I love the financial independence/early retirement blogging community fiercely, and I’m proud to be a part of what is unquestionably one of the most positive, supportive places on the Internet. I didn’t even really read FI blogs before we got started on our journey, or before I started blogging for that matter, but I’ve still gotten so much from them, and from the community of readers who comment and share thoughts, too.

For those of us interested in living a particular kind of unconventional life made possible by the subtraction of work, FI blogs serve a crucial purpose.

And that crucial purpose is why it’s so critical that we always tell the full story.

Last year, I wrote my feistiest post to date (possibly ever – depends how this one goes!), in which I encouraged readers not to listen to FI blogs, especially when it comes to the question of whether early retirement is sustainable, because too often they don’t tell that full story. (Bottom line: nearly every retired FI blogger draws significant income from their blog, and therefore isn’t actually testing the approach to early retirement that they espouse.)

That post started some great discussions, and I was pleased to see a few more bloggers disclose their blog income as a result. But that alone isn’t enough.

So today, I’m going farther. This is a manifesto of what FIRE bloggers owe our readers. We’re at our best as a community when we push each other to be better, and this is my big nudge to all of us, including to myself.

The predicament I see with FI blogs is, interestingly, that many are too encouraging. This may be the one and only time I ever complain about a group of people being too positive, but the fundamental conflict is that if we make early retirement seem too easy to achieve, or too simple mathematically, we lead folks down the primrose path to potential financial ruin later in life, at exactly the time when they are least equipped to deal with it, because they simply did not save enough to weather all the future unknowns that none of us can control. We need to be both encouraging and realistic, and sometimes full realism is what’s missing.

Problem One: The Plan Vs. Reality Mismatch and the Incomplete Message That Creates

Let me make this completely clear: I do not think that making money from your blog is the problem here. I know how much work it is to write a blog and keep it going, and I believe people deserve to be compensated for their work. So if you make money on your blog? Great job!

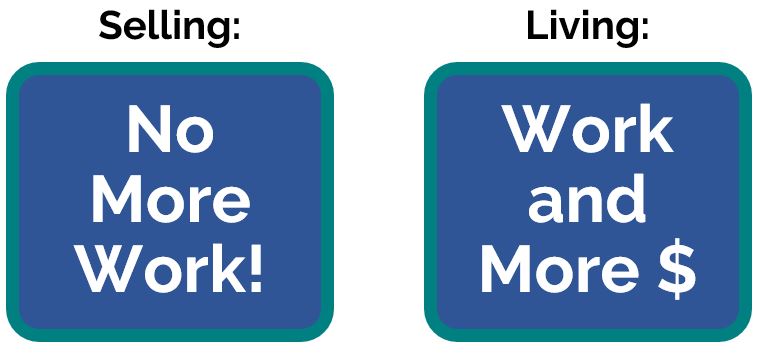

The problem is that what folks espouse and then what they actually do are often quite different, and that creates a real and important issue in the message. Let’s break that down.

Consider the most commonly discussed levels of financial independence or early retirement:

While bloggers may have different approaches to getting to financial independence, the model of post-career life that most espouse is this one:

No inherent problem there! Never having to work ever again is what we all want in an ideal world, right?

Here’s the problem:

Or, to put it more simply:

It’s understandable if you spend all these years working a high-stress job, thinking you never want to work again, and then get to retirement and realize that there actually are certain types of work that you wouldn’t mind doing. (Hi. We did that.) Or your blog grows because you achieve financial independence and become a big inspiration to people and realize that you can make big bucks from that. All well and good.

But imagine this scenario:

A blogger who needs retirement cash flow of $40,000 a year saves a million dollars and leaves their career. Great! They quickly begin netting $50,000 a year from their blog, and now instead of withdrawing $40,000 a year from their portfolio, and actually testing the 4 percent rule they espouse in their posts, they are now not withdrawing anything, and are instead reinvesting dividends and even adding $10,000 more to their portfolio on top of market gains. In no time, their portfolio balance hits $1.1 million, and then $1.2 million and beyond. Should the blogger’s blog income ever disappear and force them to default back to their original withdrawal plan, they’ll now only be withdrawing 3.3% of their portfolio each year, not 4%. If the economy tanks, they can sustain a 17% correction before they’re even back at their base level they need to be completely financially independent forever. Or maybe they have a $200,000 cushion on top of their FI fund to weather things like higher future health care expenses or a home purchase if they decide to move somewhere higher cost.

The question is: If this person keeps blogging about the likelihood that the 4 percent rule will be adequately conservative in the future, or whether an economic crisis would sink their finances, or about why “enough” is a lot less than you think and you should stop working already, or whether we should all be more confident about our early retirement money working out just fine, should we trust that?

There is an unstated social contract at play in the FIRE blogosphere between writer and reader which says: You can trust what I’m telling you and incorporate my ideas safely into your own retirement plan because I’m actually doing this myself and betting my own finances on it.

Of course it’s still the reader’s job to consider the source and do your own homework, but when bloggers break that contract, the least they can do is tell you.

Problem Two: Ignoring the Reality for Many Readers

I appreciate the lengths that so many bloggers go to to make readers of all stripes feel welcome here. It’s why I write posts like how I started with essentially nothing saved only 10 years before retiring early. And I’ve heard from enough readers to know that that inclusive spirit is absolutely a positive thing.

But there’s a dark side to that: To be inclusive, we often have to act as though the things we say apply to everyone, and that’s just not true. Looking at income breakdowns in the U.S., for example, most people simply cannot save for early retirement in 10 or 15 years without spending so little that it’s below the poverty level, an impossible reality in the age of housing shortages, massive student debt, skyrocketing health care costs and wage stagnation. Sure, some people can save in that time frame or more quickly, but they are not the norm.

So when we say “anyone can do this,” or start throwing out big numbers or percentages that are clearly out of the mathematical realm of possibility for the majority of people in one of the wealthiest countries on Earth, we’re actually excluding with our attempts to be inclusive or, worse, we’re shaming those who can’t save at those levels for being less capable or dedicated.

I don’t believe that the answer is to be less inclusive, but simply to acknowledge a much wider range of economic realities. And if you aren’t sure what those realities are, keep reading.

I think we as a community of FI bloggers are already doing a great job on the encouragement side, and that won’t change, nor should it! So the encouragement part isn’t represented here in the manifesto. Where we’re lacking is on the realism side, both our own as bloggers, and potential future problems readers could face. And that’s where we can and must do better collectively. That’s true for both the big, influential blogs, and the small blogs, too, because they could be the influential blogs tomorrow.

The Manifesto: What FIRE Bloggers Owe Our Readers

Be Transparent About Whether You’re Testing Your Own Plans – If we write about the 4% rule and taking an approach to saving that embraces more risk, then we need to be living by the 4% rule and not continuing to pad our investments. Or if we find ourselves unexpectedly making good money in retirement (good for you!), we need to be clear with readers that our plan has changed and we’re no longer doing what we said we’d do with respect to our finances.

Share the Parameters of Your Own Financial Independence – Not all financial independence is created equal. To one person, financial independence might mean that if you never work again, you won’t be comfortable but you won’t starve, while to someone else, FI might mean being able to live large forever. Readers deserve to know what standard of living is build into your definition of financial independence, whether it covers only you or you plus a spouse or family, whether it relies on living in a particular place like a low cost of living area or overseas, and whether you’re factoring some future work into your numbers or not.

