I need to confess something: I am freaked out about being able to live within a budget in early retirement.

I know we can do it big picture, and our spending these last few years doesn’t have to change much at all to be in line with our early retirement budget, but we’ve always had a huge safety net built into our finances up to this point. If we spent too much one month, no big deal — there was another paycheck coming in at most two weeks, plus there’s the life happens fund for big ticket items like an unexpectedly large federal income tax bill.

But in just over a month, that safety net disappears. There’s no more continual cash flow to pick us back up if we fall down.

Those of you reading who are traditional budgeters might be puzzled by all of this. “How on Earth,” you might wonder, “did you save all this money if you aren’t sure you can live within a budget?!”

And it’s a completely fair question!

The answer is that we did it by artificially constraining our income, automating most of our saving, and underspending on big ticket items like housing. We hid most of our incoming money from ourselves before we had a chance to see or spend it, and we lived on what was left over. Which mostly worked, and when it didn’t, we had that safety net.

But let’s put it another way: we’ve never budgeted. Or, rather, when we did, we sucked at it. We just couldn’t stick to X amount for groceries, Y amount for travel, and Z amount for everything else. And that was incredibly disheartening.

We definitely didn’t budget to meet owls in Tokyo. Total impulse buy. (I think the owl knew that, hence his look of owly consternation.)

Except we didn’t just throw up our hands and proclaim ourselves bad with money. Instead, we found a different system that worked for us. Which was our particular approach to automation.

Now, with early retirement approaching fast, we’re becoming all the more aware that the system that worked for us during our accumulation years was entirely income-focused. And while that was great up to this point, our draw down strategy isn’t going to give us income every other week anymore. We’ll have dividends a few times a year, sales of shares quarterlyish, and the rental income that will eventually come monthly doesn’t actually become cash flow for another 11+ years. Other income may come from part-time consulting, speaking gigs and the blog, but that’s likely to be unpredictable.

All of which means: We need new systems, both to ensure our financial success in this next chapter of our lives, and to give us peace of mind as we make this huge transition. So let’s dig into what we’ve settled on!

A New Financial Infrastructure for Early Retirement

Some people are naturally super disciplined. (Not us.) Some people thrive with a clear line-item budget. (Not us.) And some people do far better when they operate within a system that makes a lot of the choices and removes decision fatigue for them. (Ding ding ding!)

That’s why we think of our systems as our financial infrastructure. They’re the lane lines and guard rails that keep us from driving off the road, and the power lines that keep us operating smoothly. Or, if you think like I do, the safety net.

In our new world of full financial independence, there are very few limitations on what we can do or how we can operate, and while that’s freeing, it’s also a recipe for failure, or at least a recipe for our failure. We welcome that infrastructure to keep us operating within some orderly system, so long as that system is of our choosing. (It is.)

And here’s what it looks like:

Primary Spending Fund

Making ourselves believe that we have less to spend than we earn has worked well for us to date, so we’re going to continue this habit into retirement, leaving only spendable money in our primary checking account at USAA, which we think of as the primary spending fund. Basically, all expenses should come out of this fund, with a small number of exceptions (keep reading), and it should be the amount that we live within.

Operational rules: Source of funds for all routine expenses.

Care for the tiny snugglers comes out of the primary spending fund.

Transfer Fund

A new account we’ll open is what we’re thinking of as our transfer fund, a secondary checking account at USAA that will be where we park funds after we earn them, if they are not allocated for the current month we’re in. And then we’ll dole those dollars out to our primary spending fund slowly, so it feels more like a regular paycheck.

Operational rules: Holds proceeds from dividends, share sales and other income, with a set amount transferred to the main account each month.

Known Large Expenses Fund

While we own our home free and clear, we know that only stays true so long as we pay our property taxes, and because they are our single biggest annual expense, we prefer to set that money aside so there’s never a question of whether we have it. With each quarterlyish share sale, we’ll deposit approximately a quarter of the amount needed for our annual property tax and other big ticket expenses like insurance bills into our known large expenses fund, so we always know we’re set there.

Operational rules: Only spend on expenses as earmarked.

Life Happens Fund

Plenty of folks say you don’t need special funds in early retirement, but we heartily disagree. If we accidentally spend too much in retirement, we don’t want to be forced to sell shares at a bad market moment or carry credit card debt to get us through to the next cash infusion. And while we have all those contingencies, we don’t want to have to use them. So that’s why we plan to retain our life happens fund. It’s a savings account at USAA, and the money is easy to transfer over if we need it. If you prefer, you can think of this as the “peace of mind fund,” because that’s how we think of it. (Or the “training wheels fund,” as we learn to trust our cash management skills in early retirement.)

Operational rules: Don’t spend it capriciously, but fine to use it if we need it. But then top it back up again at the first opportunity.

Sometimes you get the chance to see Hamilton with your friend Revanche and you don’t pass up the chance. Life happens!

Emergency Fund

Here’s another place where we disagree with a lot of folks. We definitely think you need an emergency fund in early retirement, even though the “emergency” most people are guarding against while working is job loss, and that will no longer be an issue for us. While the experts will tell you that a robust emergency fund while working is six to eight months of expenses, a retirement emergency fund should be based entirely around your own circumstances. The biggest single non-healthcare expense we can envision is total home loss from earthquake, which comes with a deductible that is — by law — tens of thousands of dollars. And although we’re not going to keep that full amount on hand in cash, the fact that that is a possibility tells us that we need more than a few thousand liquid dollars at our disposal at any given time. Another good number to base it on is the out-of-pocket maximum on your health insurance plan, which is often $10,000 or more. Our number will probably evolve over time, but we’re starting out our early retirement with a hearty e-fund.

