A hot topic around here lately has been the question of whether early retirees in the U.S. should count on Social Security in their calculations for their 60s and beyond, particularly as I’ve tried my hardest to make the case for a more conservative approach both to projecting what we’ll need and to the amount we save in the first place.

In our case, we are not banking on Social Security payments coming our way in our 60s, which isn’t to say that’s the best plan or the right plan — it’s just what feels right to us. (It’s also possible for us, which is a different thing, and something we’ll discuss.) Let’s dig into all the issues here, and then let us know in the comments how you’re thinking about Social Security.

This is part 2 in a mini-series on Social Security and Medicare, two under-discussed topics in the early retirement community. Read the first part, on the dangers of planning for level spending over time, here.

As always, my goal in writing about this isn’t to profess to know all the answers, it’s simply to ask more questions that might help strengthen a plan you’re working toward. So our choice not to build Social Security into our plan might still help you think through the details on how you would count it in yours.

Why We Aren’t Banking on Social Security

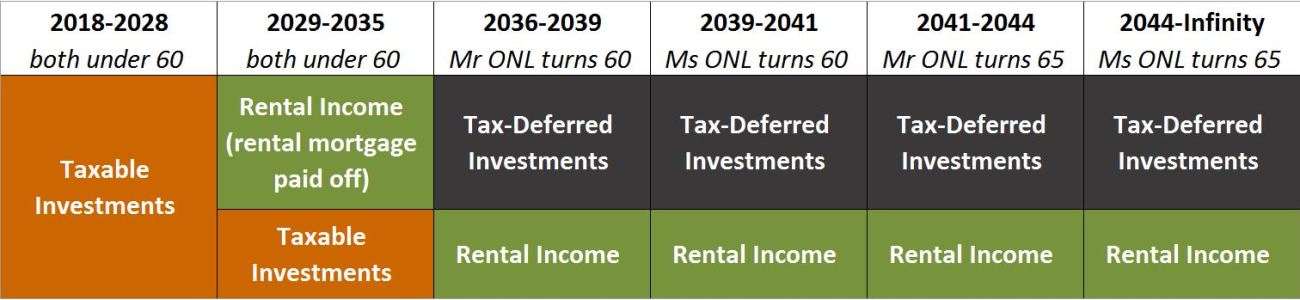

As a reminder, here’s what our phased out retirement income plan looks like, not counting any passion project work we might take on:

Because we’ll have multiple income sources in our post-60 years that we consider reliable (rental income is our way of diversifying so we’re not wholly market-reliant, and our 401(k)s only need waaay-below-historical-average gains to support us at a higher level when we hit 60), we’re in the fortunate position of not needing to count Social Security, and we know we’re lucky to get to say that. It’s certainly not true for everyone. But there are several other big reasons we don’t count Social Security in our projections, even though we expect it to be there for us at some level.

Here are those reasons:

The benefits will change, which is hard to plan around — Though analyses differ on how much longer the Social Security trust fund will stay solvent without policy intervention, the fact remains that Congress will be forced to reform Social Security at some point in the not-too-distant future. There are a range of ways they could ensure that the program has enough money coming in to pay for the benefits going out, from removing the cap at which individuals’ pay has Social Security (FICA) contributions taken out of it, to raising the full retirement age again, to creating a sliding scale that provides larger benefits for lower income people and smaller benefits for higher income people. I suspect the age shift will not be a popular solution because the average retirement age (62) hasn’t gone up in years, despite Social Security’s full retirement age moving to 67, mainly because the majority of people don’t retire by choice. The other two options hit higher income people in particular, which always becomes extra touchy on a policy level. So there won’t be an easy answer on this, but until there’s an actual long-term fix in place, it’s wise not to bank on getting as much as the calculators may say you’re entitled to.

The benefits could even disappear for high net worth people — Though Congress has not recently shown any hunger for implementing means testing on affluent people, most of us in the early retirement community are looking at long timelines, over which just about anything can happen. (Consider: nine years ago, California voted against same-sex marriage. California! And now it’s legal everywhere. That was a difference of only a few years.) And it’s not unthinkable that Social Security could be reformed in such a way that everyone pays in, but only those who truly need it get the benefit, meaning those of us with high net worth or other large income streams may no longer qualify. Medicare is already partially means-tested, and whenever Medicare comes up, there’s always talk of adding more tests or making premiums more closely tied to income. There’s no reason Social Security couldn’t adopt some of this same logic. I don’t believe it’s likely that some higher net worth people will lose the benefit altogether, but stranger things have happened.