Acknowledge If You Have a High Income – I get that “high income” means something different to everyone, and that if your income matches those around you it’s not going to “feel”’ high. But I see way too many bloggers saying “Anyone can do this!” or characterizing their own situation as normal, average or the massively misused term “middle class” when it’s clearly not, and that both misrepresents the truth and alienates readers who can see through it. But let’s take the ambiguity away from what “high income” means. Here are some facts: the 50th percentile of household income in the U.S., per 2014 Census data, is $57,000 per year. That’s with an average of 1.41 earners, meaning the individual average is just above $40,000 a year. So if your household earns above these figures, you already earn more than average. If your household earns above $80,000 a year you’re in the top third of all households, above $100,000 you’re in the top quarter, $160,000 puts you in the top 10 percent, $200,000 is top five percent and $250,000+ is top three percent. That’s household, not just one person in a dual-income home. Even earning top quarter ($100K+ for the household) puts you well above average and about double what most households earn, so is going to materially impact what you’re able to do financially and the rate at which you can save and invest. That’s why you must say so. (It also means if you earn six figures as a household, you’re – by the most generous possible definition of middle class as the middle half of everyone – not middle class. To say you are is untrue.) And if you’re in the top ten percent or higher, then you absolutely need to clarify that what you’re doing is going to be out of reach for the vast majority of folks. I’ve always acknowledged that we earned well above average, but I can do better and owe readers that. Our lightning fast saving for early retirement was absolutely aided by having a household income in our final saving years that was in the top three percent, along with not having kids. It wasn’t always there, of course, but when it was in lower brackets, we saved more slowly.

Tell Readers If You’re Working – This one doesn’t need elaboration, but it’s important for readers to know if you’re still drawing an active income. And as two people who telecommuted for years, I can absolutely affirm that just because you’re doing it from home, it doesn’t mean it’s not “real work.” If you left the office but are otherwise doing your job, it’s still work.

Be Clear About the Limits of Good Intentions – We can talk all day about how important it is to be flexible, but how flexible can you be if you’re 75, you haven’t worked in three decades, the cost of Medicare has tripled so that health care is now your largest expense, and you just found out you have stage 3 cancer? Is that when you’re going to “just go back to work”? Of course we all must stay on top of our spending in early retirement (and traditional retirement), and constrain it if the markets start tanking. But we owe it to readers to remind them that flexibility and frugality have their limits, and sometimes the only answer is to save a bit more or build in more contingencies.

Drop the Health Arrogance and Ableist Bias – This is going to sound harsh, but many bloggers are either blind to this or are deliberately choosing to see themselves as better than others simply because they are currently healthy. And hey, lucky you. There is a lot we can all do to improve our chances of staying healthy over the long run, and if you aren’t focused on staying active and eating healthily, I think you’re doing it wrong. But to say to your blog readers that you can control the costs of health by making healthy choices is straight up lying to them. First, none of us can control the cost of health care, and health insurance alone is currently going up in many states by 20 percent a year. (That’s about seven times the rate of overall inflation, each year.) And that’s before the expected cuts to Medicare arrive, even though the average Medicare recipient already has to pay more than a quarter million dollars out of pocket on health care between when they get on Medicare and the end of life. But more importantly, anyone can get sick anytime. Even the healthiest people. Or you could get hit by a car and need massively expensive surgeries and hospitalization. We can and should do everything we can to improve our odds, but we can’t even begin to control this stuff. Because health isn’t something you can plug into a spreadsheet. So don’t talk about it like it is.

Talk About Your Backup Plans and Their Limits – If your plan fails, what happens? Do you have contingency plans you can fall back on, like a home you own that you could downsize to free up resources? Do you have family you could move in with if it came to that? Do you have family connections that would let you move to another country with free or inexpensive health care? All of this stuff matters, because it provides your reader with important context. Saying it’s fine to save slightly less than your numbers suggest you should means something different if it comes from a blogger who has a big fat safety net versus one who doesn’t, and readers deserve to know your context to assess whether your advice feels right to them.

Consider the Usefulness of Partial Numbers – There’s no need to share your actual numbers if you’re honest with readers about your general financial situation, particularly on questions like whether you have or had student debt, the range of what you earn(ed) and whether you’ve had any windfalls that have sped your progress. But if you don’t share all of your numbers, consider whether it’s useful to share any of them. A popular metric to share is savings percentage, and there was a time when I shared ours too, but if you don’t specify the “Of what?” answer, the percentage itself will shame some of your readers into feeling that what they’re saving is a fail, and it will tell others that you must have such a crazy high income to save that percentage, and therefore you can’t possibly be talking to them. Better metrics to share are those that could truly apply to anyone’s situation like progress percentage toward your goal or simple facts like whether you reached your saving targets or not. Info like that keeps you accountable on your journey without the unintended side effects.

Keep Yourself Educated About Financial Realities – Very few FIRE bloggers are trained financial experts, and that’s fine! Sharing real world examples of the FIRE journey is absolutely inspiring to a great many folks. But if you opt to write a blog about a financial topic, you have the responsibility to stay in touch (or maybe get in touch in the first place) with the financial realities for most people, including those who might be very different from you socioeconomically. If you don’t know anyone who couldn’t come up with $400 out of savings in an emergency – an attribute that describes half of the country – or if you read those income figures above and thought, Really?!, that’s a big sign that you have some work to do to get grounded in what most people are up against. The more that you reflect that reality in your writing, the better your blog will be, and the better it will serve your readers.

Your Turn!

Obviously I have strong feelings, but I’d love to know yours! For non-bloggers, what do you wish bloggers would universally do more or less of? Is there anything that would help you in your planning that bloggers aren’t generally doing now, or are doing and should stop? And for bloggers, what would you add to or subtract from this manifesto, and why? Anything you take issue with? Let’s discuss!

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: community

Tanja, Thanks for the candor. Bloggers who left a job and now draw income from the blog have changed their income model from employee to free lance writer. Being a free lance writer has many lifestyle advantages and can not be affordable to some, who have debt or other obligations, so it is still an accomplishment. Understanding this change in income sources is important to potential early retirees because a source of income reduces the stress on the retiree’s portfolio. Fred

It absolutely does reduce portfolio stress. And it just colors their perspective on things. If you know your investments have the pressure off, it’s easy to feel optimistic and breezy about all things and to therefore push your readers to be equally nonchalant about things that may very well warrant a bit more focus and concern. ;-)

Speaking of different realities … I used to work in financial literacy. We had community focused staff who did grassroots, face to face workshops and programmes generally with people on very low incomes struggling to make ends and meet and low financial knowledge/skills. We also had, at the other end of the spectrum, a person who focused on investor education (a lot less frontline, a lot more media focused). That person was so frustratingly out of touch, hassling those of us who didn’t live in the inner leafy suburbs for our long commutes (us lowly staff lived where we could afford to) and literally puzzling over why people at large don’t contribute to superannuation (who can’t afford $20 a week? That’s chump change) and don’t have emergency savings to avoid borrowing from loan sharks (apparently he actually believed that everyone has a solid EF 😳). Truly bizarre disconnect.

Thank you, from someone with a master’s degree who is barely making ends meet. I budget only £40/week for food, groceries and misc after all the bills have been paid, and even then my income-based-repayment on my student loan isn’t close to cover the accruing interest. So my debt continues to grow even with the monthly payments I’m making, and early retirement, let alone a savings account with money in it, are pie in the sky for me. Not exactly what I expected from a solid education. I follow ONL because I find it very interesting and I do hope to do something like it someday, as unlikely as it seems. I am expecting a rather large salary increase about a year from now (after qualifying professionally, leaving public practice and going to industry), so hopefully that will help start to turn this runaway train around.

I appreciate so much that you read ONL despite what must feel like some overwhelming obstacles to reaching FI! You’re such a great case of someone who has achieved a great deal academically and is clearly very smart, but you have some circumstances that put FI out of reach, at least for now. And I do think some of the messaging out there has probably made you feel bad about that. But you have nothing to feel bad about, and I commend you for being so focused on your finances when it must be awfully tempting to go the nihilistic way sometimes. :-)

That’s troubling to hear! I saw a stat just today that in the U.S. at least, the top 20% own 93% of the stocks. So when you’re talking about stock investing, you’re already talking to only a small slice of the population. It is mind-boggling when people do not recognize that.

