouldn’t have deactivated my LinkedIn profile? 😮 That was never a source of career opportunities for me anyway… However, until this morning I experienced zero regret for the decision. You made me think a little more about it, and I’m grateful for that, but I still know it was the correct decision for me (not for everybody). I have been cleaning out my contacts extensively – I’m about halfway through that process – and thinking long and hard about who I should keep. To me it’s more of an exercise in minimalism/intentionality by clearing out the excess to make room for the important stuff than shutting down possibilities.

Ha. LinkedIn is the worst. I dream of deactivating mine. And I totally applaud you for culling your contacts — I’m only talking about going back to work if you decide you’re bored or miss it, and that would definitely NOT mean working with folks you don’t like or on work that’s not fun and interesting. So I fully support doing a full “spark joy” declutter on those contacts!

I figured if I get bored and feel like doing a little work part-time and on my own terms, one of those good contacts would be a great place to start. I understood what you meant, it’s just funny that it made me think for a nanosecond that maybe I was shutting down some options. Try the LinkedIn thing, it was truly liberating! Since I am about to leave on great terms with a good attitude and integrity intact, the deactivation of that account was satisfying mostly because it had become so irrelevant and annoying.

Yeah, I’m sure you won’t have any trouble just because you shut it down. I have never liked LinkedIn.

I think about this a lot. I actually registered (and coughed up $1850) to renew my board certification this fall for another decade. This means a few hundred more in study guides and a summer spent with my nose in a book that I wouldn’t otherwise choose, but it’ll help keep my options open if I have to go back to work. Now to decide if I keep paying my state license fees, DEA fees, etc. The upkeep fees are a significant portion of our budget and it would still be really hard to get a clinical job after taking time off for any reason other than having a kid.

I think that’s smart, both for the stuff I’m talking about in this post (the possibility of finding that you actually miss what you do now) and the stuff I normally write about (needing money if markets don’t cooperate). I’m sure it’s hard to stomach all those expenses and time on a big maybe, though!

Excellent post that we’ve been talking a lot about lately. We just bought our retirement house and the situation/location is a bit different than we thought just even a few months ago. The key feature that made us go in this direction were flexibility and giving us multiple options rather than stretching to do something that we may not want to be locked into long term.

Also agree that we tend to do all of our worrying/second guessing up front and Mrs EE particularly in this case has been a bit of a basket case wondering if we should look for ways to back out. I also think this is actually a healthy approach, rather than just thinking the grass is always greener and jumping into things and then having regrets after you commit. Like you, once we pass the point where the decision is final, we avoid looking back.

You bought your retirement house?!?!?! That’s huge news! Are you going to post about it? And if not, will you email me and tell me where you guys decided to land? :-) CONGRATS!

And it’s nice to hear that you guys make decisions like us — do the stressing up front and avoid second-guessing after the choice is made. ;-)

Not officially a done deal yet, but will share on the blog as soon as it is. Location is in Ogden, UT.

Just saw your post and need to reply. So exciting!!!!

Maintaining flexibility may be the key. It is important to avoid the kinds of obligations that require work income to support the lifestyle, but that is fundamental to FI anyway, not just when considering exit plans if/when retirement doesn’t work out as planned. The point is that life doesn’t work out exactly as planned. The market swings will happen, changes will happen in the world, and health will fail sooner or later, all outside of your control. Just leave yourself adequate flexibility, don’t paint yourself into a corner, and try to live a healthy life.

We are working part-time now, 3-4 days a week, as we are sorting out some of the retirement issues like where to live, and what healthcare/insurance will look like until Medicare several years away. Might I return to employment for health insurance? I suppose it’s possible, but I’ll also look into options through my consulting LLC. That seems better than direct employment. The risk of losing professional skills or marketability may be an issue, so I plan to keep options open for contract/consulting, as long as it is on my terms and fun. Maintaining my wife’s professional licensing could be an issue for her.

You are totally right that things rarely go to plan. In this case I’m not talking about contingency planning (for once!) but about life circumstance flexibility, which is slightly different, and might require more funds than simple financial contingencies. The advice is still solid, but the level of scale might be worth looking at. ;-)

I’ve got this “exit plan for the exit plan” too — and am in the middle of using it!

For me, having been an acting “early retiree” for the past two years, the gap wasn’t too much trouble to address. In fact, for the opportunities I’m looking at (with startup companies), the extra rest and energy and angles and flexibility are major positives. That I’m not having to press hard on salary and compensation either also helps. ;-)

Were it five years’ gap instead of two, I’d have gone with my next exit option: retrain as a manager, demonstrating the new competences with courses and volunteer leadership and running my own “vanity firm” with a few part-time employees. Worst-case, take on trying to turn a business around, or work fast-food as a manager.