Operational rules: Not to touch except in true emergencies.

Debit Cards — Maybe

We haven’t used debit cards in years, and hope not to need to in retirement, because travel points. We’re not travel hackers by any means, but we do prefer to get points when we spend money, and have used credit cards exclusively for many years now. That said, in my early days of getting my act together, I insisted we use debit cards so that we could see how much we have at any moment, rather than having the mystery of each other’s credit card accounts and the possibility of overspending. (Yes, I know this is fixable with technology.) But if we feel ourselves getting at all anxious about our spending and cash flow, then we’ll go back to debit cards until we have solid new habits in place.

Operational rules: Use for routine spending on non-planned expenses.

Tanja Mii: “I think we might need to bring back debit cards to manage our cash flow.” Mark’s Mii: “Nah, everything will be fine.” (Art imitating life.)

Points Credit Cards

Assuming we can trust ourselves with credit cards, we’ll keep using them for all spending. And if we find we need debit cards to better manage our flow of expenses, then we’ll reserve cards for large planned expenses like airfare and hotel charges.

Operational rules: Use for planned spending like travel expenses (and on unplanned expenses if debit cards aren’t necessary).

Allowances

See below.

Operational rules: Up to each of us to spend how we see fit. No free refills.

New Addition: The Return of the Allowance for Early Retirement

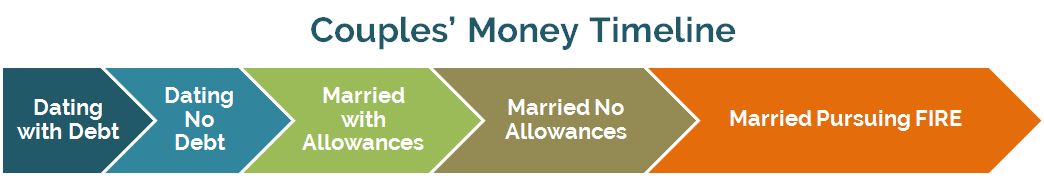

Waaaaaay back, when we first combined finances after we got married, we decided to give ourselves allowances so we could each spend a bit without any fear of scrutiny. (Though if you listened to episode 2 of The Fairer Cents, you know we thought of our money as joint well before we actually combined it.) That phase of our joint moneying was the third arrow from the left, in light green:

I say “without fear of scrutiny” as the reasoning for the allowances instead of “without scrutiny” because we we both trust each other a ton, so it truly was the fear of scrutiny that we each had within us that was the actual concern, and never any actual scrutiny.

And that’s why, not too long into marriage, we scrapped the allowances and just bought the things we each wanted or needed for ourselves without stressing about it, moving into the “married no allowances” phase before we moved into full-on pursuit of early retirement.

But going from working with ample income to retiring with a whole lot less income feels like a huge moment in life, about as huge as getting married and combining our money. And so just as allowances were a great tool to smooth the transition then, we think they’re an ideal tool to smooth the transition now.

The Allowance Reboot

I’ll happily admit that I am the driver of Allowances 2.0, because I am the most anxious about the adjustment to our new spending regime. And yes, I know we’ve been (mostly) spending on our retirement budget for a few years already, but I just prefer a safety net. (Seriously, if this is a surprise to anyone, you have not been reading this blog for long. I’m bucking for the title of “Most Cautious” when the FIRE yearbook comes out.) And just as I don’t want to have the ability to screw up our traditional retirement, and therefore plan to leave our traditional retirement funds alone while we live in early retirement, I don’t want to screw up our early retirement by getting over-eager at Whole Foods or falling head over heels for a new hobby that requires gear.

That’s why allowances are perfect. By giving ourselves an allowance that we sock away in our individual checking accounts at the start of the year and then don’t refill, we each have this little pot of funds to spend capriciously if we feel like it, without having to justify anything. And there’s another good reason to have them besides fear of screwing up our retirement:

Fear of screwing up our relationship.

If I decide that $50 worth of gluten-free pizza from Tony’s in San Francisco is a worthwhile expense — because seriously, there is so little edible gluten-free pizza in the world and it’s totally worth it — I don’t want that to cause relationship friction.

Allowances As a Money Relationship Hedge

We haven’t had any money stress burdening our relationship for years now, and there are several good reasons for that: We trust each other, we’re both mostly responsible with money and we have a shared vision of what we want our money to do for us. But the biggest reason of all has been the one we have the least control over: We’ve had more money than we require coming in each month, and ample cushions saved.

That last factor goes :::POOF!::: at the end of the year, and while we’ll still have the trust, responsibility and vision, we’ve never tested our relationship before with the challenge of not having more money coming in each month than we need. The last thing we want is for money to become a new source of stress, though we’d be naive to think that couldn’t happen to us.

Perhaps the main reason we’ve trusted each other with spending in the past is that we’ve known we could afford whatever the other partner chose to buy, even if the other one of us didn’t love the idea of that purchase. And now, when “afford” will mean something different, the last thing we want is for either of us to resent the other for making a spending decision we don’t agree on when our margin of error is suddenly so much slimmer.