Good points here to consider for FI blogs. From what I’ve seen most do a good job of disclosing incomes and talking about their side hustles. For me it comes back to what so many people don’t understand about the “RE” part of FIRE – most of us are not striving to fully retire, we’re striving to retire from the traditional W2 job and do what we want. We still want to make money, but on our terms. Call that gig-economy, freelancing, whatever. But blog income clearly falls in that realm.

As I said in the post, I have no problem with the income, and you’re right that many do disclose it. The problem is with how that then changes your view of your portfolio and every other aspect of early retirement finances. If you don’t disclose that, “Well, I might actually be a bit more risk-tolerant and confident generally because my portfolio has all the stress lifted off it,” it’s a huge and important omission.

The health assumption is a big one for me. I see a lot of folks who think that they’ll be healthy forever, but my family has been through the near death of my husband from septic shock six years ago. Even today, that event still has impacts to his health. I also have two friends who died of cancer while having young kids, and my husband has a friend battling cancer right now. The “it can’t happen to me” mindset is just incorrect. And if it doesn’t happen to you, that’s great! But it doesn’t mean that there aren’t millions of people out there battling their own or a loved ones ill health.

You guys have been through some truly awful stuff, for sure. I appreciate that you share your story, and I hope it convinces some of the “We’re healthy so we can control our costs” folks to reconsider that shortsighted view.

Totally agree, and I appreciate this blog calling that out. I’m a vegetarian who trains hard and has raced bikes for over 20 years …. and I’ve had cancer, pulmonary embolisms twice, and live with rheumatoid arthritis. When bloggers advise “just eating right and exercising” I roll my eyes and think, just you wait.

As usual, love the honesty and the fresh view! Great, detailed read! I wish more bloggers were as forward and open book as you guys! :)

Thanks so much, Corinne! :-)

Great points, Tanja. I think if anything though, people are often too tepid to test the waters, and they end up staying in their jobs longer than they need to, out of fear. “If I could just get to 2 million, or 3 million, or even 4!!!”

We probably do oversell some of this stuff because hey, if it’s working for us, it must be easy enough for everyone else, right? That’s why it is important for bloggers to write about failure as much as, if not more so, than success. I blew it big time in my 20’s and early 30’s – when you SHOULD be socking it all away.

As for health – you’re spot on. But part of what makes early retirement enticing is the health benefits of getting away from that coffin of a cubicle. Health care costs are too stupid high in this country. And I’m hopeful we eject the current clown and push towards some sort of Medicare for All in a couple of years. I can dream.

In the meantime – I’d encourage all of your readers to do their homework. The numbers don’t lie and the math is pretty sound. If nothing else, remember that life is full of twists and turns. Building your margin of safety is super important, but so is enjoying the ride.

It goes both ways. There are for sure folks who feel too scared to make the leap and work far longer than they need to. I’m not worried about those folks financially, and I do think it’s right to encourage them to pull the ripcord and live their dreams. It’s the other folks, the “get out as fast as possible” folks who I worry many blogs are encouraging to just wing it. To your point about sharing failure, the inherent problem with blogging is that it’s totally optional, so those who in fact fail at ER are unlikely to talk about it. They’re more likely to just disappear. And so we have nearly 100% of retired folks making it look all rosy, and while it’s great that it’s rosy for them, I think we’re potentially missing an important piece of the picture.

On health, you’re absolutely right that many jobs come with health impacts these days, and the stress generally is affecting all of us. But retiring is not a cure-all, either. And we shouldn’t act like it is. (I don’t think you’re saying that! Just making a general point.) ;-)

Right on, sister. I know you’ve mentioned migraines that haven’t dissipated (though I hope it’s just a lagging thing and time will help.) I personally have an auto-immune thing that’s triggered by stress. Workplace stress and domestic stress are the two biggies that get me. I’m hopeful that eliminating the cubicle solves one of those instantly, and then helps mitigate the domestic in turn.

It is a good point you make. The bloggers who keep writing on after hanging it up should be the ones we cling to the most. Interestingly, some go back to work for no better reason than they’re bored (I think that’s what happened with Jacob and BNW?)

Tag line for the day: “Early Retirement: Don’t Wing It. MATH IT!”

Mark has a stress-triggered autoimmune issue as well, and we’re hopeful the lack of work will help it! But not so far. Too soon to tell, though.

I hope he see some improvement. I’ve been reluctant to write about mine, but I think it’s going to happen in the coming weeks.

I get that it’s tough to share, but I can also say that every time I’ve written about our health stuff, I’ve gotten lots of notes from people who’ve said how helpful it was to them. LOTS of people deal with chronic health issues, and it’s so nice to know you’re not alone.

Love your writing. You have such a great way of expressing your thoughts and ideas. This is great topic and very well done. I remember reading a little about one of the very first retire early bloggers that is now making high 6 figure income off their blog and it seems he was worried about hurting his creditsbilty of his blog. I think your approach is needed, transparency is a good thing.

I look forward to getting my emails with each new posting from you.

Thanks so much! :-) I truly have no problem with bloggers making money as long as they disclose that fact AND acknowledge how it might be coloring their view on things like risk tolerance and how much folks need to save. Most of the people I see saying that the 4% rule is too conservative, for example, have another income source from a blog, pension, etc., and I don’t think that’s a coincidence.

Great post!

It’s easy to understand why people might find it tough to talk about these things, but just because you disclose being a low, middle or high income earner, does not mean you have to give out hard numbers!

The health one is a big one too and cannot be underestimated. My partner will have to be on medication his entire life, regardless of its price, so that is something we decidedly add into the equation!

Gosh, we can relate on the meds! Mark’s meds are $1000 *generic* without insurance. We chose our ACA plan entirely on the basis of drug coverage, and thank goodness it is now affordable!

Thank you for bringing up the health issue. An accident or a disease can derail the best plans. As you age, you must be pro-active about your health. That costs money – whether you go to acupuncture, buy herbal remedies or get body work — you need to pay for it. Once you hit 50, there are many preventative procedures you should do. If you have a sub-par health plan, these procedures could cost quite a bit of money. Everyone has a different situation but I do believe you need to spend money to maintain your health.

Being pro-active about your health – sure – but acupuncture is a scam, and so are most herbal remedies. With the exclusion of a good cup of tea to improve your mood, but hey, that doesn’t have to cost a lot. I wish people would stop promoting these quack “remedies”, as they cost money and sometimes cost people their health or their life – for example if they fail to go to a real doctor on time.

On the other hand, there’s a very strong correlation between taking vitamins and being healthy, even though vitamins do not themselves make anyone healthier. The advice I’ve heard is to be like a person who takes vitamins without actually buying or taking them, and I wonder if the same could apply to acupuncture, homeopathic remedies and other “treatments” that rely heavily on placebo effect. ;-)

Is there new science showing the effectiveness of acupuncture? Every past study I’d seen showed that it was an expensive placebo effect. But I’m also not opposed to doing some things for placebo effect, so long as they aren’t harmful and are cheap. ;-) To your larger point, though, eating healthily costs more than eating junk food, and staying active might require a gym membership in a place where it’s cold in the winter or too hot in the summer to exercise outside. We DO need to invest in our health. But even then, we can’t control what will happen to us, only improve our odds.

Perhaps it’s a placebo, but acupuncture and reflexology changed the pain level in my body substantially. And did not actively cause harm. The same cannot be said for the western medicine routes I was offered.