Social Security has tended not to keep pace with real inflation — As I shared in part 1, the cost of living adjustments (COLAs) built into Social Security are pegged to the consumer price index (CPI), which is not considered to be a good measure of actual expenditures for seniors. Meaning Social Security payouts lose real spending power every year, making it a little like counting on a depreciating asset to hold its value. While there’s no reason to think that Social Security benefits will fall totally out of step with real-world costs, but there’s also no reason to think they’ll ever start keeping up with real price inflation.

We love contingencies, and Social Security is good gravy — If you made me choose between A.) saving an amount that felt comfortable and coming to realize in hindsight that we’d saved too much and worked too long, or B.) saving an amount that felt mostly comfortable but allowed an earlier escape from work and coming to realize in hindsight that we’d saved too little, I’d choose A every single time. Trading a year or two of work for decades of financial stress or worry? To me that’s a dumb trade. I’d rather work another year or two and be free of that anxiety. Which explains why we have saved more than lots of folks would say we need for the lifestyle we plan to live (though we don’t think we’ve “oversaved” — we think too many people undersave), and why we have a whole slew of contingency plans. And we think of Social Security in that same category, as something we might be able to fall back on if our original plan fails, but which we aren’t banking on. And if our phase 2 retirement happens to get graced by some extra income? Well great. Maybe we’ll fly first class once in a while. (Or, more likely, we’ll ramp up our charitable giving.)

We’re happier with one less moving target in our lives — We already have the biggest source of uncertainty (health care) to worry about, and that’s plenty. The markets come with their own uncertainty. Given that we don’t need Social Security, we’re happier just not even thinking about it, because it’s one of those things that can bring on a headache awfully quickly once you dig deeply into it. (Especially after you see that there are at least four different benefits calculators at various places on the Social Security site. All of which may give different answers, depending on the day of the week. I am not exaggerating.) So while that may seem like a silly reason, I’ll fight anyone who tries to argue that there’s no value in doing things for happiness reasons. (That’s completely why we paid off the house, and that has paid HUGE happiness dividends. Which is worth quite a lot of money to us.)

It’s simply possible for us to ignore Social Security — We are in the fortunate position of having saved early and often in our tax-advantaged accounts, and of also having had the means to keep maxing those out while also saving a lot in taxable funds. It’s why we don’t have to sell out our future selves by relying on backdoor Roth conversions to fund our early retirement, and can instead leave that money alone to grow so that it supports us in comfort in our 60s, 70s, 80s, 90s and 100s (I’m optimistic like that). We know not everyone can do that, and I’m not about to tell everyone who can’t that you better plan to work forever, then. But if your plan does lean heavily on backdoor Roth conversions to work, it’s worth considering whether you’re also leaning heavily on assumptions of level spending over time, and I’d argue you should plan to step up your spending every few years because of expenses like health care that significantly outpace inflation.

Considerations If You Are Counting on Social Security

The older you are now, the less likely any changes to the program will affect you. If you’re 55 now, you can probably use the Social Security calculators out there to get a pretty good idea of what will be coming your way in a few years. But if you’re 25, different story. Wherever you are in your journey, if you need Social Security to make your plan work, here are some considerations:

Know how benefits are calculated — You only qualify for Social Security if you’ve earned income in at least 40 quarters (10 years), and your benefit entitlement is calculated on the average of your top 35 earning years, indexed into today’s dollars. And many early retirees are willingly putting a lot of $0 income or small numbers into that average. (Only earned income counts, not things like dividends and capital gains.) If you earn $100,000 for 15 years, but then have 20 $0 years, your average is only $43,000, which puts you well below the maximum benefit. Right now, that would get you a monthly benefit of about $1200. As opposed to if your average was $100,000 over those 35 years, which would get you $2100 a month. (These are rough estimates — the actual calculation formulas are complex and have multiple variables.) Of course, in reality, even those of us who are high earners now have plenty of entry-level or just above entry-level years included in our average, so the actual benefits you receive as an early retiree could be quite small.

Consider the benefit of delaying — Social Security now considers full retirement age to be 67 for those born after 1954 (66 for those born ’43-’54), while previously you could get your full benefits at age 65. We should all expect, as reforms happen, that there will continue to be incentives built in to entice us to wait until we are older to claim our benefits. Right now, benefit amounts increase 8 percent for each year you delay the start of your benefits, up to age 70. But that could go even higher. So the later you can wait to claim Social Security, the better in terms of the total dollars you’ll receive if you live for several years beyond when you claim.

Keep projections extremely modest — Knowing that Social Security doesn’t always keep pace with inflation and that some program changes will happen out of necessity, it’s wise to base your projections less on what they might look like today, and more like what they could look like with some major downgrades. I’ve heard some readers say they anticipate getting 25% less than they’d get today and others say they project as much as 50% lower. As with everything, it’s your call what projection will let you sleep at night!

This Motley Fool article has the best simple breakdown of how Social Security amounts are calculated currently (it’s a complicated formula), and what the amounts are this year. I highly recommend it!