Sometimes you just want to enjoy a flight of gluten-free beers at Ghostfish in Seattle without having to log it in a ledger. (Especially because I only know of two places in the world where you can use “gluten-free” and “flight” in the same sentence.)

So that little chunk of cash we’ll each have to spend without scrutiny each year? It’s so much more than the money itself. It’s pretty darn cheap peace of mind, with the bonus effect of taking a big potential source of tension off the relationship. I will take that any day!

Let’s Talk Infrastructure, Allowances and Budgeting!

So much to discuss here! Are you better at operating without a safety net in your relationship than I am? Do you use allowances? Think you’ll use allowances in retirement? What other infrastructure do you use, in any stage of your financial journey, to keep you on track? Are you a skilled budgeter who’s utterly befuddled at how we can be smart people but still suck so much at budgeting? Let’s talk about all of it in the comments!

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: gearing up

You know I love this level of systems and checks. I used to budget to the PENNY for years but after I started making real money and then combined with PiC, we needed something less granular so we both didn’t go crazy. My money management evolved a similar holding system for our money with our spending checking and savings accounts at USAA and it works wonderfully so 2-thumbs up on that and I hope it works as well for you as it does us.

I’d say the same about our allowance system. After three years of the allowance system we just forgot about it without any fighting over spending which proves it was an excellent training wheels / transition tool for two adults to learn how to spend in harmony and faded out when we no longer needed it. Cheapest substitute for marital counseling ever.

Hi Tanja–Great blog! I’ve read a lot of it, and maybe you’ve addressed this, but are you going to do Roth conversions of your 401k, not to spend now, but so that you can avoid RMDs later? If you are going to be living on cash, this would be a perfect opportunity to do Roth conversions at a zero or low tax rate. I know I’m planning to!

She’s touched on it in a few areas, specifically https://ournextlife.com/2016/02/17/how-we-calculated-our-numbers-for-each-phase-of-early-retirement/ and https://ournextlife.com/2016/04/20/later/. Here’s a snippet that answers your question: “a large majority of our cash is saved in our highly restricted 401(k)s, which we can’t legally touch without penalty until age 59 1/2. and sure, we could do the roth conversion ladder trick, except 1. as risk-averse investors generally, we like knowing that we’ll have a bigger pot of gold waiting for us in our later years, so don’t want to dip into our 401(k)s very much or at all, and 2. the conversion ladder wouldn’t let us move over enough cash each year to make enough of a difference, or it could mess with our obamacare subsidy eligibility.”

Thank you for chiming in with this! The truth is that we’re not averse to doing some Roth converting so long as we don’t spend the money, but just set it aside in a non-restricted account. But the last point, about health care, is really the crux issue for us!

Hi Monica — We’re not planning to SPEND our retirement funds before 59 1/2, but we may do some limited conversions before then IF doing so doesn’t hurt us with health insurance. Here’s where I talked about how much doing Roth conversions can hurt you in terms of health care (as can things like tax loss harvesting): https://ournextlife.com/2016/10/31/low-income/.

I don’t know how I would function in life without systems. ;-) I’d just be a blob who never left the couch. Hahaha. (Not really, but there’d be days like that!) And I totally see allowances as training wheels, and while I expect we won’t need them long term, I’ll gladly put the training wheels back on while we figure out this new transition! LOL — soooo much cheaper than counseling!

Some people are naturally super disciplined. (Not us.)

I disagree! I see what you’re trying to say, but remember that you’ve been publishing great articles on this blog religiously twice a week for a long time now. That’s discipline. And putting the money away first so you never saw it as a way to save all those years is also still discipline You knew that you had that real cash-money and you still didn’t spend it. I think you’re discounting that. Compared to the average couple out there, you and Mark are super-disciplined! Don’t just compare yourself to the best.

I think you have a great plan laid out here for spending. As always, you’ve clearly thought this through. Great post!

I appreciate your comment, but my “discipline” with the blog is the result of its own system! ;-) (https://ournextlife.com/2016/04/27/streaks/) Maybe I should rephrase it to say that I am not intrinsically disciplined, but I have found ways to make myself extrinsically disciplined. ;-) What matters is the progress, and we’ve found ways to do that despite our natural inclinations, and I 100% believe that’s what matters. But I’m not naive enough to think we couldn’t instantly devolve back if we didn’t keep giving ourselves systems to rein us in. So that’s what this is all about. ;-)

I’d suggest you take a look at how folks with lumpy income profiles (freelancers, business owners, etc) do things.

If you’re inclined to worry about stuff then recreate what has worked for you to date. Create a regular “pay cheque” funded by dividends, rent, asset sales, whatever.

That way your existing proven approach and systems just keep working.

Worked for me anyway, your mileage may vary.

Good luck with it.

This is similar to what Mrs. FF and I did as well.

We’ve been FIREd for over 5 years and I transfer a monthly budget amount into checking. Sometimes we spend a little more than the monthly budget and sometimes little less, but it all works out. We used to have allowances, but I found that we treated allowance money differently – think spend frivolously – than other money. It’s definitely been an evolutionary process and will likely continue to change as we learn.

Best of luck!