I’m super glad to know that. I don’t know if it’s just me, but acupuncture is super painful. For a while, I was seeing a naturopath, but insurance would only cover it if I also got acupuncture from her. By the last few visits, I was begging her to do just one needle. And I don’t mind needles for things like blood drawing and I even did platelet donation for a lot of years. But there is just something about acupuncture needles. (Oh, and perhaps obviously, I didn’t feel like it helped me.) ;-)

Fascinating. I felt all sorts of weird things. But no pain except for the one time a solitary needle went in too far. It was so soothing to me that I fell asleep for most of the procedure. I was super skeptical going in and am still skeptical, but I go with what my body reacts positively too. Reflexology (same premise as acupuncture, but just massage) works even better for my body than acupuncture. I don’t understand it, but I accept it for me. I also accept that it may be entirely placebo. But it’s placebo I love.

As always, I’m just glad it works for you, even if it’s a miserable thing for me. ;-)

Yes to all. I think each item in your manifesto is key, but a few stuck out to me…

Tell People if you Work: This one is big for me. I have found myself enchanted, then woefully disenchanted by a few blogger narratives. I’ll hear the “I’m retired!” and image their days doing as they please… enjoying family, activities and volunteering. But when I find out they are working in some significant capacity (30 hour a week blogging certainly counts in my books!) and making a decent income, I’m thrown for a loop. Its not that they found their ideal life or that they found meaningful work that annoys me, it is the lack of transparency vs. what is touted in their writing.

Health: Sure, it is great to encourage folks to live a healthy lifestyle. This will certainly help increase chances of a healthy body with less medical intervention needed… but it by no means guarentees a low cost medical life. Pretending that “eating lots of farm market veggies + running 3 miles a day” will ensure health is just silly. This is where I want to stand up and shout “We are all in a unique situation!” And our unique situation may include genetic issues, tough habits to break, the inability to afford healthy options, living in a food desert, bizzare diseases/accidents and so many more factors that affect our health.

Great article and thank you for posting, Tanja!

ps- Loving your powder-day Instagram posts!

I agree — sometimes the lack of transparency is just disillusioning and not necessarily unethical. And yeah, on the health stuff… sigh. ;-) Thanks so much for your comment here and the encouragement on Twitter! Stay tuned for more pow pics. :-D

I don’t know this for sure because I don’t consider myself a FIRE blogger, but my guess is that a blogger starts off with one perspective and their site gets popular. They retire and then their perspectives change. You view yourself as having gotten popular because of your previously held beliefs (especially you see it repeated elsewhere) so it’s hard to change publicly. Maybe you’re concerned it’ll mean people won’t read your stuff anymore?

I don’t know if FIRE bloggers “owe” it to their readers but I think that sharing how your perspective and approach changes has tremendous value. Very few people are on the other side of FIRE, the retirement side, and so there aren’t obvious models that you “know” are right. You can plant your flag in the ground somewhere as your way and be one of the first.

As a side note, I know I have seen people get upset when they learn bloggers make money. This happens everywhere, not just FIRE blogs. If a blogger tries to sell a course or an ebook, people react negatively. They put advertising on the site and people say they hate it. Not a lot of people but they can be vocal. But after years of giving away free material, shouldn’t the blogger get some compensation for their time if it makes sense?

I had an initial reaction to the word “owe” in the title. It reminded me of a Bart Simpson quote about Comic Book Guy complaining about a bad episode of Itchy and Scratch (http://www.imdb.com/title/tt0701245/quotes/qt0207837):

“Comic Book Guy: As a loyal viewer, I feel they owe me.

Bart Simpson: What? They’ve given you thousands of hours of entertainment for free. What could they possibly owe you? I mean, if anything, you owe them.”

Aww that’s a low blow, using a Simpsons quote against me! ;-) I think there is plenty bloggers DON’T owe readers. I don’t owe it to anyone to stick to the posting schedule I established. I don’t owe it to anyone even to keep blogging if I don’t feel like it. I don’t owe it to anyone to keep my blog ad-free or sponsored post-free or to use a mobile responsive-theme. Doing all of those things is my choice. But, if I’m going to hold myself up as an example — which is what every PF blogger is doing — I do owe it to readers to be completely transparent about the factors that will allow them to assess if what I’m saying applies to them. If I say my blog is nonfiction, it needs to be nonfiction. Surely you wouldn’t quibble with that. ;-)

There’s probably a Simpsons’ quote for everything. I actually thought that Lisa said it. It doesn’t seem like the kind of thing that would come from Bart.

I think the word choice of “owe” is very loaded, especially with a “manifesto” in the title.

I’m not sure that every PF blogger is holding his/her self as examples. I think I’ve just been just telling my financial story for the last 11 years (which does include some example stuff because that’s natural).

I don’t know if I have seen a blogger say that his/her blog is nonfiction. If a blogger does say that then certainly I won’t quibble with an accountability with that declaration ;-).

I’d argue that if you don’t say it’s fiction, the implication is that it’s nonfiction. ;-)

I AGREE entirely with this. The danger with not being ‘honest’ about the success of FIRE/ER while blogging is that someone who is not as ‘woke’ may take a bloggers words too literal and make a huge financial mistake that they may not be able to correct. It’s especially dangerous for someone who has a lower income or savings buffer and may have lower marketability, so a recovery for that person won’t be as easy. I applaud the community for all it gives but it can be a dangerous trek for someone who just doesn’t know any better. High income earners don’t owe per se, but it’s our moral obligation to ensure we don’t ruin someone’s life with untruths.

Gosh, yes. And you made a particular point in here that I think is super important to acknowledge: higher earners are more likely to be able to bounce back after adversity, for a wide range of reasons. They likely have more education, and higher education levels are always linked to lower unemployment. They likely have more in-demand skills. They likely have more financial literacy. I could keep going, but you get the idea. Thank you for adding that in!

Worst episode ever…

Just had to do it and finish the quote.

I think you make a good point about changing perspectives of blogs/bloggers. We used to read some blogs that we now avoid because their focus and tone changed so much that they are barely recognizable now. The bright side is that there seems to be an endless supply of other interesting blogs to take their place!

That is the wonderful plus side of the community having grown so much! There are so many great new blogs to discover all the time.

I think you’re exactly right. You’re on the record with one approach and maybe it feels weird to acknowledge a change. But how boring is it to stay the same? So much more interesting to trace your evolution, especially given that the principles of FIRE are not rocket science and don’t require ongoing blogging. It’s the personal story that people come back for.

And on making money, as I said in the post, I have zero issue with bloggers getting paid. But I do think, especially with FIRE blogs, earning a side income that lessens the stress on your portfolio without seeming to do any “work” (What?! I’m just blogging!) can’t help but color your worldview, make you feel more confident and optimistic, and if that results in you pushing readers to make the leap before they’ve reached their solid FI number, for example, I think your readers deserve to know what’s behind that risk-embracing worldview. The income isn’t the problem, it’s what it can potentially do to the advice you give.

Wow cannot thank you enough for this! Glad to see the whole community waking up to realistic numbers, though some will always continue to fight, the numbers don’t lie. Perspective is everything, you can be “middle class” in your particular town, or county, but when you jump to state level, all of US, or even better the world, that changes things. And blog readers can be anywhere. If your blog is based on your experience and advice of FI with the intent of telling anyone else they can also do what you’re doing, you do owe it to them to share what you’re ACTUALLY doing.

Well said! As some other comments here affirm, there will always be quibbling over what constitutes “middle class” and whether earning six figures in an expensive city somehow makes you poor. (I call BS on that.) But failing to acknowledge that you’re still way ahead of the bulk of people, and that that is what allows you to save quickly, is a major lie of omission.

I think (and hope) you’ll get a lot of love for this post! Such an important message. I think the FIRE community can turn into a bit of a bubble where we’re all patting each other on the back, when in fact we all need this type of accountability you’re describing.