I’m thinking of this exit plan post as being different from past posts on contingency plans. This isn’t working because you HAVE to work, but working because you decide you’re bored and want to work — and so in that case, the good thing is that you can wait to find the right opportunity instead of being desperate for money and having to take whatever is offered to you. It could also be building your vanity firm up and making it a more substantial business, if that’s something you enjoy! ;-)

That’s funny you’re talking about exit plans because that’s what spurred the whole “we’re buying some land in Canyon Lake” change to our Lifestyle Change Plan. As Mrs. SSC put it, it can be our exit plan once we decide we’re done with our current Lifestyle. As I jokingly refer to it, it’s our “first” retirement house, lol.

Mrs. SSC thinks that we’ll be there for quite a while, but honestly who knows. She wanted to make sure we didn’t sign a contract to start building until after our vacation out to MT/ID. Just in case we changed our minds yet again. Palm slap to forehead and big eyeroll from me…

As far as an exit plan to our Lifestyle Change, I couldn’t tell you what it would be. Things tend to change so much and happen so quickly that I feel like I’d have a better chance to win the lottery than predict that. :) I know that neither of us are afraid of work, whether it would be in the same field or most likely different fields. She could teach, I could do a myriad of things, but until that time comes, who know what they could be.

I think the whole notion of an exit plan from the exit plan is that we CAN’T know what we’ll end up wanting to do. ;-) The only way to find out is to forge ahead, live in the situation you’ve planned for, and then see what happens. As long as you have a sufficient financial cushion so you could move if you feel like it, you’re probably in good shape. ;-)

As others have stated a financial cushion is helpful. With stocks at high levels (Shiller PE 29.9 today) I assume there will be a market correction the day after I retire that I will have to weather. Also that health care insurance will go up significantly from the ACA in the next 15 years. Hope for the best, but plan for worst.

One question is: if you had to go back to work would you do it in the same field? It sounds like that is what your exit-exit plan is. That you would work in the same field but scaled down. Maybe you could write out how difficult re-entry into your current field would likely be, and if you would even do that or instead pursue another field.

Yes, the secret thesis of this post is: build up a bigger cushion than you need to do exactly what you envision, because you may end up wanting to do something else. ;-) And the field Q is a good one, and one we can’t answer right now. Right now we’re eager to be done with this type of work, but after many years pass, who knows? It’s a great suggestion, though, to think through what it would take to re-enter whatever one’s field is.

As it is my assumptions that I will stay busy on something once FI, I do not wonder too much about an exit from the exit. I plan to keep doing projects, on my terms. That will add to my experience and make me stay up to date. I also plan to go to different schooling programs, once FI, just to stay current.

As I understood from previous post, you are working on an activity post FI. Rather than looking at a 5 year GAP on your résumé, look at ways to present that differently: We took a year off to travel while preparing our book (or other activity), then we did volunteer work and used this and that skill.

I agree with you 100% — we will be doing plenty, so it’s all about how we present that on a resume, should we need to have one again. I am honestly not worried about this for us, but more for folks who might be boxing themselves in with their FI plans! ;-)

If it all come tumbling down, then I’d just go walk the earth. Just keep moving and keep the expenditure to the minimal. I’m pretty sure it’d be way cheaper than living in Portland…

You know I’m totally picturing the Kung Fu version of this, not the Go Curry Cracker version. ;-) And hey, there’s always house-sitting! Hahaha.

Aspiring full time nomad here. Having only traveled for max 2.5 weeks at a time, deciding to sell everything I own and hit the road full time feels a bit like jumping out of a plane without a parachute. It’s impossible to know if I’ll like it prior to making the leap. I obviously *think* that I’ll enjoy it immensely, otherwise it wouldn’t be my plan. But it’s a bit daunting. Talk about a lifestyle change!

Like you, I have given thought to my exit plan. Who knows what I’ll want in the future? I’m way different now than I was even 10 years ago. I’m sure I’ll change even more 10 years from now. Because of this, my exit plan, like my retirement plan, has to be a flexible one.

If I’m bored while traveling, I can move faster. If I’m getting burnt out, I can stay in one spot for 6 months or a year. If I absolutely can’t get over the fact that I don’t get to ever sleep in my own bed and am simply craving routine and comfort, then I can move back to the US and set up a home base, grow a garden, get a small pack of dogs, and go from there. (Although I’d probably choose Mexico as a permanent spot instead, I have enough money to choose the US, at least away from the coasts.)

And then I reserve the right to change my mind *again* whenever I want. That’s always been the beauty of FI to me. It gives you options.

It sounds like you’re going into this with exactly the right thinking! The fact that you have enough saved to move back to the U.S. is the key ingredient, so congrats for making sure you’re set there! (And likewise set with Mexico.)