Glad to know that the pretend paycheck method works for you guys! And yeah, it’s our hope that allowances will be temporary this time around, too, but I still want to start out having one. ;-)

That’s the plan! ;-) The idea with the transfer account is to dump dividends and share sale proceeds there and then do a regular paycheck to our main checking account.

I found it interesting you all started with allowances than changed to live without them. Was this causing more tension then just trusting the other person? Or was it the fundamental principle of feeling like you weren’t trusting the other person in the first place?

I’m pretty with you on budgeting, I like to put estimates for each month and of course do my best to hit those estimates. If I go over, or if I need to buy more food but will be over budget, I’d rather be full than go hungry for the sake of $10 on the budget.

Overall, I typically live more frugal than the estimates by nature, so it hasn’t been an issue and helps me track my money very well.

I love that you all automate so much, me too!!

We each both trusted the other but we each didn’t want to be scrutinized. But we pretty quickly got over that, and then stopped the allowances. And I’d say some of that sentiment is recurring, at least for me. If I buy something, I don’t want Mark to be angry about it — and I think that says a LOT more about me than about him. ;-) And hooray for automation!

We budget but mainly to see where we spend our money. There are some good tools out there that allow you to do this with very little work. The budget is our guardrail and is more of range of spending that can be adjusted during the year. In fact it can be blown in a particular year if we decide that is something we want to do, but when we do we know what blew to budget ( I.e. did we go crazy with eating out)

The real benefit for us is not some much the budget but the actual tracking of spending against that budget. This helps us understand what are truly our discretionary expenses are and if we had to cut back sometime in the future, we have an idea on what our true basic living expenses are.

The budget we use is below what we can actually spend based our financial plan, thus giving us the flexibility to “blow” the budget in any given year. I guess that is a form of the safety net you referenced.

It’s so interesting to me to hear what the word “budget” means to folks. Clearly it means something more regimented to us, and though we do, in fact, stick to a budget of sorts, it doesn’t feel that way to us. ;-) But your definitely is way less strict than ours!

So well thought out! We don’t operate with a budget or allowances currently either, but use lots of automation and technology to ensure we stay on track. I do think things will change in retirement though, budgets and allowances will probably be a must.

Thanks, Amy! And three cheers for backdoor budgeting via automation. ;-)

It’s nice to know someone who is on FIRE and who is also gluten-free. The costs of GF make a huge difference in some of our extra spending, and knowing it’s possible to continue that lifestyle within early retirement is great. I’d love to read more about how you handle those extra expenses in your grocery/spending budget as you continue on. Thanks!

Some people might scoff at spending $50 for two pizzas, but we understand. I went to an all GF Italian restaurant in London for dinner one night and it was worth every penny. I offset the expensive meals by eating cheap meals at the house like eggs for breakfast, lettuce wraps for others, etc. It’s worth paying the extra money to not get sick!

Amen sister. :-)

GF holla! That stuff is freaking expensive, and I hope to have time to perfect my own homemade versions of things so we can stop spending outrageous sums on these occasional treats. I’ll keep you posted!

The lack of a need to closely monitor spending, because the income has been more than enough, really does help the relationship! I love that you have so thoroughly thought out this system. Do you find that you are both on the same page in terms of establishing systems and processes? That is the area where we tend to be challenged. Two type A personalities who both like to be in control means getting to a system we’re both happy with is a work in progress. Curious to know more about how you work through it!

Boy, does it ever help! I would say that I am the more system-inclined one of us for sure, but Mark is very supportive. ;-) He is far less type A and cares mostly about the end result, less so how we get there. And on things where we both care deeply, we have figured out ways to have our own systems (like we each have our own separately developed retirement projections) so that we each feel in control in some way. Because we’re definitely both stubborn, and aren’t the types to trust someone else’s numbers blindly, even if we trust each other deeply. ;-)

Not surprised you took a very methodical approach to this change. I think you’re on the right track. Just a couple thoughts.

I love budgeting and am a complete freak about both short term and long term budgets. But I don’t budget details–I have property taxes/insurance, utilities, vehicle expenses, vacations and spending. Spending can be dining out, groceries, clothes or anything else that isn’t specifically budgeted. Really granular budgets don’t work for me and I think non budgeters should try a more summarized approach before ditching budgeting all together.

It may be worth looking at an accident policy to cover your max out of pocket costs on your health plan. It covers us if we’re injured in an accident and, with our lifestyle, we’re more likely to be injured than to suffer from a disease. We pay $380 a year to cover 17k with a $100 deductible. Probably not the best financial decision, but I’m more likely to have something looked at after a fall for $100 than for thousands.

Enjoy these next few weeks–I’m sure everyone is telling you how awesome you are and how much you will be missed!

I think my biggest takeaway from the comments on this post is that “budget” means something very different to each of us! (Sort of like “retirement.”) And like everything, I’m sure we’ll keep evolving on how we view budgets and such. The accident policy is a great suggestion — I’ll look into that!

Thanks for sharing your new system with us! It’s definitely not a transition from getting a stable paycheck each month to having less cash flow coming in. But I know you two have been planning for this change for a long time and have no doubt that you can make it work.