How Are You Thinking About Social Security?

Where’s your head in all of this? Are you banking on Social Security? Why or why not? Do you aim low on what you’ll receive if you do count on it? How did you decide what to project? Please share allllll your thoughts in the comments, and let’s discuss!

And I specifically wrote this article to U.S. audiences, but if folks from other countries have read this far, please share with us how you’re thinking about your own country’s retirement benefit. Many of the countries with the strongest safety nets (i.e. socialism) also have the largest looming demographic crises, with low birth rates and high numbers of impending retirees, meaning the systems may not be able to bear the cost of government pensions for all. Lay your non-U.S. insights on us!

P.S. HUGE THANKS to everyone who nominated Our Next Life for the Plutus Awards. ONL is a finalist for the second year in a row for best Early Retirement/FI blog, aaaaaaand ONL is one of ten finalists for Blog of the Freaking Year. (“Freaking” added by me for emphasis, to reflect my enthusiasm level.) I feel like it’s raining gold stars, you guys. You rock. (FinCon also called ONL out as one of five breakout blogs this year, along with some other friends! How cool is that?) Oh yeah, and I’m quitting my career today! A lot tucked into this P.S., eh? ;-)

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: we've learned

Dang that is alot in the PS!! Congrats on the blog nominations! Y’all deserve it! And woohoo on today being the day for quitting!! I can’t wait to read those stories!!

As for social security….prior to being married to my extremely finance minded husband, I was very unaware of why depending on social security was an issue. Luckily, he has definitely taught me a lot about that. It also helps that I know more people that have hit that point now.

My grandmother has lived off her and my grandfather’s social security for years now, but has only truly been able to survive because she lives with my parents. The amount she makes isn’t enough for her to live on her own. In addition, my father in law just aged in a few years ago and while it has been a nice bonus to his income, he could never support himself, not to mention my mother in law, on just that social security check.

I believe we have to be wise stewards with our money, and that means not depending on someone else to invest and take care of something as hugely important as retirement income. Which means working your butt off now, doing the smart decisions not necessarily the easy or fun, so you can do awesome things like retire well before the typical age.

PS. Super excited for those reveals!!

Thank you! And yeah, lots of good reasons not to rely on SS, or certainly not entirely. And it’s great your grandma had your parents there for her, but I’m sure things would have been super different on just SS without them there for her! In terms of options, I could definitely see the value of creating a larger and more secure pool of funds for everyone (more like a souped up universal basic income, perhaps), but that’d require a revamp of the whole system. In the meantime, you’re totally right that we need to be good stewards of our own futures!

Congrats on the nomination and the end of the career.

I’m of the same mind on social security. It will change before I get to use it, though unpredictably so. As such it’s an upside I’m content to view as unplanned. It’s not the only one we potentially have or the only thing I lump into this bucket. I view inheritance possibilities the same way. I only bank on what I have control of, and the rest is unplanned upside.

Thank you! :-D And sounds like your view of SS and potential inheritances is very similar to ours.

Social Security is not a component in our early retirement plans. If we have a benefit it will be surplus capital we can use it for investments or spoiling grand children.

We are 30 years away from a SS benefit. A lot can and will change especially for high net worth individuals. It is unfortunate that younger workers today will pay into a system and likely derive little to no benefit, unless it is changed for the better.

Ha — I love that, the spoiling the grandchildren fund! ;-) I especially love it because you’re so far away from that! I think today’s workers paying in WILL get something, but I wouldn’t be opposed to there being more reductions for people who truly don’t need that money (which, we hope, will include us when we get to that age!).

I expect it to be there when I hit retirement age in 30+ years, but I am like you, I won’t build it into my retirement income plans. I intend to treat it like gravy and fun money.

We do truly expect it to be there in *some* form… we just don’t want to gamble on what that might be, so it’s easier not to count it! ;-)

Have complete left it out of any of our plans, There will be something for us, but it’s marked down as a safety net/bonus.

Congrats on the nominations!!!!!

Thanks! And yeah, we think there will be something for us… just no idea what or how much, so better not to gamble on it! ;-)

Good luck on the big day.

Like you, the plan is to need SS at all. I think I have it about equal with dog sitting income. (We both know that the great dog overlords will be sitting us in the future, but we’ll make great pets.)

That said, I would be upset if it goes away for high net worth individuals who have paid in. It doesn’t seem particularly fair to tell people to estimate something significant for years and then give them nothing. While I know that anything can happen, at that point, they might as well just say, “Oh we decided everyone will pay a flat 30% tax on Roth IRA withdrawals.”

I can understand gradual adjustments over time, but taking it away from some people who have paid a lot in would seem too drastic.