We plan to keep our resumes at least somewhat alive and well with structured, regular, extensive volunteering. I realize that’s not the same as employment, but I imagine it would opens some doors should we want to become employed after retiring. Contracting is also a likely possibility for us. I realize that doesn’t constitute “not working at all” retirement, but if it’s work we liked and could do it flexibly on our terms, it could work well.

That sounds like a great plan, Kalie! You know we’re not early retirement purists who’d say it’s all or nothing, and volunteering is absolutely relevant to paid work, in both the skills and contacts. I think your point is the most important one: if it’s work you LIKE and could do on your own terms, then there’s no harm in doing a little of that. ;-)

It’s a huge concern of mine. I know I’d be super bored – Hell, I *already am* bored. A break was great for about a month, but then what? that’s why I’m applying to jobs. lol.

If I could find the job that would just let me take a month off consecutively every year, I can’t think of a reason why I would even need to retire. Plus, in the past, I had customers who would work Tues-Thurs instead of retire. Unfortunately it’s tough to find that gig, certainly from the outside, so mega saving will continue and maybe I’ll decide that I like some other routine better than working by the time I’m your age. :D

So your exit plan had an exit plan, and you’re putting it to use! :-) That’s what all that flexibility is there for, right? I admire that you’re figuring out what you want to be doing with your time, trying different things and having the humility to go back to work. I think that’s a hard thing to do, so hats off!

I’m one of those people that fears my choices reducing my options. It’s gotten easier as I’ve gotten older, and I’ve realized that choices don’t have to be permanent if we’re not happy with them.

But I’m not even remotely on a FIRE path. So I’m not too much help there! I like Doug’s Venn diagram idea, and have noted over my life that the more money I can make at what I’m doing, the less time that “work” eats up my “life.” I may not retire when I’m 40, but I’m overall happy with my work/life balance. Mostly. It’s never perfect, no matter which path we take, and we each choose our paths for our own reasons. (I remember yours–and think it’s awesome that you guys are so close! Enjoy your new life 24/7–whether that equates to work OR play!)

I think if you’ve achieved work-life balance (even “mostly”), that’s a huge victory worth celebrating. In our careers, we’ve seen the opposite be true in every case — earning more always means living less. I don’t know any high earners who have balance in their lives, and that’s part of what has made us want to peace out so badly. We know we don’t want to work even more than now, which is what would be required to continue on. (Frankly, I don’t even see how that’s possible!)

I definitely see what you’re saying there. For me, since the vast majority of my career has been freelance work (even outside of this field,) charging more and negotiating for projects or per hour jobs has been huge and afforded me the balance. In unionized positions it was about the amount of education or credentials—you got paid more per hour, sometimes significantly so, for doing the exact same job. In 99% of cases, rightfully so. Without those bumps, working less hours wouldn’t be an option.

But I imagine there’s a tipping point, especially in salaried corporate positions, which I have literally zero experience with. Or especially if I’d like to make a massive income where FIRE was a realistic goal. (I currently earn above average for my age, but am not in the 90th percentile or anything.) Which would be really nice, but the way my cards were dealt in life, I’ve chosen to pursue the “now” balance.

That sounds super cryptic. I’ll explain to you IRL sometime haha.

Look forward to the IRL version of the story! ;-) But I am all about “now” balance!

I quit my last (for now) job 18 months ago and I am still trying to figure out what’s next. But I’ve decided one thing: just like I don’t feel obligated to work I don’t feel obligated to stay “retired” if something good/fun/unique/whatever looks good I’d work again. Maybe.

I think that’s a great mindset to have, so long as your financial plan doesn’t rely on being able to go back anytime. ;-)

I’ve thought about it a bit, and I think that even if I ‘retired’ tomorrow – or could, anyway – I’d continue consulting in my current industry on a more limited basis. It’d be extra cash which would be nice, but it’d be on my schedule. That way at least if I did for some reason NEED to go back to work, I’d at least have some recentish history of consulting to talk about.

Ultimately you’re right, nobody wants to think about it, but I think for me going the consulting route would be the best move. A bit of financial buffer, some social interaction, and tons of flexibility.

That’s likely a great option if you keep a continuous work history and don’t let a big resume gap form. And what if it wasn’t about the money, and you just didn’t love the lifestyle you retired to? What would your exit plan from that exit be? ;-)

Since my exit plan does not actually involve exiting, I think I’m covered. Just get rid of FT work and do enough work in my business to keep me afloat both relationally and financially.

Since we’re talking lifestyle here, not contingencies, I do think it’s still worth your while to think this through. If you don’t enjoy the PT work that you are planning for yourself, what’s your next option? Not that that’s likely, but it’s a good thought experiment if nothing else! :-)

Continue learning new skills to find the PT work that I actually enjoy without losing my life enjoyment.

Perfect plan. :-)