Mr. FAF and I don’t have an allowance system. We just check with other if we want to buy something, most likely more than $20. We usually don’t buy anything we don’t need. Mr. FAF’s biggest weakness is eating out, but he’s working on that ^.^

I’m sure we’ll make it work, but we’re definitely prepared for the possibility that it might take a few tries to find the right new system. ;-) And it’s impressive that you guys are so naturally uninclined to spend money! I’m sure that makes budgeting a lot easier. ;-)

We have not used an allowance system in over 15 years because we have the same short, medium and long term goals for our money. I believe it is knowing we are on the same page financially for many years to come that gives us both the security and trust in each other and ourselves that makes allowances unnecessary for us for now. If something comes up we trust ourselves and the other that it worth the cost to delay meeting our goals. When it wasn’t we apologized, learned a lesson and moved on. Sometimes the lesson was just that we are not married to our clone but to someone with occasionally different ideas. I have accepted that cable tv sports is worth it to my spouse every if I don’t see the point. He has accepted that I will occasionally buy things to read or do that I may not actually get to this year even though he believes that is just as wasteful. Once we meet all of our goals including the long term ones I can see how an allowance system could be useful to prevent many small money arguments that could happen before we develop new common money goals. Or to develop trust in yourself that you won’t go off the spending deep end if all the constraints are removed.

I think your point about not being married to a clone is an important one — you can share all the same values and goals and still occasionally disagree about whether something is worth the money. We for sure have! Like I don’t love at all how much Mark just spent on his new (used) mountain bike, and I would never have spent that much. And he’d say the same about some of my blog expenses (and other stuff, too). So while trust is huge and on most of the stuff we do trust each other completely, it’s still fair that couples could want other systems in place to help buffer some of those choices where both parties don’t completely agree even if you’re aligned on the big stuff. I’m super glad for you guys that you haven’t needed an allowance along the way — we hope not to need it forever, but see it as good training wheels during the transition. ;-) (And to your point, it’s also about building trust in ourselves — no small thing!)

I love that your life happens fund is separate from your emergency fund. A big exciting once-in-a-lifetime type of adventure might not qualify as an emergency, but you definitely don’t want to miss out just because it isn’t in the early retirement budget! I think this is a great compromise – and probably a good way to not just work one more year to have those experiences.

I’m a huge proponent of the life happens fund! I credit Suze Orman with that idea back in the day. :-)

We have allowances and plan on keeping them in our “retirement”. Even though they make up a good chunk of our budget, we find them useful. Plus, they’ve evlved over the years so they cover everything from clothes, to restaurants, hobbies, etc…

We’re anxious about what money stress will do for us, because like you, we haven’t dealt with any money stress in years. It has been amazing and freeing not feeling that. To that point, like you, we haven’t really budgeted, but rather track spending and stay conscious of where our money goes. If we go over one month or something big comes up, no big deal because we still have payhecks coming in.

We’re planning on living within our FIRE budget next year, 2018. It will be a good test run to see how easy it will or won’t be to stay within those budgetary constrants. Plus, it will test our financial conversation friction. it used to be high early on in the relationship, but since we haven’t had any stressful money conversations in years, it will also be good practice for that too.

I love your dress rehearsal plan! That’s so smart. We debated doing that a while back (post about it here: https://ournextlife.com/2016/01/20/when-were-not-on-the-same-page-about-money/), but ultimately decided not to because 1.) we’re already pretty close to our retirement budget and some of the stuff we can’t replicate, and 2.) we want to be able to splurge on a few things to let off steam while still working. But I still think it’s a good idea! ;-)

We’ll see how it goes, because there are things we want to splurge on while we still have paychecks coming in. At least for money talks and making sure it’s realistic, I think it should be good. You’re right though, there’s a lot we can’t test run, because we just won’t be in those situations until the paychecks stop.

Yeah, we think about that. And we’re definitely in that “home stretch splurge” mode right now, so I understand! ;-)

This is such a smart way to take stress off yourselves, love it!

If you’re ever passing through Colorado, we have a dedicated gluten-free brewery here in Golden called Holidaily! Amazing beers that totally hold their own, GF or not.

How did I not know this?!?!?! Thank you for the info! We will definitely hit them up. (Also, we’re doing a meetup near Denver right after Christmas — stay tuned for info. Would be awesome if you wanted to join!)

Ha! You two crack me up at the level of detail you think through all this stuff. Or maybe it’s just you, Tanja? :) I have never been a budgeter – I felt like tons of categories is like micro-management (and goodness I hate being micromanaged, even when it’s me doing it to me). I always seem to be able to constrain my spending where necessary. I think that y’all are just as disciplined, if not more, and I think what you might shortly discover is that when you aren’t in a rush and don’t have to be super efficient with your time, you may be able to find some more cost cutting hacks on some of your bigger spending items you didn’t realize were available. My retirement plan has monthly interest income cash flow available but so far I haven’t come close to spending the amounts I had budgeted I needed on a monthly basis (I have dividends flowing in too but I don’t need the money so they are just reinvesting while I pay zero attention to those accounts). We are eating at home even more than we had previously and it’s been easy to round up friends for “Happy Hour potlucks” and I find those are much more relaxing and enjoyable than going to a local watering hole (and the food is way healthier, typically).

Uh, yeah, obviously it’s just me. ;-) I think one of the things that has me wanting a transitional safety net system is the feeling that we ALREADY benefit from a lot of those cost-saving hacks because we’ve both worked at home for so long, and we live in a place with a non-spending culture. (Different from when we lived in LA, for example.) So while I’m sure there are a few more things we can do to reduce our spending, I don’t think we’re going to see any big percentage changes in the near future. But I’m super glad you’re finding it easy to save!

