Year after year, research consistently shows that health care is one of the top worries for most Americans, and that’s no less true for early retirees. Practically every week I hear from would-be early retirees who say that they long ago hit their financial independence number, but can’t/won’t retire because they’re too anxious about health insurance availability and health care costs.

Which I totally get.

We’ve lived in a state of health care limbo for a while now, which I sometimes calls the health care abyss. Regardless of your politics, you have to acknowledge that the Affordable Care Act (ACA, aka Obamacare) has been a gift to early retirees, many of whom would otherwise not have any way to get health insurance outside of employment. But with the ACA being so politicized, we also all know that it could go away any time – or, more likely, parts of it would go away – and that can be stressful, especially for those with chronic health conditions. (Hi.)

But while none of us can see the future, and we don’t know what our options may be five or ten years from now, we can be smart about how we choose coverage for next year, or – for those who are currently planning for early retirement – how we use next year’s costs to project for the future.

It’s currently open enrollment season – and open enrollment closes in most states on December 15 – so if you need health care for next year, now is the time to do your homework.

But first…

I’m so excited to share a HUGE update on my upcoming book, Work Optional: Retire Early the Non-Penny-Pinching Way. The publication date has moved up six weeks to February 12! That’s less than three months away. If you’d like to read it, click over here to get more info on how you can pre-order it in hard copy or as an ebook, or how you can request your library purchase it. It will also be for sale as an Audible ebook (with my voice!), and I’ll let you know when that version is available. Thanks so much to everyone who has already ordered it! xoxo

Some Degree of Certainty for Now

Every time I write about health care, it seems to require repeating the caveat that this is not a political post. So this is that caveat. And this is the only thing I’ll say that has the least bit to do with politics: with last week’s election behind us, and Congress now split between the two parties for the next two years, we have some assurance that legislative gridlock will prevent any major changes to the ACA for at least the next Congress. The executive branch still has the ability to make administrative changes, and with the individual mandate in the law repealed already, it’s possible that exchanges could destabilize if many fewer people buy exchange plans in 2019 and beyond.

But barring any major catastrophes, early retirees with no employment-based insurance available should expect to be able to buy health insurance on an exchange through at least 2021. (The next Congress after this one won’t be seated until January 2021, and if they made changes to the law right away, the earliest they could take effect is the start of 2022.) Three states – Idaho, Nebraska and Utah – also just voted to expand Medicaid (a useful proxy for health care access that I detailed in this post), and three more are likely to follow suit with the governors’ seats flipping, which should further stabilize things.

This is the most certainty early retirees have had around health insurance in a while – possibly ever. But it’s still only short-term certainty.

Your Most Important Number: Out-of-Pocket Max

A surprising bit of good news for 2019 is that the premium costs of most health insurance plans on the exchanges are stabilizing, a welcome trend considering that exchange plans have been increasing in price the last few years by many multiples of inflation in the bulk of states. In 11 states, exchange plan premiums have actually gone down for 2019, but overall, premiums are up about three and a half percent, much closer to inflation itself, and fairly reflective of the four percent increase projected for employer-based health care costs for 2019. Some experts believe insurance costs overall are now stabilizing in the ACA era as insurance companies have returned to profitability, so we’ll all keep fingers crossed that this trend holds for 2020 and beyond.

However, all of that said, the cost of premiums is only one part of the equation, and it’s not the most important number for you to keep in mind when looking at potential health care costs. The premium is the amount you know for sure you’ll have to pay out every year, but the number you should care most about is your out-of-pocket maximum, in essence your worst case scenario.

The out-of-pocket maximum is often not listed on the summary view of available plans when you search on the exchanges, and you may have to click on a plan and scroll down:

FYI, for all examples in this post, I’ve used an early 40s couple with $50,000 per year in MAGI (gross income minus qualified retirement savings contributions, essentially), living in Los Angeles County.