I second this thought – I think it is unfair. Changes have to be made and I understand that. Still, for those of us who became “wealthy” (wealthy as compared to what the main stream financial media says the average person has in savings) via a good deal of frugality over many years, it is a hard pill to swallow that we may see benefits reduced. It seems like they are punishing savers. That being said, I realize everyday how fortunate I have been to have had a string of uninterrupted employment years at relatively decent – maybe even considered high – wages. Maybe the price for that is reduced SS benefits and as such I don’t count them in the retirement plan. Definitely not in early years. In later years, if it shows, maybe loosen the purse strings in some areas or join the ONL’s in uping the charity giving.

Back in 1984, seems somewhat Orwellian doesn’t it (?), SS benefits became taxable at some income levels. This is a backhanded means test, where up to 85% of the benefit is taxable. It would have been better if they just reduced your benefit up front, so the funds remaining from the lesser benefit would help keep the rest of SS more secure for the future. Instead, it generates more tax funds for the usual deficit spending.

Yes, completely agree. Keeping it as a closed feedback loop would increase SS solvency instead of just robbing Peter to pay Paul.

I am not advocating for it going away. ;-) And I think it’s incredibly unlikely that it would ever be reduced THAT dramatically for any income category. But every aspect of taxation is structured so those who can afford it pay more in than others, and in many instances, receive less back in return. (Except for Tesla drivers who don’t pay gas taxes and therefore don’t pay anything to maintain the roads they use and are therefore scoundrel mooches. Haha.) ;-) (But also, seriously.) Assuming we all get some SS, I LOVE the idea of funneling that unneeded income into more charitable giving!

Someone should make a Social Security to side hustle conversion calculator. You’d find out the equivalence between dog sitting and SS. Hahaha. (And yes, GREAT pets.) I think chances are super slim there will be NOTHING for high net worth people, just that it’s possible. I don’t think it’s at all likely. Still, it could be reduced (and we’d be in favor of that if it keeps the fund solvent).

Big day!!!!!!! Hope all goes well.

Thank you! It was a big deal, but so glad it’s done, and feeling so much love from my colleagues who know. :-D

Eeek, good luck today! Long time reader, first time commenter. So excited for you guys, and looking forward to the reveal on Wednesday!

Thank you!! And thanks for commenting for the first time! :-D

I’ve come full circle on this issue. Initially I wasn’t counting on it at all, and presumed if it was still around I’d take it at age seventy since that would be the highest amount of income I could obtain from the system.

Real life happened in the meantime and I’ve completely changed my position for a number of reasons: medical insurance premiums are MUCH higher than we anticipated (double what they were when I retired three years ago), I retired early and am no longer paying into the system so my benefits are no longer increasing, my husband already receives more from the program than I would even at full retirement age so if I were to outlive him I would switch to his higher benefit anyway, and I don’t trust this administration to honor existing promises with regard to future benefits. In addition, the funds we have invested will provide an inheritance should we wish to provide for our grandchildren while social security will end upon our deaths.

It’s definitely a gamble and there’s no crystal ball way to predict with any certainty the right call to make, but for today, even with 85% of the benefit being taxable, my position is to take the benefit as soon as I can (nine months from now), and every day I become more convinced that’s the best decision for us.

I’m 100% with you for your case! And because you KNOW you’ll receive the benefits since you’re so close, it’s really just a question of when to claim them, not whether to count them. But given all your circumstances, I think your choice makes solid sense. :-)

Good luck with the big conversations today!! SO exciting – I bet emotions are all over the place! And congratulations too! I love your blog and your voice in this community!

We think we will have decent SS benefits because we are older than many folks in the FIRE community. But we do plan to delay them to full retirement age at this point. We included them in our FIRE plans, but we didn’t need them to make the final decision. Our spending is well under our projected income w/out SS. More to give, more to leave for the kids – and more to deal with healthcare changes too down the road.

Thank you! And YES, emotions were all over the place. And now I’m drowning in all the love. :-) So grateful for all of it — at work and here on the blog! I think accounting for SS is different than *needing* it to make your plan work, and so I applaud you guys for not relying on it even though you’re close enough that you could without being foolish. And heck yeah, get those benefits you’ve paid into the system and keep the money you’ve saved for future unknowns and for your kids! :-)

I really like the idea of seeing Social Security as gravy and that is how we are planning. Our goal is to have sustaining funds/income streams without SS so that we are not left hanging!

And congratulations on the nominations… well deserved!

Thank you!! :-) And sounds like you guys are of the same minds as us with SS. Definitely not saying we’d turn it down. ;-) Just that we don’t want to rely on it!

Congrats on that Plutus nomination! I’ll be going to FinCon for the first time this year, so hopefully I’ll bump into y’all!