I don’t really budget, more of a ballpark goal and tracking but I am more naturally frugal, if I think I am spending too much for awhile I know to cut back. I am sure you will do checks and balances naturally soon it won’t take long to figure out an easy system that works for you.

This all comes back to my anxiety from knowing that we are NOT naturally frugal, so some of this stuff that frugal folks can avoid stressing about still freaks me out a little. ;-) But you’re right that we’ll figure out the system that works, sooner than later I hope!

I don’t really budget either. At a certain point in your career, money just starts to accumulate, and so you don’t have to worry about things like budgets or spending. Also, to your point, when you have a well paying job, there’s a paycheck coming soon, so go ahead and buy whatever tickets or travels or dinners out if you’re craving sushi. I imagine quitting work will be like that for me as well – the nervous feeling of knowing there’s no more security blanket named paycheck. I don’t like worrying about spending, even though I don’t really spend that much due to my hobbies and habits. A good reminder about wants vs needs, and that if you want to blow money wherever you need a nice paycheck to go along with it.

Well said. ;-) When the money just starts piling up, seemingly by magic, it IS a lot easier to just go through life without a budget! And when that ends, some adjustments need to happen! ;-)

Disclaimer: a Cynic here. An owl imported from Japan, Hamilton tickets starting at $285 each, gluten free pizzas and beers for $50 (unless you have Celiac disease)? I don’t mean to criticize you unfairly, and I leave this comment because you seem open to many points of view. As the FIRE movement has developed, it seems to me that many of the financial bloggers are basically advocating the same way of life as the usual consumer debt-junkies, except that the means to the same end is a limited time of savings/investments so that the lifestyle can be had without massive quantities of debt. I thought that the point is to become free by learning what is enough and changing one’s way of thinking and desires. “S/he that wants but little, needs but little.” For example, I admit it’s a weakness, but one thing I’m looking forward to in retirement is to never again travel on an airplane. Not that this will be the case with you, but somehow I think the next stock market crash will see many early retirees coming out of retirement!

I’m glad you felt free to share a different point of view here, and I’m happy to chat about this stuff. I think the fundamental error you’re making is assuming that “the point” of the FI movement is anything other than each of us having control over our own time and our own lives. It’s important to think about what *enough* is, but that should and does look different for each of us. Someone like you who (I’m guessing based on your plane comment) has no desire to see the world will need much less than someone whose motivation in FI is to see the world — and one of those isn’t right while the other is wrong. The dogmatic thinking that I see espoused in certain corners of the FI world that is problematic is the idea that there is a “right way” to be FI, and I do hear hints of that in your comment. If I can afford tickets to Hamilton, $50 pizza (for my celiac, by the way, not that it matters), and all the rest, and I’ve saved accordingly, then any criticism of what I choose to spend my money on is missing the point, which is that we’re all free to make our own choices. You either believe in freedom or you don’t. If you believe freedom looks a certain way, as espoused by a certain facial-haired blogger, that’s not actually freedom.

And if you’re concerned about whether we’ll make it through the next recession, or any beyond that, here’s a post that will reassure you (though I can’t speak for others and do suspect that some folks have far too thin a margin built into their plans): https://ournextlife.com/2017/05/10/conservative-projections/.

We retired 3.5 years ago at 49 and 51 years old. My career was in finance, and I was a bit obsessed with budgets, projections, planning etc., prior to making the joint decision to leave our careers, sell our home – to travel full time. We had been saving a large chunk of our income for a number of years to make our “Chapter 2” a reality. Yes I (more than my wife) was concerned about our budget and spending during the first year post retirement, because we had given up the safety net of good salaries. The funny thing is that we are now very protective of our financial freedom, which drives us to jointly spend within our budget. We don’t obsess, but we do track our spending. Based upon your writings, I think that you and Mark have a great relationship and have a similar mind when it comes to long term objectives. For my wife and I, FIRE has been a great adventure, and has brought us closer as a couple. We now value experiences, spending time with friends and family, and the freedom of our time, a lot more than possessions . I have a strong feeling that you and Mark will do just fine post retirement!

Thanks for sharing your post-FIRE experience, Ed! I do think we’ll get to a good place, and it helps a LOT to know that we share the same life vision and can communicate well about this stuff. Hoping the allowance is a short-term transitional tool and not a long-term fixture! ;-)

Past behaviour is a good indicator of future behaviour. (I know. I know. That’s way too Dr. Phil. LOL. It is one of the things though that he was right about and stuck with me over the years). I don’t think you need to freak out about living on a budget. You were already doing it and now you’re just taking the training wheels off. Considering how long you’ve been at it, I don’t think this will be so much of a stretch. Under normal circumstances, you’ll adapt to the new normal but you’re not going to change your habits so drastically to compromise your financial independence.

Yes, some who pulled the FIRE trigger may have done so a bit early and may not have a wide margin for error however, I don’t think that is the case for the 2 of you. Throughout reading your past posts and this one, you’re both all about contingencies as well as contingencies for contingencies (is someone a bit OCD? 😜 I think in this, it’s a plus though). I’m the same way and some have mentioned I should have already pulled the FIRE trigger but I need that buffer in place before doing it. Measure twice. Cut once.

In a few months or a year from now, you’ll probably look back and laugh at the whole thing. I have a feeling you may actually end up with a surplus.