One additional thing that has irked me is when bloggers may share about their windfalls as they happen, but then don’t incorporate that into the overall narrative that they continually tell. Most of us have had “boosts” along the way, some bigger than others, and that’s wonderful! But when the overall narrative is anyone can do this, not only is your income probably out of reach to most people, but also those windfalls are not reproducible. Some of this may be due to media coverage more than a blogger’s actual writing, and I understand that it may feel redundant to keep stating the same thing, but it just needs to be loud and clear that everyone may be able to do X or Y, but not necessarily Z.

Couldn’t agree more, Kalie. I do think there’s some icky stuff that happens with news headlines that bloggers themselves likely wouldn’t choose, but setting that aside, I think it’s so true that many windfalls aren’t reproducible and play a big role in the savings rate for folks who get them. And yeah, the “anyone can do this” and especially its follow-up “and if you don’t, you’re an idiot” narrative has got to go.

I completely agree about windfalls and how I’m sure most aren’t talked about.

But what struck me most about what Tanja said is the whole pretending your income isn’t so big. That really does bug me and there is a very very popular blog that just loves doing that.

I mean if you really care you can do the math and figure out that they make well over 100k a year. But the constant message on their blog is we are just like you, we don’t make investment banker money. And I’m like ” really your going to compare yourself to people who make 250k + a year to make your self sound middle class.” Eye roll. Like you said it’s very disingenuous for people who can do the math and see through it.

I didn’t know all the number stats but I did know 50k is average… Making double+ that puts you well out of average territory.

But I also know sharing half numbers is shaddy business too. Strongly why I am considering purging our net worth post from our site.

I’m definitely not trying to push you to take your net worth down, so long as you provide folks the necessary context to understand what it means, how you got there, etc. As you can see from the comments here, LOTS of people are interested in seeing others’ numbers, but as you said, it’s the selective sharing that’s potentially problematic.

Thank you for sharing this, your blog often helps point out the more human side of the FIRE community. I had my share of stupid money decisions early in life followed by a divorce and layoff in a economically depressed part of the country. I’d like to add another point that the FIRE community seems to always be pushing: People can move to better parts of the country and/ or work online and make more money. While I’m sure I could move to a big city and make much more income, I am not giving up 1/2 the year with my daughter to do so. Many people in the area including myself have no or limited access to internet at home. While I understand bloggers aren’t able to address all unique situations, I do think some are blind to the realities of large groups of people.

I couldn’t agree more. Some bloggers ignore realities, like family obligations, that influence where people live, the car they need, etc.

Absolutely. We have no business telling someone who transports a disabled relative that they are wasting money owning a car, and should instead be riding their bike everywhere. That is for them to decide.

That is such an important point, and a big part of why staying grounded in real life realities is so important. There are a ton of good reasons why not everyone can move — specific industry, kids, needing to care for a loved one, and lots more reasons — and I think that telling folks to move or just work online can be awfully insensitive.

Well put Getting2Living! I get frustrated with bloggers acting as if it’s easy to change significant parts of your life purely for the goal of better money. I feel pushed at times because my husband and i both choose to work at jobs with lower pay but higher satisfaction for us both. Yes, our progress is slower, but it doesn’t seem like a reason to leave jobs where we’re happy. I’ve had horrible, horrible jobs in the past, and a reasonable work environment is extremely valuable to me. Money isn’t the only factor.

It’s also a little offensive to watch bloggers try to appear that they had lower salaries when it’s clear there’s no way they reached FI on my salary in a supposedly similar field.

Great post, Tanja. This is an important conversation.

YES to all of this! The idea that you’d ONLY care about money in your career and not the whole picture is bonkers, but that is definitely the vibe you get some places. And the idea that anyone can just pick up and move or downsize a home or get rid of their car, it’s all just so insensitive because not everyone can do that stuff, and not for lack of commitment to FIRE.

It seems that this presumes the FIRE model is build a big nest egg and draw down on it. It doesn’t seem to cover a scenario where someone could retire through a large blend of income streams from royalties, businesses (outside of blogging), rental property, etc.

While I may write about the 4% rule, it’s more for the reader’s information of what some people are doing rather than a personal plan.

I think most readers of personal finance blogs get an idea of whether a blogger is high income if they follow the blog for any length of time. Usually they talk about what their current or past career was. I think it becomes a thin line to walk to keep telling readers that they have a high income. High income doesn’t necessarily tell the story if the blogger lives in an area of a high cost of living.

Maybe it should be about high-income for your area. The median income in my town is $75,000, so the $80,000 number in your article is pretty close to just being average, not in the top third. It’s a little harder (maybe impossible) to get specific costs of living for most cities/towns.

The problem with the health question is that it can’t really be addressed. Like you say, it can’t be put into a spreadsheet. Everyone is going to be different. However, it is helpful to have *some* numbers, even on an average basis to go by. Otherwise, you can’t ever plan for FIRE. I think it’s also important to recognize that US health care is not normal and perhaps it is worth exploring a contingency plan to get health care elsewhere.

I make it a point to write every couple of years how people don’t have the savings of $400-$1000 for emergencies. I’m happy to see that many bloggers cover this.

If you are wealthy enough to live in a rich town you can claim that your high income is average “in my town” but that’s still a basically misleading claim.

Wealthy areas of larger metro areas have been separating themselves out into wealthy municipalities for almost a century now, for the specific purpose of segregating themselves from poorer places. Even in poor states like Alabama there are rich towns like Mountain Brook, which has a family income of $130K.

If you’re going to make the “for your area I’m average” argument, you at least need to go by county, if not entire metro area.

For instance, I’d accept that a family making $80K in the Bay Area is only “average” even though they make 40% more than the national average, because most of the counties in the Bay Area (totalling a population of several million, so it’s not all doctors and engineers) have median family incomes over $80K.

But that argument doesn’t work so well outside the really expensive big metro and coastal areas that have high incomes on a metro or county basis.

If you state the town or area that you live in, I don’t think it’s too misleading.

Looking at my county, Newport RI, instead of just my town, the median income is $69,526. I grew up in Middlesex county, MA where the median income is $83,488. That’s a county that includes a lot of suburbs of Boston. It’s no Bay Area… that’s a much, much bigger step up. I lived in Foster City for awhile and the median income there is $143,004. I think that’s normal for the county if you know the area.

I’ve always been in the coastal areas, so I see what you mean, but these aren’t extreme examples like NYC, SanFran, or Boston proper. I think this argument applies to a lot of people because, well, many, many people live in the cities in coastal areas.

This discussion kind of gets to the point that I was trying to make. Even within the United States (or poor states like Alabama as you point out), actual location of that income matters greatly.

I used to live in Foster City just a few years back. $143,000 doesn’t cover it anymore. The Bay Area is not the norm but I will tell you I couldn’t have FIRE’d at 52 without living and working there for the last 8 years of my career. Not the norm, my experience is impossible to emulate anywhere else. This is why those of us in the 3% club (or higher) can’t give meaningful advice (based on our own experience) to those trying to FIRE who are from “average America” earning “average wages”. Heck I made $500,000 on a house I owned for 2 and a half years. For this reason I tend to believe the FI guidance / experience of those who look more “average” give more practical advice (this blog is the exception to that) to their readers than do many others.

The Bay is definitely a massive outlier at this moment. I think very high earners can share good advice, but if they believe they are “middle class” and present their advice accordingly, that’s when it’s a problem. ;-)

Locality impacts your spending power, but not so much that a local median is an acceptable substitute for grounding yourself economically in the bigger picture. You for sure could say something like, “My income is in the top fifth for the country but I’m right about the median level for my area, which is especially high cost.”

Couldn’t agree more, David. Very well said! The locality adjustment skews things and is just another way to mislead. I don’t think that any blogger using that metric is intending to mislead readers, but it does suggest they’ve lost touch with what true median income means and could stand to be reminded.