I agree; in our retirement planning we’re pretending social security doesn’t even exist. By that time there’s a chance it may not exist or it’ll be very different; I don’t think it would be wise to bank on guaranteed money decades into the future!

Definitely come say hi at FinCon! I think chances are super slim that there will be no SS in the future, but you’re wise not to make your plan hinge on it being there at current levels.

I once tried to check my social security statement online to see my estimated benefits and earnings records.

The site gave me an error message and told me to try again later.

I think that spoke volumes.

Ha! The site has recently been improved, so it’s worth trying again. ;-) BUT, their calculators are only capable of assuming that you’re going to work a full career, so they aren’t much help!

Congrats on the nomination. You earned it from all the hard work you’ve done.

Social Security is gravy for us too. It’ll be there in case something goes wrong. Otherwise, it’ll be fun and donation money.

My FIL has a separate account for his Social Security benefit and he just donate it to various non profit organizations every month. He has a pension so he’s not dependent on it. That’s a good way to go.

Thanks, Joe! Appreciate you saying that. :-) I LOVE the idea of SS going straight to donations. It’s kind of like its own donor advised fund. Maybe we can start a movement to get more people to use it that way! ;-)

Early in my career, I also assumed SS would be gone. As a result, I calculated I would need about $4 million for retirement, assuming my 20 year ago salary and 4% inflation. Happily, inflation has been much lower and SS will still be mostly intact for me. Full benefits are about 10 years off. Thanks to the better numbers, I can pull off retirement on less than half my original plan. That allows me to retire early, possibly next year.

For me, SS is part of the retirement equation, but I want my personal finances to let me live a comfortable life without it if I call it quits early. I can probably live large in good return years. I have been the primary earner, so I will effectively get 1.5 times the payout. I cannot ignore that. SS at least acts as a large longevity insurance policy. My grandmother lived to 101, so I am planning to last a while.

I like seeing SS as longevity insurance. ;-) It’s also a good hedge against the markets in volatile or down years.

Congrats on quit day! Hope all goes well.

Our outlook on Social Security has changed over the years from “let’s plan on no Social Security” to “let’s include it”. We are waiting until later to apply so that I can get a larger payout upon hubby’s death. I stayed home with the kids, so have a lower benefit. When we tapped his pension early, we made the decision to have it come to us over his lifetime only. He did the midlife career change and we needed income as well as living off savings.

As things stand now, both retired, he’s 62, I’m 56, our investments are still increasing (yay bull market!), so Social Security looks like it’ll be gravy. Still hoping for it, but more and more it looks like we will be asset tested out of it. On the other hand, we didn’t have to support our parents in their old age. Pros and cons. Of course the whole thing is a crap shoot demographically.

It’s hard to imagine that any changes would affect those already over 55, so I think you guys are most likely in the clear, and don’t have to worry about any means testing on your Social Security at least (though it could impact your Medicare premiums).

I haven’t even included it in my calculations because I know the program is in trouble (there is no trust fund or lock box so we all know it doesn’t work like any other invested asset and the way it works today is broken). I can start collecting at 62 and given the motley fool break even analysis for early claimants I think it’s worth it from a cash flow perspective if it’s still there in 10 years for me.

The bigger hidden issue (and I say the gay marriage example is a great one in terms of how things can change in a relatively short period of time) is the idea previously floated by the Obama administration and reported / analyzed by Forbes was the idea of a confiscatory tax to reduce tax deferred accounts to the point they could produce an annuity benefit of 211,000 a year because “no retiree needs more than that”. This feature made it into several of the budget blueprints of the Obama administration. THAT is scary because over a long term horizon level spending is a poor plan (as noted often here) and if your money is confiscated and inflation rises do they give you your nest egg back?

I don’t trust politicians to deal with this issue rationally and If the left gains all the power the soak the rich mantra will beat louder. It is why I feel you need to at least be aware this issue is lurking in terms of how you address your balance of taxable and tax deferred and non taxable account balances. If MS ONL will permit I will provide the link to the Forbes article

I think the last year should be an important caution to everyone that the people writing the laws do not understand the things they are legislating (Lindsey Graham admitted after Graham-Cassidy failed that he had no idea it was so complex and didn’t fully grasp his own bill). So yeah, I think it’s fair to have a general sense of alarm about some of this stuff. And I certainly think it’s fine to count SS in your numbers, but perhaps not to rely on it. ;-)

Good luck with the work discussion. I am sure it will go just fine.

Being age 51 (Mrs. PIE 44) when we pull the trigger next July, we approach SS numbers by taking a 10% and 25% cut respectively from our projected numbers. Overall, SS is not a “need to have” but there is no doubt it will provide us some rich tasting gravy down the line in whatever form it comes.

The PoF post on SS bend points was a great one and we independently verified our projections through the SSA site also. Delaying to age 70 and getting that additional 8% per year to the annual benefit is a no brainer for us. Of course assuming that 8% stays the same…..