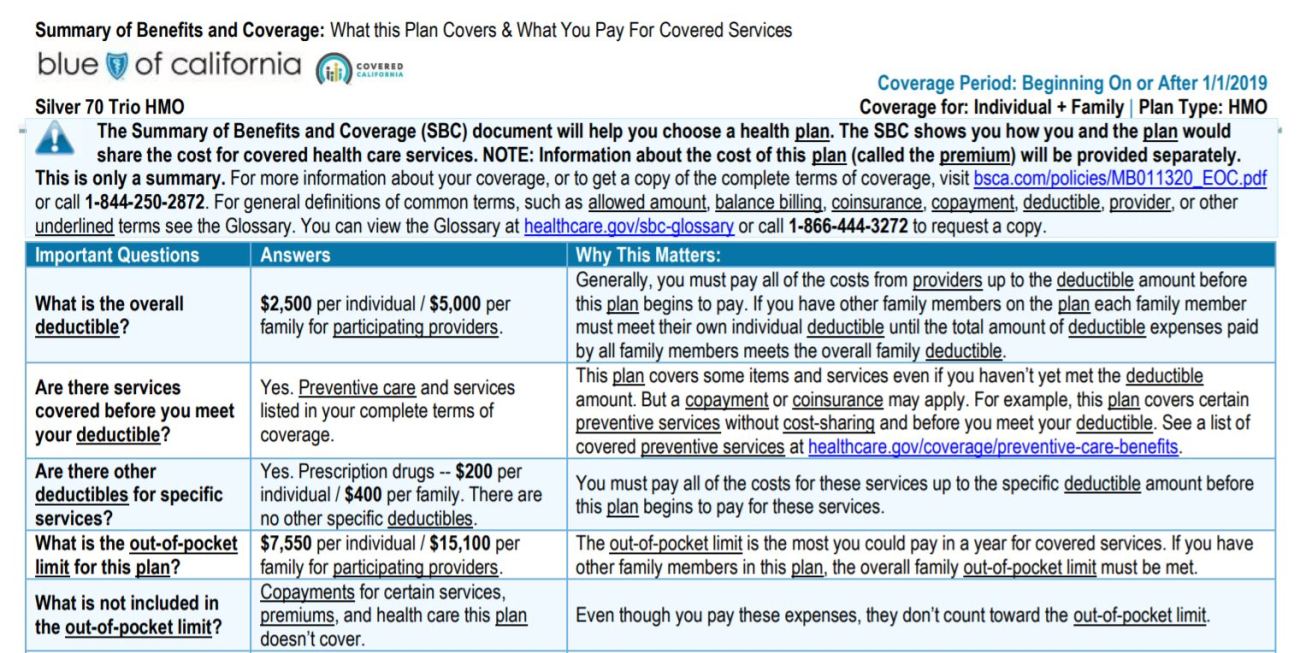

Every plan by law must use a uniform summary of benefits form to make clear to you all of your costs – it’s great for comparing plans to one another! – and this form must tell you what the out-of-pocket max is and what’s included in it or not:

Most out-of-pocket max descriptions will look like this one: clarifying that “out-of-pocket” does not include plan premiums or copays/coinsurance on services you pay for before you hit the maximum. So your total cost could be quite a bit higher than the max shown, but you can add the cost of your premiums and a few thousand dollars buffer to estimate what your true max could potentially be.

I’ve written in detail about estimating your costs for exchange plans and comparing them to one another, so please consult that post if you’re looking at health insurance plans on the exchange for the first time.

All Deductibles Are Not Created Equal

As I’ve done more research, I’ve concluded that high-deductible health plans (HDHPs) and their accompanying health savings accounts are not the money-saving miracle that they are often made out to be by those who tout their tax-avoidance benefits – namely because most people won’t actually come out ahead financially on a high-deductible plan, and because high deductibles create massive disincentives to receiving care, even for those who can afford it regardless – but here’s one more argument against HDHPs:

All deductibles do not work the same way.

Related post: The Problem with the HSA (Health Savings Account) Isn’t the HSA

Even if a non-HDHP plan cites a deductible of some amount, that doesn’t actually mean that the deductible applies to every expense. In the Blue Shield California example for the LA County couple, the standard silver plan shows a deductible of $5000 for the family, but if you look more closely, you see that quite a few services don’t require the deductible to be met before paying, including all emergency and urgent care services aside from ambulances:

The HDHP bronze plan offered to the same couple, however, has the deductible applying to absolutely everything except for the free preventive care visit required by law:

So it’s important to look not just at deductible amounts, but actually to look at service costs in detail to see where the deductible actually applies, and where it doesn’t. Our current health care plan has a relatively high deductible, but despite going to the emergency room and getting several expensive tests and imaging procedures done this year, I haven’t actually had to dip into my half of the deductible at all, because it didn’t apply to any of the care I’ve received.

Do your homework not just on deductible amounts, but on what they apply to and what they don’t.