I’m going to push back because I think this is a dangerous conflation. Nearly universally, places that have a higher cost of living also have proportionally higher incomes that more than make up for that higher cost compared to lower cost places. In addition, comparing median incomes in your area only has the potential to skew things rather ridiculously, particularly in more well-off places. If you’re 40th percentile in Belair, I can assure you you’re still flipping rich. Hell, in Belair, being in the lowest 10% still puts you in the 0.01 percent in America. I know that’s an extreme example, but I’m using it to illustrate the point. What I’d propose is saying something like “I earn an income that’s in the top 10 percent for the U.S., though I live in an area that’s 25% more costly than the U.S. average, so that reduces our perceived wealth accordingly.” Calling yourself middle class or median income if you earn the median for your area but your area happens to be pretty wealthy is telling a very skewed version of your story.

Great points, what I’m most considered about is the health piece. We take care of our bodies, are active, and have good eating habits; but you never know what fate has in store for you. I don’t like the instability of the healthcare system and the national conversation of whether healthcare is something that should be available to everyone at a reasonable cost (it should). No matter how many yoga sessions, bike rides, or miles of hiking I do – I can still get cancer, be in a car accident, or be struck by lightening. No one should go broke over health issues, and taking care of our bodies is only one part of the puzzle.

Absolutely. I think a lot of us share your concern! I’m hopeful that our leaders will take action on the health care crisis in the next few years and try to stabilize the costs and quality for everyone, not just the folks for whom money is no object.

I agree with a lot of what you said above. It gets under my skin when bloggers still claim to live off of ~$25k/year (for example) but then admit they don’t track spending numbers,and that they’re just an estimate and don’t include any actual real life spending that they actually spent money on. Spending is spending… I’m with you, I don’t care if you make money, good for you, but don’t say “I’m retired, we did it. Oh but my wife still pulls in a full time income that covers all of our bills, but that doesn’t count…” In what world does that income not count? That’s my pet peeve with the FIRE community – people that “retire” and then act like their plan worked when in reality they have a HUGE buffer exactly like your situation described above. When I leave work in another few months, there won’t be a massive “I retired” post headline because I’m jsut going to do what so many thousands of other parents do and become a Stay at home Dad/parent. Maybe I’ll get to earn some coin somehow and try consulting or maybe not. We’re so close to our “never work again” number that with a decent income from Mrs. SSC covering our bills, we’re freaking golden whether we save anymore or not. Pretty simple. That’s hell and gone from what our plan was when we first started planning for this idea, and even from a year ago. Things change, plans change, incomes change. I don’t get why it’s hard to just be honest with people about what your situation really is, however much it has changed for the positive. It’s like celebrate it, you did it, don’t feel shamed or embarassed and downplay how much you succeeded.

We don’t do specific numbers as far as a target number or specifics of what we have saved or even what we make, but anyone can go back to our monthly spending reports and take 3 mintues and figure out we’re in the upper 3% of the country, and that’s even with Mrs. SSC losing $100k/year. Even when I leave my job, we’ll still be on the border of the top third of incomes in the US. It has worked out well for us, but we also don’t try to sell the hype of living off of less than what we actually spend. We estimate our lifestyle change spending by taking out daycare, and mortgage which cuts our current spending by almost $50k/year, which is still amazing to me, but beyond that, we try to reflect what our situation is and let people judge for themselves whether they want to follow it or not.

That’s why I harp on “track your spending, track your spending, track your spending…” Whether you make $45k/yr or $145k/yr if you don’t track your spending you can’t do anything about trying to improve your situation. Sure it’s a lot harder to save $$ when you’re making $45k/yr but even I was still able to put away 15% in a 401k when I was making that much. That was during my horrid overspending and not tracking my spending days when I was blissfully ignorant of how to manage finances well.

And healthcare… A friend at work went from “healthy”, not overweight, non-drinking, eating well, good lifestyle to needing dialysis 3x a week, and is about to be put on an organ donor’s list this summer and that all changed within a matter of 6 months. Again, she wasn’t overweight, ate healthy, no history of health issues, but life happens, and hers went from top physical form to death’s door and multiple overnights in the hospital every single week, in a 6 month time frame. You can’t exercise that sort of situation away…

My mother never spent a day in the hospital in her life (except giving birth), never sick, never a broken bone and then BOOM! Cancer at age 59. You never know when something will bring your life to a standstill.

Yes! I think people get hung up on “sexy” titles rather than being able to be proud of what you’ve done and honest about what you did to get to it. Congrats to you for owning your process and being able to leave work soon!

So agree. We need to do away with the sexy titles and just be real.

I give kudos to people that track their spending and sharing their annual spending. That’s more transparent than saying that “oh we spend about $30k a year.” It’s easy to say that, a lot harder to back it up with actual numbers.

If there are exceptions, like your wife still works full time, or you are getting $40k a year from the blog, or anything else, explain it. It’s all about being transparent.

Hear, hear! Absolutely agree.

I’m so excited for you that you’re leaving work soon! :-D And yes 100% to things that “don’t count.” If you’re going to share numbers or tout your success as having happened a certain way, you need to be clear about all of it.

I think you’ve been very transparent about your income ranges, and about the fact that Mrs. SSC could afford to lose a big chunk of income without it hurting your progress much.

I’m sorry to hear about your friend at work! That’s awful. :-( And such an important reminder to all of us not to take our health for granted.

Yes, Yes, Yes. Thank you for this refreshing take. Health has always been the biggest one for me. My husband has suffered with Lyme disease for over 25 years. Some of the newly “retired” do not even have children, I have a child that was born 11 weeks early and spent 6 weeks in the NICU. Nothing can prepare you for that. He is literally my Million Dollar Baby.

Wow, you guys have dealt with some big health things! (I was also born super early and spent my first months in the NICU, so stories like yours always speak to me especially. I’ve had health consequences from that my whole life, and there is nothing I could possibly done before being born to prevent that stuff. An important reminder about the limits of individual choice in our health!) Sending lots of good, healthy vibes your way!

Possibly your most controversial post yet. Does that mean more time on your hands is allowing you to spend some time in darker corners where you haven’t had the time in the past :) ? I read about 8 FIRE blogs. I’m generally impressed by a few things in the ones that I read. First, most are quite up front and honest with their situation (income during accumulation phase) and their income from side gigs. I’m impressed with the general openness – some with very detailed (down to the penny) accounting of what they spend and what they are still making on side gigs (or now their main gig). And then how many have left their career only to have found a way to earn money in a different and less time consuming way – at least not 40 hours a week and 52 weeks a year. They say do what you love and you will never work a day in your life.

I’m a big believer that you have to change with the times. I’m going into my retirement thinking I will never work full time again. I even tease my friends who have retired and returned to the work force as “failures in retirement” and setting a bad example for me because I need new role models. In politics they call it “whiffle-wafting”. I call it getting more knowledge through eduction, experiences, etc. and making a new decision for a new day.

Thank you for being as open as you are. I had fun backing into your retirement numbers from the information that you have shared – I like spreadsheets – A LOT :P . Appreciate that you continue to make time to blog. I’ve got to get ready for my Wednesday 8:00 a.m. tee time!

Hahaha. Maybe! ;-) And I do agree that a good number of blogs are open about many things. That’s why the manifesto goes beyond just transparency. ;-) And I love how you put it with regard to future work: “making a new decision for a new day.” If anyone is turning down something that sounds super interesting and fun (and lucrative!) because they don’t want to have to say they failed at retirement, that’s a backward set of priorities.

There is actually a very lively conversation on this very topic going on right now on the Mr Money Mustache forums. The thread is focused on the Frugalwoods. I won’t go into the details here but it’s worth popping over there to check it out.