Look forward to hearing how the work conversation went. Hopefully bumpi into you both at FinCon.

Don’t get me wrong — we will enjoy that delicious gravy when the time comes! But we don’t want to be starved if it’s not there. ;-) I didn’t attempt to replicate the bend points here as it’s impossible to cover all scenarios, but it certainly warrants a deeper look for folks, and PoF’s post is a good one! And definitely find us at FinCon!!! Excited to meet you!

The SS tool below is really good. It uses your actual income numbers from SSA.gov and allows you to input future earnings and retirement dates to see how your SS benefit changes.

https://socialsecurity.tools/app.html

Thanks for linking to this! The actual tools on SSA.gov are not especially helpful. :-)

FYI, the URL has now moved to https://ssa.tools/.

The old domain redirects for now, but will expire in the future.

Social Security in my part of the world is still evolving. However, I take it as another income stream to be factored in with all the others streams. The overall visibility of money coming in and going out is ever critical for the approriate spending adjustments. Globally, social security benefits are being trimmed to make the fund pool last longer – in Asia/ Australiasia, Europe and the US. That means you got to have other sources of income or one will get into a zone where you will be get less over time and we can understand what it means to be financially challenged when that time comes.

This is all so true. Demographic shifts are causing problems everywhere, as are lengthening lifespans and increased health care usage. (Those last two are both good things, but they come at a financial cost!)

I think it is dangerous for our generation to talk about SS like it wont be there in 30 years. When financial role models say that they aren’t counting on it, it sounds like we shouldn’t expect the money we’ve been putting in for decades to come back to us. That’s like maxing out your IRA ($5500/year) and saying, “oh yeah, that’s just gravy money, it doesn’t count towards retirement savings.” I fully expect to see that money when I retire! I am concerned that if SS is reduced, it’ll be in large part because my generation and the generation after have heard “don’t count on SS” so many times that they dont fly off the handle when it is proposed.

Even at $1200/month, that is $14,400/year. If your retirement income requirement is $48,000, the SS benefit would be 30% of your yearly income!

Just some food for thought. Obviously your blog has been a success and many young people that are interested in FIRE use it. Your influence is strong and far reaching. I usually LOVE what you have to say. But your paragraph that benefits could “disappear” is a bit chicken little to me.

Perhaps if enough people recognize the fallacy of the SSI program we will implement something more like the program in Singapore. I would take that over SSI any day of he week. It is a true savings account with actual assets, not the poor “pay as you go” program we have.

For example if you are an average worker earning average wages over a 40 year work life, if your SSI contribution, and your employer match were actually saved and invested, aggressively in your early years, moderately in your last years, the average person would retire (in today’s dollars) with well over 1 million. Imagine what our retirees would look like in America if we had another 50 million millionaires. It would redefine retirement and how healthcare is paid for for older citizens.

Bottom line is SSI as a retirement vehicle, is a poor one. The fact that it is the primary component of so many peoples retirement is a combination of poor financial literacy and the lack of backbone in our government officials to move from what we have to what we should have.

For that reason I do not count on it and my 20 something kids won’t either.

SSI stands for Supplemental Security Income. It’s what people who are disabled or children who lose their parents receive. Hardly anyone retiring early is eligible, let alone relying, on SSI.

https://www.ssa.gov/ssi/

My intention of my comment was Social Security in general. Spellcheck from having previously corrected SS to SSI in another post tripped me up. Regardless the program was never destined to provide for the sole means of retirement and it should not be counted on down the road for anyone 20 to 30 years away from claiming it

Agreed that it should not be relied on! I think it’s probably safe to assume *some* small amount for folks who are over, say, 45 now, but none of us can guess what those benefits structures will look like decades down the road.

I know Phil just mis-typed, but I think a lot of folks don’t know the different forms SS can take. In addition to SSI, there’s also SSD, which I’m thankful for every day, as it provided a large share of my dad’s income while I was growing up, and let me stay on the path to where I ended up instead of going hungry or worse. :-)

I don’t know enough about Singapore’s system to debate the merits of the two against each other, but safe to say that everyone agrees our current system needs fixing. ;-) And no doubt we need FAR better financial literacy across the board. And I’d love to see more government incentives to save for retirement beyond just the 401(k), which we already know is mostly only used by already-affluent people.