Be Mindful of Your Own Circumstances

As I shared when talking about choosing this year’s health insurance, we ended up selecting a different plan than the one we originally expected to buy based on vastly unequal prescription drug coverage. That was important in our case, and so it’s the factor that won out. And in a plot twist, we just received a letter from our insurer that they’ll no longer be covering non-emergency care outside of California, a highly problematic development for those living near the state line whose closest city (and therefore entire health care team) is next door in Nevada. So we’ll be switching back to our originally intended plan for 2019 and figuring out how to bring drug costs down in other ways. (This is why it’s so important to review the plans closely every single year.)

What’s important for you isn’t necessarily either of these factors, but to know your own situation and needs. If you’re nowhere near a state border and don’t require autoimmune drugs, then you can focus on provider network as most important, something you can research right from the plan page on the exchange. Or perhaps you care most about benefits like how many physical therapy or acupuncture visits the plan covers. Know what you need, and research what your plan options offer.

Project for the Future, Including Traditional Retirement

For those still saving, the best thing you can do for your future finances and current peace of mind is to estimate what your health care would look like for 2019 if you were buying it on the exchange, and then do two things:

Factor next year’s expenses into your future retirement budget along with an increase factor greater than inflation (we estimate 8-10% a year), and

Factor next year’s out-of-pocket maximum into your plans to ensure that you could afford to pay it, in addition to premiums, in any given year and still be okay financially.

One of my biggest arguments against aiming for the smallest possible early retirement budget is that it doesn’t allow enough wiggle room to accommodate potential health care realities. If you’re only budgeting for health care premiums, that’s not enough.

And as of now, the average out-of-pocket costs for Medicare recipients, above and beyond premiums paid, are nearing $300,000 between age 65 and the end of life. That works out to well more than $10,000 a year, with much of that skewed toward the last few years of life. If you’re aiming toward a “spend it all down to zero” vision of traditional retirement – something I don’t believe is actually common among early retirement aspirants – I urge you to reconsider.

Weighing All the Risks

I know it can feel discouraging to look at these large costs for health care. I know it’s tempting to consider options that aren’t real insurance like health care sharing ministries. I know it can even be tempting for those with ongoing health challenges to decide never to quit working. But what each of us ultimately needs to do is weigh all the risks, not just the most obvious ones.

With my ticking genetic clock, I had the reminder that I couldn’t necessarily wait until traditional retirement age to do all the things I want to do in life. And I truly feel lucky for having that reminder, because none of us are promised any amount of time, and if I hadn’t had that nudge, I might still be blindly continuing through life, never questioning if another path was possible, and taking my young, healthy years for granted. Instead, I appreciate them so much more.

For me, the equal and opposite risks were obvious: risk running out of money in early or traditional retirement, or risk spending all my good years working.

It’s up to you to take an honest assessment of what your risks are, because only then can you truly decide what’s worth the risk and what’s not.

Your Turn

Chime in with your thoughts and questions! Any questions you have about health care that you haven’t been able to get answered anywhere else? Any hints or tips you’d like to share with others here? Any decisions you’ve struggled with that you can share for others’ benefit? Let’s chat in the comments!

Don't miss a thing! Sign up for the eNewsletter.

Subscribe to get extra content 3 or 4 times a year, with tons of behind-the-scenes info that never appears on the blog.

Categories: we've learned

Awesome information, thanks for posting. I guess those instances where you didn’t have to pay a deductible were a pleasant surprise. But like you said you really have to dig into the plan’s info to find out if something like that exists and if you think you’d be using that service a lot. I’m still on my employers plan and the full book of benefits is massive and rivals the Bible. I’m not sure I wanna read it, I just hope search works well within the document ;)

Budgeting for the full potential cost (premiums + out of pocket max + misc) is smart not only because a disastrous year could be handled in-budget, but also because the medical budget from non-disastrous years can be ‘set aside’ into a ‘health endowment’ that, for people who beat the odds (which would be most people), would grow very quickly and provide a significant buffer against future disastrous years or those ever-present worries about end-of-life care, etc. This could be done either explicitly or implicitly, depending on how each individual likes to keep the accounts. The end result is an ever-increasing security for retirement finances, at least where health costs are concerned.

Healthy people would be well-served by paying less in premiums for high-deductible plans, so that they can benefit from the high likelihood that they can just set aside all of their health care budget into their health endowment. Those expecting to need care can move up the insurance scale as best fits their needs.