I won’t say OCD because that’s a legit mental illness, but totally fair to call me an over-thinker, over-analyzer, over-planner or anything along those lines. ;-) OR, what I’d actually say is that I like to do all the thinking upfront (the part you see reflected here on the blog), and then I can put whatever plan we land on into action, and then I can relax and not think about it (that part you do NOT see on the blog). ;-) But YES! Measure twice and cut once is exactly my view on all things financial, and why I like having systems and training wheels. ;-) And we do HOPE to have a surplus — that is the ideal outcome.

We are full on budgeters but know that it’s not for everyone. Though in FI, I can see how it’s actually a lot more critical than it is while you’ve got regular income coming in every month to “smooth the edges”.

I definitely think a emergency fund/cash fund is essential in ER: probably more so. When emergency strikes you want to be able to address it immediately, and not worry about the market being down a bit.

Smoothing out the edges is the perfect way to put it! And yeah, totally with you on the cash fund in ER, even though we’re no longer worried about job loss (most people’s worst case emergency).

Wow, you really are a belt and suspenders (and maybe another belt, just in case, and maybe a rope tie, you never know) kind of gal. Do you think you’ll be able to relax at some point, maybe after the first year? You give the impression that you secretly fear this will all fall apart, despite your careful planning and back ups of back ups, such that you’ve now invented yet another system of elaborate checks and balances.

Personally, I’ve moved away from tracking spending too closely on a month to month basis and now just check into trends in Mint every few months. We don’t do allowances, but we do run spending by each other if it’s anything over about $20-30, and I’ve relaxed a bit from the tight grip I had on spending the 1st year after deciding to follow the FIRE path. I was disappointed to have to use our emergency fund back in August (even though that’s what it’s for), but it seems like we’re still on track to hit our savings goals this year.

You raise such an interesting point Lisa, which is that you guys only get a SLICE of my thinking here, which is all of the upfront planning and analysis. You don’t see me relaxing after we make a decision, knowing we thought of everything. So I need to share more of that here! Because absolutely I’ll be able to relax — that’s just my process: do all the hard work upfront so that we don’t have to do any second-guessing or hand-wringing later. ;-)

For someone that does not like budgeting that’s an awful lot of funds and allowances. Feels like a chore to me!

Fortunately you don’t have to live with my system! ;-) Haha

We don’t “budget” really either; we have automated our savings and frugality to the point where we don’t think about it any more. We also don’t do allowances; if we want something, we buy it, within reason. But we are still working and in the accumulation phase, with about a ten year horizon to retirement; I can see how for some relationships and situations, it would be a totally different story.

I enjoy reading about all the funds. I am a safety net/second parachute kind of person so I imagine when the time comes to plan the nitty gritty of our retirement finances I will be doing something similar!

We’ve been in that same “no allowance” place for the last eight years or so, and feel a little sheepish, actually, admitting that we want to bring them back for the transitional period. But just like the multiple accounts, the allowances are just a tool to help us smooth out the transition. ;-)

Thanks for sharing these details, Tanja. My department is getting ready for layoffs, which is putting me in planning mode for contingencies. I LOVE the idea of the allowance since I could definitely imagine some money stress / friction arising in my relationship should we end up in a reduced income situation.

Oh man — I hope the layoffs don’t affect you directly, or at least aren’t too stressful! Thank goodness for contingencies!

I think this is a decent plan. We don’t really budget THAT precisely. We track our expenses and the like, but we’ve never been huge on creating a finite budget, in part because when the cash is flowing in, there just is less pressure to care about it.

That being said I still like to take a look at it. Partly because it’s a great gauge for me on how much money we’ll REALLY need to live the lifestyle we want in retirement.

I think having an allowance would be beneficial to avoid hiccups that you aren’t used to having to deal with. It’s not really a trust issue, it’s a behavioral crutch until you get the hang of it. I think it’d be foolish to dismiss the idea of an allowance (“It’s juvenile!” they’ll say) when the reality is you’ve NEVER experienced something like what you’re going to experience. Wouldn’t you rather take precautions to protect the assets you’ve earned from your own silly behavior, just because it’s not something you’re used to?

Seems to me like you’ve got the right approach on this.

I think you got right to the point: when there’s cash going in, there’s less pressure! Looking toward a world with no cash coming in feels scary by comparison, hence the system that is probably a bit of overkill, but incorporates a nice safety net. ;-) And thanks for your note on allowances — EXACTLY. It’s like a set of training wheels for each of us. And if we don’t need them for more than the first year, great — we’ll ditch ’em! ;-)

This is a concept I hadn’t thought too much about – how would I feel about my significant other making large purchases after retiring? Like you’ll, knowing that new money is coming in, and coming from an abundance mindset, it’s always been a non-issue so far.

The idea that I’ve been loosely going for is to save so much money that our yearly spending (without tracking) is likely way below the safe zone. Still though, knowing the “safe maximum withdraw rate” and sticking under that would still be a budget – just a higher one.

As someone who doesn’t budget, but who splurged on Hamilton tickets and checked out weird themed cafes in Japan, this post hits close to home!