I consumed all the Fire blogs in high volume at the beginning of my journey (about 2.5 years ago) but have since became a bit disillusioned and find myself rolling my eyes more often than not…lots of repetition, rehashing the formula of make more, spent less, invest the difference. I would like to hear more about their post-fi business ventures. They’re a part of the equation and as an aspiring entrepreneur I would appreciate that perspective more.

And of course with the financial success of many blogs you start getting more and more bloggers trying to replicate the model and things get diluted a bit. There is even a newer podcast that essentially aggregated all of the fi bloggers in one spot. Started off strong, got really weak despite the hosts’ (annoying) enthusiasm…would love to see those guys create something new vs trying to get paid off of other bloggers’ work :)

Anyway, I think I’m going to start reading your blog more in depth vs just skimming the emails. Sounds like you have the potential to be a more realistic virtual mentor.

Do you have a link to the mmm forum thread?

https://forum.mrmoneymustache.com/welcome-to-the-forum/what's-up-with-the-frugalwoods/

Thanks, Kate! :-)

I think he’s referring to this (long) thread.

https://forum.mrmoneymustache.com/welcome-to-the-forum/what's-up-with-the-frugalwoods/

You read my mind, Captain Cactus, and I’m with you 100% on the podcast. I used to tell my wife it sounded more like an infomercial than a podcast. That’s probably the main reason I stopped listening. The only place I disagree with you is that I think the FI space is more than “a bit” diluted at this point.

I’m honored that you found this post worth reading! ;-)

I appreciate your note at the end very much! I don’t know that I’d call myself a perfect mentor by any means, but I do my best to keep it real and not to rehash other people’s content. ;-)

Who are these disingenuous bloggers? I read lots of them and I’m not seeing the same deceptions. Maybe I’m not looking hard enough, but I’m seeing income reports (either published or via newsletter), discussions of side hustles, contingency plans, etc… from transparent bloggers genuinely helping people.

Obviously, you’re not going to name names, but it seems like you may have a beef with one or two sites and are making broad accusations at dozens of FIRE blogs. Maybe I’m being overly defensive, but I think the problems you see apply to a select few, so why indict an entire category of bloggers? It feels like a manufactured controversy.

Best,

-PoF

I think this is precisely why a discussion of “what is middle class” is so necessary. Let’s say a FIRE blogger makes $200k/yr but truly believes they earn a middle class income, then they are going to present themselves to their readers as an average Joe. They may not intend to be deceptive or disingenuous but they are setting up a false narrative for their truly “average” readers to compare themselves to.

PoF, you’re great. You fully acknowledge as a physician you earn a high income and you communicate clearly that your intended audience are high-income earners. When I read your content, I take it with a grain of salt–not in a bad way, but I know that my household income is significantly less than yours and so your financial planning looks different than mine.

PF Geeks – You need to re-read your Mr. Money Mustache. These concepts cut across MANY levels of income. We don’t need a bloody discussion about “what is middle class”. Do you think MMM is presently a false narrative, living off $24K a year, even though he reaps over a million in blog income nowadays? He barely broke six figures before he retired. Keep your grains of salt in the salt tin. Stop comparing, and start getting after it – the way you know it’ll work for YOU.

Hey Cubert, I completely agree that a discussion on middle class should not be necessary because it should be based on data. The problem is that some people don’t get that and say that middle class is up to your own definition. So when a FIRE blogger publishes an article saying that a $300k income is needed to have a middle class lifestyle, then maybe a conversation reminding people what middle class is, is necessary.

I’m honestly more concerned about the path to reaching early retirement rather than what one does once they get there. Some people get in a tizzy because a blogger makes an income in retirement–I say, “Good for them.” I love MMM and read everything he puts out.

The math to get to FIRE cuts across income levels–but the paths and journey to get there looks drastically different at various income levels.

If you’re in the top 3% of earners as Tanja acknowledges she was then the path is lightning fast.

If you’re truly middle class, then it looks significantly different.

The problem comes when a popular FIRE blogger who is a top 5% earner presents his/herself as making an average income in order to make them more relatable to their audience. To me, that is presenting a false narrative. Do you disagree with me on that?

Side Note: The reason I mentioned my respect for PoF is because he presents his own story honestly and makes no attempt to present himself as average. Even though I make a truly middle class income I can learn from his writings and apply them to my context.

Let’s call some people out then. Who is masquerading as a low *income* FIRE blogger, when they’re making big coin? The $300K “middle class” example makes me really curious. Must be someone out of San Fran or Manhattan?

The one key thing to keep in mind, is that we don’t START OUT making a good wage. Over time, we make good decisions, we educate ourselves, we work hard. Suddenly, we find ourselves making six figures, maybe 10, maybe 20 years after we started out at $20,000 a year.

So yes, I agree that it’s a problem when a FIRE blogger doesn’t come clean about their income, *while claiming* to earn a modest wage. However, does it change the math behind savings rates, side hustles, low fee index funds, geo arbitrage, etc. etc.?

It doesn’t change the math, but it does drastically change what’s possible. And what message readers take away from it. I can tell you’ve read a bunch of the comments on this post — surely you saw quite a few from folks who said they felt super discouraged reading about how “middle class” folks were saving a huge percent of their income. But of course it turns out those folks were actually high income all along. If we’re discouraging readers in our attempts to encourage them, we’re doing it wrong. ;-)

It’s not always a linear exercise though. For instance, I spent well over 80% of my career under six figures and in negative net worth territory. The game changer wasn’t my income, it was rental houses. I’m always clear about how lucrative side hustles like real estate (and eliminating debt, avoiding debt) got us to our current standing.

So yeah, I was discouraged too – for many years, but time discipline and risk taking eventually add up.

And I don’t think you should stop telling that story! Just make sure you’re providing your context along with it, and it’s all good.

Well said! If middle class was a clear definition that everyone agreed on, and people used it consistently, we wouldn’t have to have this discussion. But as one notable post made clear this week, we’re not at that point.

I agree with your sentiment on people making money post-ER and think as long as they disclose that fact and think about how it might be coloring the opinions they espouse, then it’s all good. And agree that PoF does a great job of being transparent about his income and context! (He’s also awesome on the charitable donation front, which is close to my heart.)

The wrinkle I’d add is that it’s not about MMM’s or anyone else’s principles. That stuff is NOT rocket science, and the ideas are sound. But things like risk tolerance or how much people discuss the need for contingencies are very much impacted by the blogger’s mindset. And there is simply no way in hell that making many times your annual expenses on your blog doesn’t color your worldview in some way. And for some bloggers, it might very well make them less concerned about things that pose a real threat to the financial solvency of folks who don’t have the benefit of that large side income. Is MMM worried about health care expenses? Almost certainly not, because he can afford anything at this point. Therefore he doesn’t talk about them as a concern, and if lots of bloggers take the same approach, readers could easily get the impression that health care inflation is not a huge deal. When in fact it is. That’s why talking more about our own situations and how they impact our mindsets matters.

Agree, Tanja. I suppose that’s where the disclaimers come into play. But heck, even working until your 90 doesn’t guarantee you anything, other than regretting you worked until 90. ;-)

Absolutely true! There’s risk on both sides.

So perfectly said. And this is exactly what I’m talking about. Not folks who are deceiving deliberately (I know they’re out there, but that’s not who I’m addressing here), but those who are out of touch with what average really means and therefore see themselves as average or middle class when they are clearly not. It’s such a weird relationship we have in this country with money, and we both all want to be rich AND can’t see we’re rich when we get there. As bloggers who profess to be knowledgeable about money, we need to do better on this front.

I agree, I see an astonishing transparency on money issues that simply doesn’t happen in real life. For example I have no idea what my friends earn or spend. Or even what my brother earns or spends. But I have pretty good line of site into the incomes and spending of random internet strangers.