Of course, this is all just doing variations on the exact same math we all know and love: spend a smaller percentage of the portfolio, and the portfolio has a higher likelihood of being secure.

I’ve been doing similar research into health plans and I think I’m going to pull the COBRA lever for the first eighteen months.

What do you think is driving the big changes I’m seeing on ER coverage and ever shrinking networks? It seems like most plans I’m pulling and testing have limited networks with no out of pocket coverage.

On a side note, I hope the IRS and HHS can get together on HSA eligibility. It seems insane to me that a plan with a $15k out of pocket max does not qualify as a HDHP due to some ancillary benefits

I retired in Dec. 2013 at age 49 and have been thankful for the ACA. I’ve had a lot of health issues in the past and most insurance companies want to deny coverage even though I’m fairly healthy now. Unfortunately, the plan I’ve been on since 2013 isn’t being offered next year and so the only doctor I’ll be able to continue with is my PCP. The specialists I’ve been seeing aren’t in-network with the new plan. There is a new insurer in my state that would cover these specialists but after Googling the company, I don’t want anything to do with it. They get horrible reviews. So I’ll just have to find new specialists as needed and have my records transferred to them. Health coverage is probably the biggest stressor I have in my retirement, with worrying that the ACA might just go away. due to politics.

Great news to report from Phoenix– instead of one option like last year, we now have four companies from which to choose (although one of the new ones is run by a Kushner!!!) and the premiums are down about 10% from last year with similar deductibles.

The one ACA provider in the Phoenix area in 2018 had practically no provider network. A broker told me not to expect anything better with 4 ACA providers in 2019 – there is no “competition” among ACA plans, rather they all seek the lowest common denominator.

Do you have different information that causes you to think this is “great news”?

I am trapped in my job because it provides good insurance, and there are no worthwhile options otherwise.

In SC, somehow the premiums have increased but so have the subsidies. My fam of 5 paid $117/mo (highly subsidized) for a Bronze plan in 2018. It might be 0$/mo in 2019.

This is my first year on the exchange, so hopefully when tax time comes the $117/mo will turn out to be legit! Hopefully my $11k in planned traditional IRA contributions for my wife and I will decrease our MAGI.

Tanja, thank you for continuing to cover the topic of healthcare in retirement. Most of the RE bloggers that I follow seem to be using a healthcare ministry, leveraging a working partner’s employer plan, getting greatly subsidized plans via the ACA, or are just lucky enough to not have much need to spend on healthcare. None of these options are particularly well matched to my own situation, and I can’t imagine I’m the only one who feels that way.

Thanks for this post, which (as I’ve come to expect) is incredibly insightful, helpful and actionable.

I’ve opted for COBRA coverage for my first 18 months of FIRE, but I will be on the ACA market a year from now. I’ll bookmark this post as well as your past and future posts on the topic as essential references for when that time comes. I’ve already drained depressing amounts of time and energy figuring out how to model healthcare costs into our plan, and your analysis will greatly expedite the process of making choices next year.

The health insurance mess is one reason my family FIREd in California. Should the ACA one day collapse, I’m hopeful that California would step up with a replacement, whether a single payer system or something else.

Thanks for the info that ACA costs might be starting to stabilize. Mine in CA went up 11% for 2019 and I still only have one provider to choose from. I had been trying to guess if that’s what I should expect for planning purposes. (I’m still working half time so I’m a little insulated from that price increase this year.)

Wow, so interesting on what services do and do not go towards deductibles. Thank you for the insight. We are employed still, but I found that if we each do our own plan/deductible through our employer (happens to be HDHP) it was a better deal than a joint plan. I had knee surgery last year and instantly met my $1500 deductible and hit my $5000 out of pocket so I was able to utilize that benefit. But if I were teamed up with my spouse the deductible and out of pocket max all were higher as a family and cost us more. Is this similar in the health care market? Do you have to do family or can you do individual while married?

Hi, we’re in SF Bay Area. The unsubsidized health care premium for my family of 3 increased 16% for 2019. I suppose it’s an improvement because in the past few years, the premiums increased over 30% each year, but it’s still way above the inflation rate. I dealt with these increases by downgrading my health plan each year. Definitely should be one of the main concerns for early retirees as the increases are not really predictable.