This is a super interesting point, and not something I’d thought about this way, so I appreciate you raising it. The hard thing is that you could have a scenario in which the best advice I can offer truly contradicts the most helpful story on a macro level. Just to use a completely ridiculous example, if we’re at risk of nuclear war, I’d tell everyone: build a bunker and prepare yourself. But then if everyone has a bunker and is prepared, is there less incentive for the government to try to head off nuclear war? I know, terrible example. But the point is: NOT talking about this doesn’t serve anyone, and I believe being *reliant* on Social Security (as opposed to just expecting to receive it) is a mistake. It’s kind of an interesting game theory question, though — on a macro level, the message should be that Social Security needs to continue to be there at equivalent levels to now for generations to come, but that doesn’t help the individual on the micro level who needs to do what’s best for him or herself, not what’s best for everyone. Interesting food for thought!

Congrats on the nominations!

We aren’t using it in our projections either. Regardless of whether I think it’ll be there or not, I KNOW we can hit our numbers without it. And I’d much rather have extra wiggle room – the amount of which I don’t particularly even care about lol.

I think if people banked on SS providing a third of their income in retirement, there’s a pretty high likelihood that the average person would eventually become lax with the rest of their savings…a scenario I feel like we’re already seeing pan out.

Thank you! :-) And that’s an interesting question — whether knowing that SS is there makes people more lax with their savings. I bet that research is out there!

Congrats on the reveal to your employers today! Good luck! Same congrats on the Plutus nominations too!

For our calculations, we don’t plan on SS, rather we look at it as any extra will be a nice cushion, but if there’s no extra we aren’t “out” $1200/year that we were banking on. I do like looking at my projected earnings and cutting it in half and throwing it into the cfiresim and spreadsheets we have created and watch the comfort factor rise even more.

The same with our pensions. While small, and not included in our calcs, it’s nice adding them in when they should start paying out and see the bump it provides. Again, I don’t include them because they could get taken away at any point, or who knows what could happen to them between now and then.

I like running our numbers without those 2 added in and seeing it come out positive. When I run the “best scenario” with them included it’s never at full value for either one. Just me being conservative on the planning side. :)

Thank you thank you! And big week! ;-) I’m sure it’s a huge comfort to you guys that you have multiple streams of income out there, so if one or two disappear, you’re still in great shape. (You know I’m endlessly jealous of the pensions!)

As of right now, we are pushing towards FI assuming no help from SSI. That’s not to say that we think we won’t get any benefits: we almost assuredly will. But for a lot of the reasons you noted, I just think it’s wiser to build a net that will catch you without any extra help. If it comes, all the better.

That’s smart. And yeah, I think chances are high you’ll get something, as we all will, but if you can afford not to rely on it, then all the better!

I definitely count SS as part of my retirement plan. You’ve met regular people, right? The program isn’t going away anytime soon.

If it so happens that the means testing is increased, and I don’t collect much, then that’s great news as that will signal that I have a healthy portfolio balance. If the portfolio wanes after ~20 years, then SS would certainly prop it back up.

There’s basically no downside to planning for it in my view.

Agree there’s no downside to planning on it, but depending on how old you are currently, *relying* on it could prove problematic.

Congrats on the nominations! I hope you win them all! :)

Thanks so much, Rachael!

I don’t include SS in any of my calculations even though I assume it will survive in some form by the time I am eligible for it. I am too far away to feel comfortable making any projections. I’d rather do all that I can to take care of myself and count it as gravy. Whatever that gravy ends up being.

I think that’s wise! I feel confident there will be something there for you, but it’s so hard to make guesses that far into the future, and if you can afford to build a plan that doesn’t require any particular amount, that’s far safer.

Hoping to retire at the end of 2018 at age 63 1/2. Counting on social security but not planning to collect until age 70 (see it as longevity insurance). I voted for ONL, congrats on being finalist in two categories! Well deserved. Looking forward to hearing how your talk with your employer went….

Thank you for your congrats! :-) And I love the “longevity insurance” idea. I feel certain you will get the SS you are entitled to, and if you can afford to wait til 70 to claim your benefits, that puts you in a great position.

I have no idea where social security will be in 30 years when I’m finally eligible, but I’ve been pretending since my first day out of college that it will provide me $0. I’m pretty sure it’ll still exist in some form, but planning for nothing and getting something is a lot better than the alternative!

Back in 1980 when retirement was 40 years away I thought SS wouldn’t be there and now I’m a few years away from actually collecting. Plan for the worst as they say

Let’s hope we can ALL look back and say, “Oh, how silly that I didn’t think SS would be here for me.” ;-) That would be a good problem to have!

Amen to that! It’s like prepare for the worst, hope for the best. ;-) (And for real, did you really start thinking about retirement saving the first day out of college??! That is crazy pants.)

Hi, I’m new to your blog. I’m just wondering what you guys were doing before job-wise before you started your blog and what made you decide to get financially free? I’m sure you’ve probably answered this all the time, I’m just really curious. Also, you are absolutely right about social security changing and not being reliable. With so many of us, by the time we get to retirement I’d honestly be scared if I had nothing else except social security to relay on.