And I hope it’s still a non-issue in the future… but bringing the allowance back lets me be sure. ;-) As you’ve probably surmised, we’ve also likely oversaved, but given where the markets are currently, our fear of sequence of returns risk feels well justified. If we manage to get through the first few years without taking a massive hit, we’ll probably default back to that abundance mindset, but the weight of the transition definitely has us backed into that scarcity corner a bit. ;-)

Here’s to worthwhile splurges! (Like going to see Harry Potter on Broadway in May! Woot!)

I wanted to throw this comment out there as a fellow house-owning Californian. I was going through all of my circumstances just like you did here and realized that I had successfully procrastinated on looking into earthquake insurance. I finally got it a few months ago and was actually surprised on how it works. In case you didn’t know, unlike car or regular homeowner’s insurance, you pay the deductible last instead of first. I had the guy from CEA (the only earthquake insurance provider in CA) repeat that to me after my initial confusion and verified that on the website too. Apparently they evaluate the damage and you can opt to go for cheaper building materials to save on the final rebuild cost so you wouldn’t have to pay much or all of the deductible which can easily be tens of thousands of dollars like you said. (You could get laminate instead of hardwood flooring or marble countertops). I would have bought earthquake insurance many years ago had I known how that worked. Hopefully you knew this already, but I was pleasantly surprised so I’d thought I’d share in case you have other readers in CA who are part of the majority without earthquake insurance.

I appreciate you throwing this out there! I learned this recently as well, which made me feel a LOT better, given that our deductible is (no joke) $37,000. But, there’s also a LOT about our house that we would upgrade or change, so if our whole house really did shake down, I don’t think we’d want to put in crappy materials temporarily only to pay for them again later in more upgraded form. But let’s hope neither you nor we ever have to face this!

Hi Tanja. First time commenter but have been reading the blog for a little bit. I am so glad you wrote this post as I have the same exact fears about post FIRE. The fear of knowing you don’t have that next paycheck coming in to cover any mistakes. It is kind of scary. We have reached our FI number but I am not ready to retire just yet. My husband retired a couple of years ago because his job was very stressful and was affecting his health and while I didn’t retire I did move out of highly stressful CPA work in to full time teaching at our local community college so I feel like I have semi retired myself. It is so much less work than being a manager at a CPA firm. I will continue to work for awhile as I really like what I am doing now and we really need the awesome health insurance because I have a disability. It is nice knowing though that i could go in tomorrow and quit if i wanted to. FI actually makes work some much less stressful. I just don’t sweat all the politics.

By the way, obviously being a CPA I am a big proponent of budgets. (Big surprise right? 😁) But I also agree with some of the other commenters that our budget is flexible and more of a guideline because like you mention in your post we have been lucky enough to have had high enough income where we have that flexibility.

Hi Amy! Thanks for reading, and for crossing over into commenting! ;-) You are definitely not alone in your fears — and that’s why I wrote this! I’ve heard from other folks who I know feel similarly to you and to us, and I didn’t want it to only be rosy stories out there on blogs of the transition. We’re going to use the heck out of our training wheels as we move into the next phase! ;-) I’m super glad for you that you’ve been able to move out of your full-time CPA work!

The idea of the allowance is very intriguing! During my “first career”, I always had a “buy what I want, save the rest” mentality and during the initial phase of “not working”, it was obviously a very drastic adjustment. I found it very challenging to allow myself to spend money beyond the essentials because I didn’t know when I was going to replenish my stash. That definitely led to me being a homebody in a new town more than I would conceptualized when I thought about travel.

It didn’t matter that i had a solid emergency fund, it didn’t matter that I had additional investments. Conceptually, I even knew that it was unlikely that I just wouldn’t have any earned income again, but i think the fear of not knowing what the hell I wanted to do with my life overweighted pretty much everything else.

I really like the allowance concept, even for a single person, because it essentially gives permission for some extra fun. In my case, that’s huge because I’ve always shied away from blowing money around when it’s just me, but I’ll more willingly open the wallet when it’s a social situation. So when my income went away, I put myself in a lot less social situations and it was pretty isolating. Because I associate being with people with spending $$ because I’ve never known anyone who is content to chill at home with a board game or go on a hike or whatever.

I’m sure there’s some net worth where the emergency fund becomes irrelevant, but unless your income is drastically higher than your expenses which naturally builds a cash buffer for you, I just don’t see myself deviating from a large emergency fund. If my investments tank – at least I have plenty of cash to figure out another contingency.

I just wish I could figure out what my why is. Sometimes I feel like I’m throwing darts and trying to see what sticks. There has to be a better way.

I love this comment, TJ. I know that freaking out about selling shares and spending money is something that could happen to us as well, despite knowing that our stash is big enough to last, so I love thinking of the allowance as many things, including as permission to spend a little. Thanks for sharing this way of looking at it!

I like this concept and that you are both flexible to change things as necessary. My future “FIRE” will involve work in my own business at a reduced rate. My current plan is to maintain a big EF in one savings account, and a relatively big buffer in my operating account so that I don’t have to worry about slow months at my business. If my business can cover 50% of my expenses and my investments the other 50%, it sounds like I’ll have reached some magic. That should hopefully allow me to work as much as I desire while still having the lifestyle I desire and not worrying about money so much. Obviously, I would not want to withdraw so much from my investments that they would stop growing. (I have not yet come up with ideas for this proposed timeline. It’s a general idea so far)

For a general idea, that’s pretty darn sound! And as you said, building in both the technical ability and mindset to be flexible is key.

Here’s hoping!