In NC here. We as a family of 4 were looking to FIRE at 56 next year. After role playing on Healthcare.com site found that we would pay appx $1,500 per month with a $20,000 out of pocket. None of our doctors participate as well. No thanks. Luckily my wife works for the state and will have the ability to buy into the plan once retired in two years. Its very expensive but at least we will have a choice of doctors and stability of known outflows. Of course since “role playing” I now get around 20 junk emails and 10 or so phone solicitations daily.

Thanks for this as it’s a timely topic for our family (me, wife, 3 boys under 10 y/o). My wife and I are both self-employed without a subsidy. Our first year after leaving my job meant a $1,200 plan with high deductibles. That’s increased to a little over $1,300 this year (roughly 2x the cost our of mortgage and property taxes before we paid it off). Last year, after much research we made the switch to Liberty Healthshare. We documented the entire experience throughout the year at http://www.mylibertyexperience.com – hopefully that will help some people in the same position. Needless to say there were pros and cons and our experience hasn’t been perfect. This year we are seriously considering short term plans from United Healthcare since Ohio has increased the number of days you can hold one to 360 (and the plans have our primary care providers in-network). Yes, they aren’t for everyone but I do believe they are worth researching for those without (or with limited) pre-existing conditions or maternity care needs (but engage in the required research!).

Shouldn’t we expect costs to go way up for plans on the exchange once the mandate is gone?

Thanks for this post! Your articles on Covered California were particularly helpful this year, as I applied for coverage + subsidies for the first time. We started an extended travel period, so our income dropped remarkably – and rather than spending $380+ for each Bronze plan this year, we will be paying $2/month with subsidies. Thank you, ACA!

Thanks for the updated post on your latest ACA experience Tanja, last year’s post was very helpful as I prepped for my exit this past September (wife finished 3 years ago at 50, I’m 53). I took Cobra for my final 3 months of the year at roughly $1,100 a month and just finalized my 2019 ACA enrollment. A couple things I think are worth repeating to folks depending on their circumstance. The first is the importance of knowing as closely as possible what your Modified Adjusted Gross Income (MAGI) is going to be in the year you are receiving subsidies and knowing that the standard deduction cannot be used against that calculation. I didn’t realize that until I saw it in your write up last year. Second is a hindsight is 20/20 comment, when I started to focus on investing in my late 20’s I followed the standard advice to spread investments across different fund types, the one I leaned heavily on for maximum return and was always highly recommended was a US Growth Fund, made perfect sense at the time and its performed very well, I’m not disappointed, the problem for future FIRE aspirees that want to get subsidies on ACA (assuming its still around) is that it is an actively traded fund that returns capital gains to the fund holders every December regardless if you sell any shares, I’ve had years with as little as $4,000 and as high as $20,000. Those are some big swings to navigate when you are trying to keep your MAGI under $65,840 and not knowing what the amount will be until late December is going to weigh heavy on my mind every year as I sell taxable funds to generate income. The last item was something else you mentioned last year. My last tax return on file is from 2017 working a job with income well above the ACA limits, while going thru the verification process I was preliminarily accepted based on my entered assumption of earning $64,000 in the upcoming 2019 tax year, in my first go around I split the $64k between my wife and I but for some reason the site requested that I provide proof of income for her (but not me) I assumed it was because she hadn’t had a W2 in 3 year so I went back in and adjusted the app to show the entire $64k under me…same result. The required docs needed to be a tax return and 1099’s etc. so I scanned the first page of our 2017 return (showing income significantly over the ACA limits) and the 1099’s but I also drafted a short letter stating my wife and I are early retirees beginning in 2019 and we plan to fund our income through dividends, interest and capital gains all the while recalling the hours of time you said you spent on a similar item last year. I chewed my finger nails for about 4 days and finally received a confirmation that everything was received and approved. We’re in a Florida Blue Select Bronze plan (that surprisingly had both our current doctors) for $222 a month with $15k deductible and total out of pocket, subsidies were $872 a month. We luckily have only needed basic preventative care in years past so I was thrilled with the outcome as we had originally budgeted $1,000 a month in premiums as a placeholder. Knock on wood but phase 1 is completed with few hurdles. Hope that helps anyone in a similar spot.

Very useful information both in the articles and accompanying comments. I’m a single, early 50’s FIRE gal and as the author suggested, have learned to read the fine print in the policies under my consideration. Because I travel quite often, the tidbit, usually at the very end, that describes covered expenses while out of the country is of particular interest.

Healthcare is the most complicated and terrifying part of Fire. How did you get over the fear to take the plunge and fire?