Stay tuned! All will be revealed on October 23. ;-)

I know it already happened as I type this, but just want to put in my best wishes for your conversation on quitting your job. I’m sure you were well prepared–hope you are happy with the outcome!

Thank you so much, LG!! :-) It was super nerve-wracking and emotional, but ultimately so positive and heart-warming. :-)

A person born in 1981 who earned $100k for the past 15 years and never worked again would be eligible for an $1800 monthly benefit (due to the way the SS PIA bend points work) – far more than the $1200 stated in the post. I realize the example from the post is simplified, but given the huge difference in numbers, it’s important to be accurate and understand that it’s *not* necessary to have high earnings for 35 years to get close to the full SS benefit.

That is theoretically true if no future calculations change, but given that a person born in 81 is only 36 now and is ~30 years away from eligibility, there’s still a LOT that can change. But your larger point is correct that I had to pick one number which doesn’t remotely fit all circumstances, given how complex the SS calculations are. (It’s why their site doesn’t even have a very good calculator to tell you what you’d get in different scenarios.)

At 60, I’m a little older than most of the posters. I am counting on SS as a contingency plan. We have plenty of money to support our lifestyle but we are worried about the sequence of returns. So, we plan on retiring next year with 2 years of expenses in cash. If the market goes south early, we can live off the cash first and then turn on SS. If it doesn’t , we will just wait until 70 and use it for fun, charity etc.

I think seeing SS as a market hedge makes really good sense! Plus, you know in your case that you’ll receive it, so there’s no harm in counting it so long as you aren’t overly reliant on it, which it sounds like you aren’t at all!

Congrats!! I’m excited to follow your journey post-early retirement. We have never counted on SS for supplementing our retirement because my husband works for the railroad. He doesn’t qualify for SS because he doesn’t pay into it. :)

Thank you!! :-) And that’s a pretty good reason not to rely on Social Security! Hahaha.

Exactly correct. I wrote a post recently breaking down the math and assumptions behind the SSA’s projections. Long story short, if you’re under 48 now you will probably never receive a full SS check.

There’s still a ton that can change, of course, and the entire system could be reformed at any time. But it’s a risky thing to bank on!

I’m expecting it but not counting on it. I’m taking it at 70, though I could take it next year but I’m waiting. I have plans for Roth conversions for the next 5 years and want to keep my income to 15% taxes. In addition waiting till 70 gives me a 6.1% compounded improvement on the payout, which may prove useful to my younger wife if I happen to croak. Waiting nets an additional 12K per year at 70. I’m going to retire in aliquots. 1st aliquot is to Roth convert and live off cash. Second aliquot is to get to 70 where SS kicks in for me and RMD and I’ll have to completely re-analyze my funding plans, third aliquot is when SS kicks in for my wife, and 4th aliquot is when RMD kicks in for her, so about every 5 years we will be re-retiring. I think it’s completely rational to include it in your plan with ideas to re-evaluate your plans every few years.

Well said. You SHOULD expect it, but not put yourself in a position of relying on it. Of course, it’s highly age dependent, so you being closer to SS have a very different calculus to make than someone who’s currently 30 and not looking at claiming for 35-40 years, during which essentially everything could change. But it’s quite clear that you’ve thought it all through and have a clear vision of your plan! Kudos.

I’m totally counting on Social Security! :)

People have been fear mongering about it disappearing for decades.

Of course, if they means test it and I’m in the good position to be wealthy enough to not need it, then I won’t really care.

While there has been plenty of fearmongering for sure, it’s still true that smart, rational people agree that the current system is not built to withstand long-term pressures. So things will have to change about Social Security, even if it doesn’t disappear, and that will certainly affect you.

I haven’t paid much into any social security systems in any country I lived in, so personally I don’t count on SS. The reason is mainly because I tend to move after a few years. I think SS will exist for people who contributed for decades. Nevertheless, I think it’s good to be conservative in this regard, because much can change in the next years and decades.

Even outside of Social Security, I think it’s always smart to be conservative financially if you can afford to be! ;-)

Love this post

I really love this post too

get Latest 2019 songs

this is really nice

Very Nice Article Writing

nice writing from you, thank you for sharing this with us

you are indeed trying alot, thanks for this great info

i do appreciate great work, you have done well

Nice Article, i love it

Nice Post thanks for sharing.

Great article you really made an impressive point here thanks for sharing though

Nice and good points made here

Social Security is not a component in our early retirement plans. If we have a benefit it will be surplus capital we can use it for investments or spoiling grand children.

Thank you for the amazing post! the post is quite interesting. I came to know about this development from your blog.

I have never thought of this before, i think our insurance payment cover this also, this ha open my eyes to a lot good things about this.

i love this

yes it is nice truely

amapiano 2029