I guess they could be deceiving me, but the numbers don’t seem way off to me.

Thanks for the article.

I truly don’t think it’s about anyone attempting to be deceptive. It’s about folks who have lost touch with what the average earner is up against mischaracterizing their income as a result (because even the highest earners believe they are “middle class”) or not being transparent (perhaps because they themselves aren’t even aware) of how having additional side income or other hedges affects their confidence in the whole FIRE concept. If someone is telling readers that they shouldn’t be so worried about recessions and should just make the leap, but they aren’t actually relying on their portfolio because of side income, readers deserve to have that context.

POF, I have a question for you – if Tanja were a man and/or if she made the same kind of income as you did when you were still working full time, would your commentary be the same? Might you have stopped to consider that just because you don’t see what she’s seeing doesn’t mean that it’s not out there and just maybe you are being reflexively mansplain-y? I mean no disrespect to you but goodness that commentary feels condescending and I’m not the person who wrote the article or had the opinion. Perhaps your motivation for your blog is to help people, I don’t have an opinion either way on it, but I get the feeling that many of the FIRE blogs out there don’t have such pure motivations, many are repetitive, pick and choose metrics, and conveniently leave out important details or leverage points along the way. But, like anything in life and anything online, I take away what I like and leave the rest. I appreciate Tanja’s original contributions to our community because she DOES make me think differently about a lot of things and consider points of view I hadn’t previously considered and further acknowledge our extreme privilege and she has got me thinking more about my own ableist bias today (and how I can be more considerate).

@wishicouldsurf,

I wrote about six paragraphs in response yesterday, but apparently they got caught up in the undertow. I enjoy Tanja and her writing, and look forward to getting more face time with Tanja and Mark (is Mark coming?) at Camp FI Midwest in my home state of Minnesota this summer.

I may be a bit tone deaf as a white guy from the northwoods, but I don’t think my reaction would be any different if this post had been written by a man. Of course, implicit bias is difficult to recognize. To quote the Butthole Surfers, “You never know just how you look through other people’s eyes.”

I made the comment above because it felt like a bunch of my friends (and maybe me) were called to the principal’s office for something that they (or we) didn’t do, at least not to the extent of the accusations.

I do agree with everything in the manifesto. I think the blogs I follow, and that’s a lot of them, do a good a job as they can. It’s possible and perhaps likely that the blogs being called out are ones that didn’t appeal to me or didn’t seem genuine, and I moved on without paying much attention.

An oft-cited recommendation in blogging is to write for a particular niche, or better yet, one fictional person or “avatar.” If you take that advice, you’re not going to write articles that are so broadly applicable, and if you try to make qualifying statements and acknowledge your privilege in every post, your writing will be clumsy and insufferable.

I recently wrote about surfing in Hawaii — we got both our boys up on boards and I was able to catch my own waves for the first time — it was awesome. I was inspired by the people working with Accessurf on the beach that day, and I made a donation on the behalf of our volunteer instructor to help them continue to help disabled people experience the magic of the surf. I know that most people can’t afford to spend a few weeks in Hawaii or donate money on a whim, but the people I write for people who can and I aim to inspire. Dozens of people have told me they started donor advised funds based on my frequent articles on them.

If you read my Hawaii post in isolation or my posts about the physician households earning $300,000 a year, you might think I’m completely out of touch. But I’m writing for physicians who can’t figure out how to max out a 401(k) on that salary while working in a profession with a suicide rate double that of the general population. They may have high incomes, but they need to learn how to become financially independent and gain control over their lives.

I’ve been forthcoming with my background in various posts and podcast interviews, but have never put all of that information in one place. I’m writing a post for next week that does that. So there’s something that came out of this conversation.

Best,

-PoF

Yeah, sorry about that comment — it never popped up in spam so I have no idea where it went! Let’s blame the internet retirement police, who are for sure out in force today! ;-)

You already know that I greatly admire your commitment to charitable giving, and I love that you have pushed so many to start DAFs. And I think you’ve been great on making clear your economic situation and that it’s not widely applicable. I wouldn’t suggest that you change who you’re writing for. Now, if you start calling your household income “average,” we’ll have to have another talk. ;-)

My guess is that what wishicouldsurf was talking about — though I’ll let her respond for herself — was accusing me of manufacturing controversy rather than asking yourself if maybe there was stuff out there that you’re missing. (Hint: I think there is.) That’s something that especially happens to women, and while you might equally have quibbled with a male blogger who wrote something similar, the “I haven’t seen that so therefore I don’t believe you and think you made it up” narrative is one that women are unfortunately incredibly used to. And there are now a great many comments in this thread (it took me nearly two full days to respond to them all!) that can give you plenty of examples and corroboration, if you’d like to see them. :-)

I’m so touched to know that the ableist bias comment spoke to you and is something you’ll pay more attention to moving forward. That’s all any of us can do. When we have our eyes opened to something, start paying better attention! :-)

Hi PoF — You are correct that I’m not going to name names. ;-) The fact that you don’t see this stuff could also mean that you just haven’t noticed some of this, and the intent of this post is in large part to draw attention to some of the things that I believe we as a community can do better. Given that there are currently more than 120 comments here from people who have said some version of “thank you for saying this!” I think it’s fair to say that others have noticed much of this, even if it’s not on your radar, and not just from one or two blogs. Perhaps this is a good reminder that just because we don’t notice something ourselves doesn’t mean it’s not there.

The discussion I’m attempting to start here is that sometimes transparency itself is not as simple as saying, “Hey, I make some money from something!” I agree that plenty of bloggers report blog income, and that’s a great start. But then there is often still a disconnect between what they preach to readers and what they themselves might do in the absence of that income. Getting into specifics would call folks out, and I have no desire to do that, but it’s all to my larger point of context. Readers deserve to know the full set of circumstances that might impact both your finances and ability to save, and your general worldview. Those who are risk-averse tend to have reasons for being that way, and likewise those who embrace risk (and, in my view, are most likely to lead readers down the primrose path by encouraging them to undersave and just hurry up and quit already) have reasons for being that way that are rarely discussed. That’s worth examining.

POF is very open and honest about his expenses and income.

Tanja – I’m a FIRE blogger and to date I’ve made $0 from my blog because I haven’t tried. I also don’t work at any other job so I live entirely off my retirement savings. Mrs. FF works part-time because she likes to work but she makes less than $6K per year, so that’s not much.

I agree with your list, but I do have one nit to pick. I would like to define “retirement” as the freedom to do whatever you want – part-time work, no work, hobbies that make money, whatever. Otherwise, it creates the idea that “retirement” is some how restrictive. Just my two cents!

Agree, Mr. Freaky. In my simplistic view, “Retirement” = “Escape from the Rat Race”. Let’s leave it at that, and then focus on whatever makes us happy.

Yup.

Mr Freaky Frugal

How about we try this definition:

I no longer think of FIRE as the right acronym. It should be “Freedom In Selecting How You Spend Most Everyday Living Life Without Having Any Material Money Issues”

or

FISHY SMELL WHAMMI

Again I like the thought provoking nature of this blog but I do not consider Tanja and Mark “retired” living off of their assets, they have transitioned away from W2 work to something else they enjoy KNOWING they are safe (financially to do so). FISHY SMELL WHAMMI. It’s what everyone should aspire to on their way to eventually NOT WORKING and relying solely on your assets to live off of (e.g RETIRED)

We have zero disagreement here! I agree 100% that retirement is whatever the hell you want it to be (https://ournextlife.com/2017/04/26/what-is-work/), and my only issue is when bloggers write about one approach, practice another but then don’t change what they espouse. Zero issue with the work itself or with making money from the blog, as I went to great pains to say multiple times in the post. ;-)