Hi Tanja:

I love your blog. I’d like to point out, though, that one of your points in this post is inaccurate. You state that “early retirees with no employment-based insurance available should expect to be able to buy health insurance on an exchange through at least 2021. (The next Congress after this one won’t be seated until January 2021, and if they made changes to the law right away, the earliest they could take effect is the start of 2022.)”

However, there is currently a lawsuit against the ACA that was brought about by several GOP state attorneys. Without getting into the weeds, being the GOP was unable to repeal and replace the ACA, they are now trying to attack its constitutionality. With the ACA being a Federal law, it’s the Trump Administration’s job to defend the ACA against lawsuits, such as this one. That said, they are being derelict in their duties, which furthers their efforts to sabotage the ACA.

Long story short, the ACA, unfortunate, is not all that secure—even in the near future.

Here’s an article link that sums up what’s going on in court: https://cnn.it/2Nm5Ooa.

Hey, Tanja. I’m sorry I’ve neglected your blog for so long. Great stuff. Mrs. Groovy and I signed up for Obamacare a couple of weeks ago. We’re very fortunate. Our BCBS North Carolina policy will cost us $24.73 per month. The premium tax credit will be $1,756 per month. Our maximum out-of-pocket limit is $2,450 per individual/$4,900 for the family. Is our insurance good? Damned if I know. The only way I’ll really know that is if I have a serious illness or get into a serious accident. I got my fingers crossed, though. Good luck with the book. Cheers.

How on earth could you sign up for an insurance with no idea if it’s any good or not? That seems insane to me. Are your doctors (or equally good or better equivalents) in the network? Are all your prescriptions covered? Did you price out any scenarios?

Maybe I shouldn’t be too surprised, since “Mrs. Groovy” wrote a comment on another site which I think was directed at me but when I asked if that was so, she didn’t reply: “It pisses me off when I see people who are reduced to making life decisions based solely on health insurance. I know it’s important and if you have an existing condition that’s serious, you’ve got to think carefully about leaving a job with coverage. But most people who’ve spent years assessing and building their financial lives have the capacity to pivot should things not work out as planned.”

“Fingers crossed” is not responsible planning.

Hi, Tanja. I’ve read your post from January (of this year) about your experience signing up for ACA thru CA’s exchange. Very helpful. I have a few questions if you don’t mind. Forgive me for posting the question here instead of the post from January, as I figured it’s too old a post to comment on….

We are currently in a “red” state that does not have its own exchange, of thinking of moving to CA in the future. Your post certainly is illuminating about possible problems a FIRE member might have signing up. The ACA is no where as “strict” as far as proof of income as CoveredCalifornia.

You mentioned in the other post the easiest thing to do is to estimate your total income on the W2 line (instead of breaking it down into unearned income, rentals, etc.). Is this what you did for 2019? Does that cause any problems at all? You also mentioned you could submit a “sworn statement” as proof of income (I googled and I believe the form’s title is “Attestation of Income”). Just wondering if you (or anyone reading this) did this, and whether that’s a better route than declaring your estimated income as W2. (Just as background, our income will be all unearned — dividends and capital gains — so it’s next to impossible to estimate; however I have the ability to do Roth conversions each year if I need to adjust actual AGI upwards…)

Also, for those that answer… What’s your experience as far as how much scrutiny CoveredCalifornia places on proof of income on your application? Do they ask for all kinds of documentation, especially if using the Atttestation of Income route? Do they question your estimates? I am in a good position of hitting my estimates +/- 10%, but afraid the process would be such a hassle that it’d be extremely difficult to get the application approved. Thanks in advance for your help!

In reference to your income verification question, with 2019 being my first ACA year the only proof of income I had was my 2017 tax return showing our total income exponentially higher that the ACA cap. On my application I estimated 2019 MAGI as 64k and was tentatively approved but received a follow up email requesting proof of income, I used the download feature scanned my 2017 tax return page 1 and wrote up a cover page explaining that we were early retirees in 2019 and would be generating income via cap gains, dividends and interest. 5 days later I received an email from the exchange saying all was approved and it specifically stated “we require nothing else from you”.

Thanks, Eddie!

Something that doesn’t get mentioned often enough is retiring early and moving overseas. I have a great quality of life in a beach community and purchase health insurance through the government. I pay around $90 per month for a policy for my wife and I that covers health, dental and prescriptions at 100%. I have been impressed with the quality of the service available in our area.

I am also able to earn 10% on my CD investments, paid in US dollars, which greatly enhances my ability to remain comfortably retired. While I understand that overseas living isn’t for everyone, I think it is something that should be considered given the state of healthcare in the US. My entire budget for living overseas is covered by what it would cost me for just the premiums for a good health insurance plan in the US.

Which country if I may ask and how does that 10% CD exchange work?

I am surprised that most people repeatedly miss the biggest problem with US healthcare, which, as i would contend, is not necessarily the insurance affordability (which, sure enough, is a close second). The biggest problem is predictability of the charges; in particular, out-of-network charges.

Let me give you an example. Suppose you get hospitalized (or even just visit an ER, that would be similar), and your hospital is in-network, and your plan says your deductible is $250, so you’d think that’s all you get billed. Sounds good in theory. Well, almost any hospital uses independent contractors, who are likely to be out-of-network, and whose charges are not going to be anywhere close to “customary” charges your out-of-network plan assumes behind the scenes. So chances are (real life case) you’d pay $250 deductible, plus you’d get a $4800 bill from an anesthesiologist, and about $5200 from a company you never heard of but that claims that supplied some equipment for the procedure. Your insurance takes the first bill, says customary charge for that would be $400, so it would hopefully pay 60% of it ($240) and apply 40% ($160( towards your yearly out-of-pocket maximum deductible (which is likely at least $3-$5k), and you would still be on the hook for the 100% of that bill. A similar thing happens to the second bill (if insurance does recognize it as necessary for the procedure at all).

Bottom line, you are still on the hook for about $10k to settle on your own, with less than $500 of that actually being counted toward out-of-pocket, of it even applied toward your yearly maximum (not paid!). You maximum out-of-pocket promise isn’t in fact what it says it is. Not even close.

And hospitals and providers will never (and i mean, never) tell you who will be attending to you, so not only you won’t be able to come up with any reasonable estimate of their charges, you won’t even be able to figure who might be in-network and who is not.

This is all based on first-hand experience, not some hypothetical example. Through experience i know that many hospital providers differ in terms of how much risk they carry that one can run into some outlandish out-of-network bills afterwards. For example, with Kaiser, such risk is almost non-existent, as long as you attend their own facility, while with say Sutter Health and some smaller hospitals conducting mostly outpatient procedures may present the greatest risks where out-of-network charges are quite easily to exceed an order of magnitude what insurance is willing to count toward maximum out-of-pocket (let alone pay for it) even despite the facility being part of their proclaimed “in-network” list.

The problem with US healthcare is not so much insurance availability. Rather, it is the fact that it is neither socialized, nor market. It is more like a shark-infested pirate bay.

You can’t shop for a procedure in advance, not even for a ball park figure. Have you tried to call up say even 4 labs and be able to get a quote for your MRI order? Let alone a more complex in-patient procedure.

Nobody ever is going to hand you procedure estimate disclosure to sign before you decide to go in. There’s no strict “truth-in-healthcare disclosure” law framework, unlike, for example, there is for the mortgage insurance. So prepare to be raided whether you have insurance or not, and see if they’d care.

Among other things it means, unless you are part of some provider network where your out-of-network participation is entirely predictable, the HDHPs are not that unattractive as it may seem, since you have a significant uncertainty in overall bottom line liability either way. But at least with HDHPs you can pay a lot of it with tax free money IIRC both in contribution and deferred sense, which, aside from yearly limits, is more than what either Roth or IRA can do for you in taxation sense.

One possible strategy is to try and max out HSA balances as much as possible assuming health is good enough (20…35yo period), and then switch to something like Kaiser with significantly less out-of-network uncertainties so that their copays and even maximums ideally can be covered by the proverbial 4% of the HSA balance even one has a chronic condition.

But even then, it all can go south very easily (what if Kaiser doesn’t have a critical treatment that might really be your last resort?). And Kaiser is only in a handful of states.

Absolutely, DmLi. Healthcare is the one area that most of the FIRE bloggers avoid like the plague (is plague covered by insurance? Beats me.). Because none of them understand it in the detail that you obviously do, don’t want to learn it in depth like you have, and you just can’t write all snarky and “yay, totally!” about the state of health care today. Anyone who’s early-retired who doesn’t disclose what they’ve done for health coverage (this author does, to her credit), I just dismiss and don’t bother to read at all.